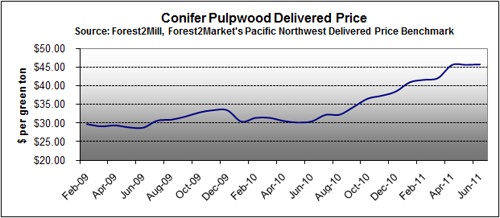

June established a trend of flattening wood chip values, following a nine month run-up where prices increased by 40% (see Figure 1). Total conifer fiber prices have settled at an average of about $125 per bone dry ton (BDT) across the Pacific Northwest. Forest2Market defines total fiber as the weighted average price for combined residual and whole log conifer wood chips.

The pulp and paper segment enjoyed a period of relatively stable chip prices early 2009 through mid 2010. During this time, an increased market for pulp and paper paved the way for an improved business environment for Northwest mills. But beginning in 3Q2010, chip prices escalated sharply. By October 2010, prices surpassed the $100 per BDT level for the first time since the end of 2008. Prices spiked quickly during spring 2011 as the news of new chip buyers in the marketplace fueled supply concerns.

Residual wood chips, long the staple of the Northwest pulp and paper industry, have been scarce as sawmills cut production in response to the decline in demand for housing lumber. To meet their needs, most pulp mills increased usage of whole log chips to nearly 50% percent of their supply. Traditionally, whole log chips made up about 15% of total consumption at Northwest mills.

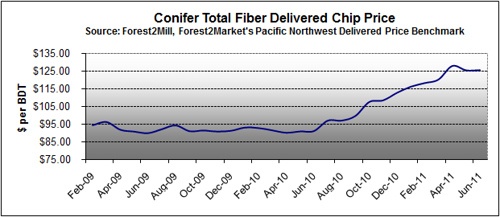

The necessity of whole log chips has strengthened demand for pulpwood across the region; in some cases, small chip-n-saw logs normally destined for sawmills are being chipped to supplement the supply. Presently, the price trend for pulpwood has steadied. Buyers are generally cautious and with a few exceptions don’t wish to discourage pulp log deliveries. Conifer pulpwood prices across the region are averaging near $45 per green ton; this is an increase of 50% since early 2009 (see Figure 2). Some pulp logs are being shipped via rail from Rocky Mountain States to support Westside whole log chip production. Fortunately for chip users and timber sellers, the resurgence of China the wood products market has stimulated harvesting of saw timber and created new opportunities for pulpwood supply.

Pulp and paper mills now have adequate chip inventory to meet consumption. By 1Q2012, however, weather and flagging markets will likely tighten the wood chip supply, as timber harvests and sawmill production reach their lowest seasonal point. At the moment, mills are being vigilant about supply. A satisfactory chip inventory can turn quickly, leaving mills scrambling to secure required wood chips, another reason whole log sources of chips are important.

High wood chip costs combined with weak finished product demand and prices sealed the fate of several Northwest mills that closed during the 2007-2008 down turn for pulp and paper. With the potential of a double dip recession for the US and increased uncertainty in the global economy, future product demand may again stagnate. Further escalation in fiber costs may jeopardize profitably and place the pulp and paper segment at risk for tougher times ahead.

For a comparison of US South and PNW fiber markets, visit the Forest2Fuel archives.

For more information, visit Forest2Market’s Pacific Northwest Delivered Price Benchmark page.

Comments

Northwest Wood Chip Prices Level Off | Forest Busi

09-08-2011

[...] Wood Chip Prices Level Off September 8, 2011 - 0 Comments By Gordon Culbertson – Forest2Market Graphs by Gordon Culbertson – [...]

Gordon Culbertson

Gordon Culbertson