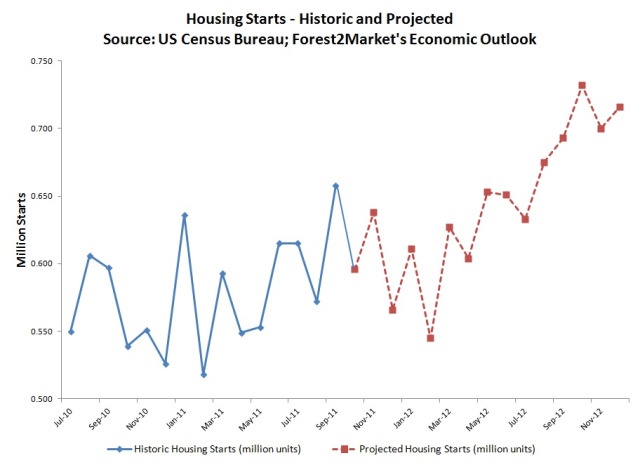

Despite increased activity in the housing market, US South sawmills experienced lackluster results for 3Q2011. US seasonally adjusted, annualized housing starts increased 7% to end in September at 658,000 units, a 5% increase year over year (Figure 1). This translated into little increase in demand for southern sawmills, however, as lumber sales volume and lumber prices dropped over the quarter.

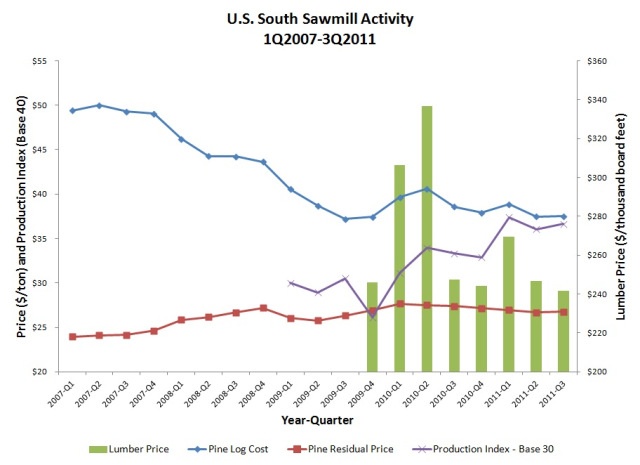

According to Mill2Market, Forest2Market’s volume weighted lumber pricing service, board foot lumber sales were down 16% compared to 2Q2011. While this is an improvement of 11% compared to 3Q2010, it appears that the market remains at a standstill, taking a wait and see approach to how the US economy is going to pan out over the coming months (Figure 2).

Our 3Q data shows that sawmills concentrated on holding log costs down while building their log inventories; at the same time, they produced more lumber. While lumber sales may have been down 16% from 2Q2011, lumber production climbed 2% in 3Q--mostly during the month of August. As a result, our lumber composite price fell $4.77 per mbf to average $241.80 per mbf for the quarter, just slightly under 4Q2009, 3Q2010, 4Q2010 and 2Q2011’s $246 per mbf trend line. Log costs experienced the same flat pattern; they averaged $37.52 per ton this quarter, slightly down from the previously stated quarters’ trend line average of $37.84 per ton. Residual chip revenue offered little relief; they averaged $26.77 per ton, slightly down from the trend line average of $27.05 per ton, though still $0.10 per ton higher than 2Q2011.

What should we expect in the coming quarters? Our Economic Outlook and Stumpage Price 4cast indicate that housing starts will fall over the 4Q2011 and for most of 1Q2012 (Figure 2) as uncertainty prevails in the US economy. However, beginning in March 2012, we’ll begin to see a steady increase in housing, which will approach 716,000 starts by the end of 2012 (a 9% increase over September 2011).

While sawmill production increased by 2% in 3Q, September wiped away what might have been even bigger gains; production in September fell 9% to match the fall-off in lumber demand. Two mills have publicly announced curtailments: Jordan Forest Products in Barnesville, Georgia and Hankins Lumber in Grenada, Mississippi. We’re also starting to see more closures: Georgia-Pacific, for instance, announced plans to close its Columbia, Mississippi sawmill and its Monticello, Georgia studmill. We expect little to change with lumber demand as we enter 2012, though as extended Christmas and New Year’s Day holiday curtailments are certain to occur, we do expect future production declines.

Sawmills have few options for surviving the remainder of the residential construction dry spell. Those sawmills that have good market price data can find sources of revenue by:

- Taking advantage of better residual chip prices, which are sure to rise with reduced lumber production

- Targeting their lumber sales to diversified product dimensions (for example, timbers have had positive price appreciation the last 2 weeks)

Will they be able to maximize that revenue until the market turns in March 2012? That remains to be seen. With the housing market likely to gain ground in 2012, however, sawmills appear to have weathered the worst of the drought.

Comments

US South Sawmill Activity – 4Q2011 | F2M Market Wa

02-01-2012

[...] Stuber’s post on 3Q2011 Sawmill Activity. Share this:PrintEmailTwitterLinkedInDiggRedditStumbleUponFacebookLike this:LikeBe the first to [...]

Daniel Stuber

Daniel Stuber