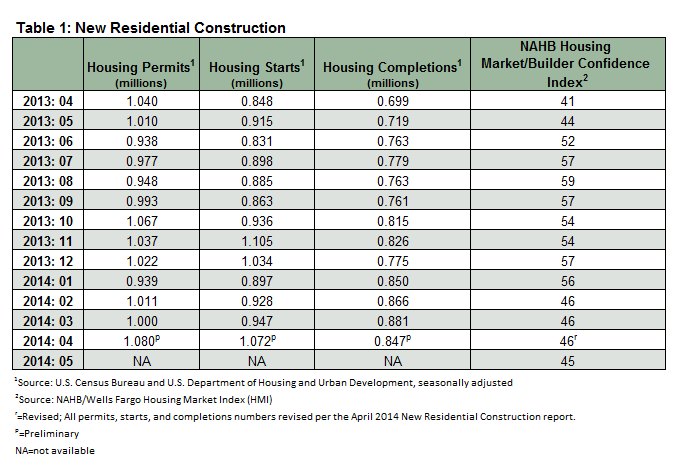

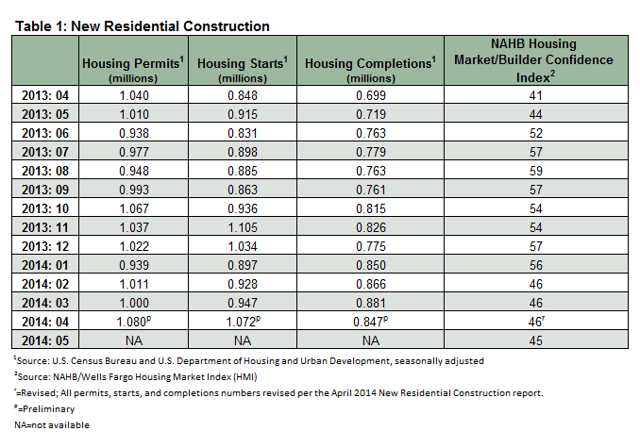

Housing Starts, Permits & Completions

For the first time this year, housing starts topped the one million mark in April. Like most of the gains seen throughout the past 12 months, multi-family rather than single family home construction accounted for the rise.

Permits for new housing also remain strong, although completions fell to their lowest levels this year. Nevertheless, April preliminary numbers for all three statistics were higher than those recorded in 2013.

Builder Confidence

A lack of available credit, qualified labor, and lot availability along with rising construction costs continue to stymie builders. Confidence among home builders fell one point to 45 in May, indicating most builders have few positive feelings toward the current construction environment. After holding above 50 for eight months to close out 2013, the index has failed to rise above 50 since January. A number above 50 indicates the majority of builders view conditions for new construction as good, whereas a number below 50 indicates most builders consider conditions to be poor.

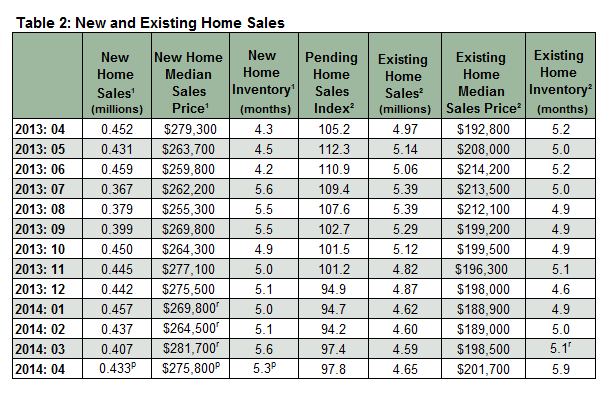

Home Sales & Inventory

Buyer demand for new homes continues to remain absent from the market. New homes sales rose 6.4 percent in April, rebounding from a March that saw purchases fall 6.9 percent. Despite the uptick, sales of new homes are about half that of a healthy real estate market.

Sales of existing homes also increased, reaching the highest rates seen this year. Despite this positive news, existing homes sales numbers for each month of 2014 have yet to reach those recorded over the course of last year. Buyers purchase approximately 5.5 million existing homes in a healthy housing market each year. [1]

Home inventories remain low compared to historic levels, and many homeowners have expressed a reluctance to sell for fear of being unable to find a new home. A reduced supply continues to keep home prices fairly high.

Home Prices

Annual price increases reported by the the Standard & Poor’s Case-Shiller 10- and 20-City Composite Indices have slowed since the start of 2014. In 1Q 2014, the National Index gained just 0.2 percent. However, the index recorded a 10.3% gain in the first quarter of 2014 compared to the first quarter of 2013.

The 20-City Composite Index reported year-over-year home prices rose 12.4 percent through March 2014, gaining 0.9 percent month-over-month. The 10-City Composite Index recorded similar gains of 12.6 percent year-over-year and 0.8 percent month-over-month.

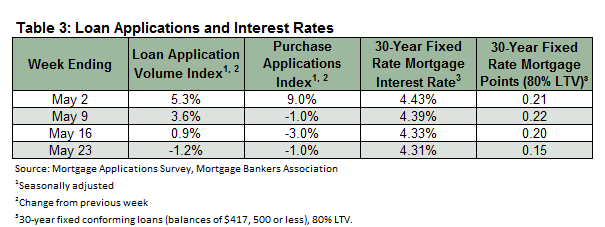

Mortgage Rates

Interest rates for a 30-year fixed-rate mortgage continued the slight decline observed last month. The 4.31% rate recorded for the week ending May 23 marks the lowest level since last June.

Despite the slight decline in mortgage interest rates, stringent bank lending standards and high rates of student loan debt have left many buyers unable to take advantage of historically low rates.

Overall, housing indicators remain mixed. Most economists anticipate the housing market will shake off its slow start and gain momentum throughout the year.