"The only function of economic forecasting is to make astrology look respectable." - John Kenneth Galbraith When the economic data is sending mixed signals, wading into the forecasting arena is a bit like wading into a school of jellyfish.

When unforeseen events occur in the midst of uncertain economic times, however, the jellyfish can quickly turn into piranhas.

While clearly not the equivalent of developing a horoscope, forecasting is certainly as much of an art as it is a science.

From a scientific perspective, forecast or predictive models are based on a seemingly endless series of IF/THEN (if b occurs, then x will happen) and ELSE (if b does not occur, then y will happen) statements. Economists comb through mountains of data, historical correlations, and information in order to determine which events are likely to affect their forecast subject (housing starts, oil prices, GDP growth, etc.

The art comes in when the economist then has to determine the probability of events in order to identify both the direction and magnitude of the change that will occur over the course of the forecast period. And they must do this for numerous variables that all coalesce in the end into a forecast.

A good example of this can be seen in the passage of a bill last December that extended all of the Bush-era tax cuts. A reasonable economist might have predicted a high percentage chance that President Obama would refuse to sign into law any bill that extended tax cuts for the wealthiest of taxpayers. When the President made the decision to extend the tax cuts in order to protect the fragile economic recovery, however, many forecasts improved, ours included.

But some events cannot be predicted, even by so famous an astrologer as Nostradamus. Nor can they be easily accounted for in forecast models. Unrest in the Middle East, for instance, disrupted some forecast models. As that unrest began to spread from Tunisia to Egypt to Libya, the earthquake, tsunami and nuclear disaster in Japan shocked the models further.

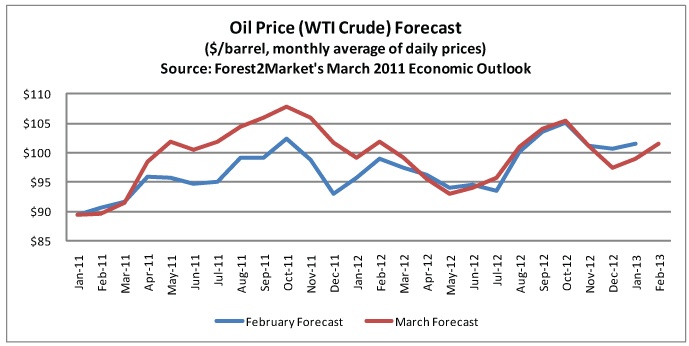

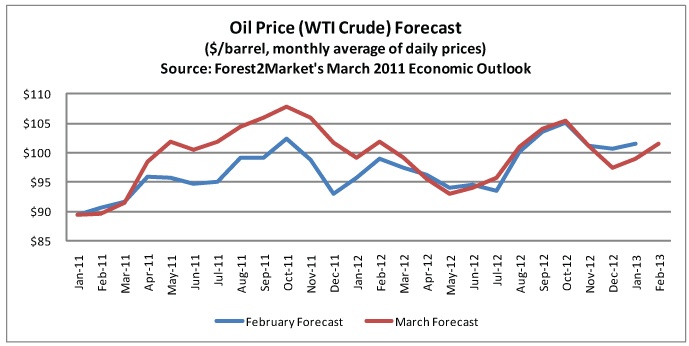

Let’s look at an example. The following graph demonstrates the type of changes that occurred to our oil price forecast because of the events unfolding in the Middle East. While just 25% of oil consumed in the US is imported from the region, these events drove our forecast for oil prices higher.

As this graph indicates, the forecast calls for oil prices to peak at $107.73/barrel in October of this year, return to the $95/barrel range by mid-2012, then go back up to $105/barrel by October 2013. Over the 2-year forecast period, oil prices are now expected to eclipse the $100/barrel mark in 14 months (March forecast) instead of 7 months (February forecast).

This change in the oil price forecast will be one of the factors that will lead to a change in Forest2Market’s stumpage price forecasts going forward. When producing these forecasts, we look at all the factors that affect stumpage prices in the South. Oil prices are an important input in the construction of that forecast. We also consider other general economy factors like GDP growth and currency exchange rates. We include industry effects (housing starts, etc.), local market effects (weather and ground conditions, etc.) and seasonality and momentum effects (spring building season, holiday curtailments, etc.).

While forecasts will always be subject to the changes brought about by uncertainty and tragedy, they remain extremely powerful tools.

Forest2Market's Economic Outlook and accompanying stumpage price forecasts provide equally powerful decision making tools: a knowledgeable estimation of where prices will be in the future and an overview of all the current events that are likely to affect prices and how these factors correlate to future price changes. Clearly, better than horoscopes.

Suz-Anne Kinney

Suz-Anne Kinney