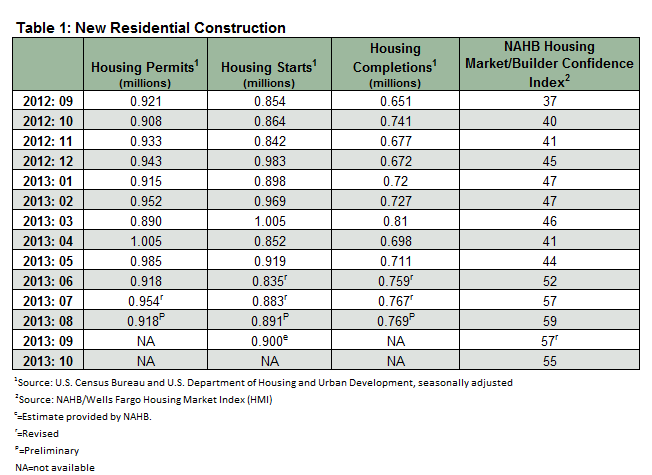

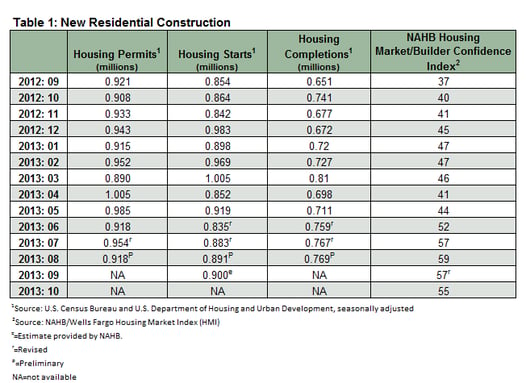

Housing Permits, Starts & Completions

The government shutdown prevented the Census Bureau from releasing permit, starts and completion data for September. Based on steadily increasing numbers for single-family home starts and in the multi-family sector, the National Association of Home Builders (NAHB) estimated overall housing starts would stay strong, ranging between 875,000 and 900,000 units.

Builder Confidence

Indecision in Washington and ongoing challenges associated with the cost and availability of skilled laborers led to a two-point drop in builder confidence between September and October. Despite the decline, steady demand and low inventory kept builder confidence relatively high. A measure over 50 indicates the majority of builders view market conditions as good.

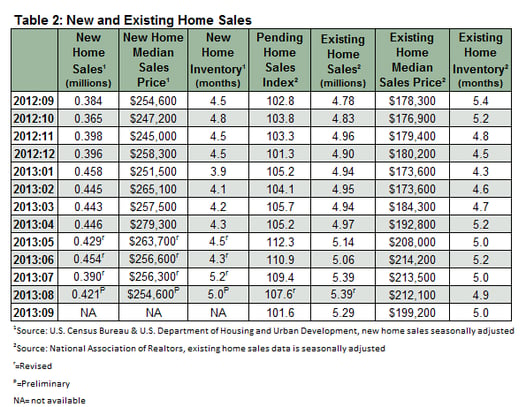

Home Sales & Inventory

The inventory crunch seen at the beginning of the year has tapered off somewhat. Nevertheless, the five months of inventory measured in September remains below the six-month supply indicative of a market balanced between buyers and sellers.

New home sales data was not available, but both the number of pending and existing home sales decreased. The median sales price of existing homes also declined.

Home Prices

August 2013 numbers show average home prices are back to the levels seen in mid-2004. The S&P/Case-Shiller Home Price Index reported the 10- and 20-city composites gained 1.3% for the month and increased 12.8% year-over-year through August 2013.

Index Committee Chairman David M. Blitzer noted each of the Composites displayed the highest annual increases since February 2006. “The monthly percentage changes for the 20-City composite show the peak rate of gain in home prices was last April. Since then home prices continued to rise, but at a slower pace each month.” Fewer mortgage applications in light of rising mortgage contributed to the trend, according to Blitzer.

Mortgage Rates

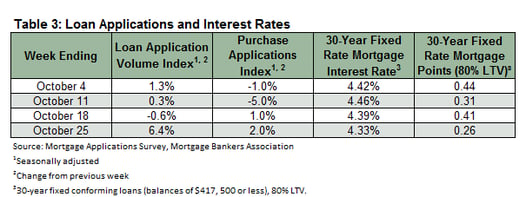

That trend, however, may be coming to an end. The number of people applying for a mortgage increased 6.4% after relatively little movement during the first few weeks of the month. Interest rates on 30-year fixed mortgages fell to 4.33%, marking the lowest rate seen since June. Overall, mortgage rates have fallen nearly half a percentage point since the beginning of September.

Now that the government shutdown is behind us, consumer optimism is expected to rebound. Time will tell if that same optimism extended to potential home buyers.