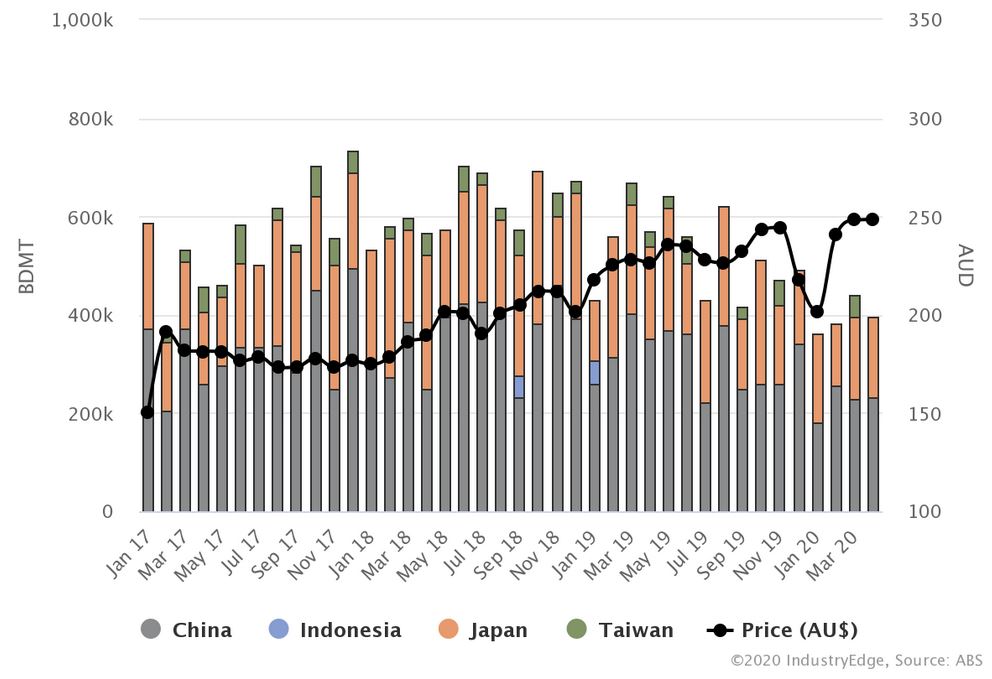

Australia’s combined annual exports of hardwood and softwood woodchips for the twelve-months-ended April 2020 were recorded at 5.728 million bone dried metric tons (bdmt). Monthly export volumes began dropping around the middle of 2019 and have not been above the 500,000 bdmt mark since October 2019.

Hardwood chips make up the majority of Australian exports. Their annual volume fell 23.5% across the year to total 5.165 million bdmt, well below the 6 million bdmt per annum mark, and the lowest annual total since October 2015.

Always variable, total exports of softwood increased, albeit off a smaller base, up 7.8% compared to the prior 12 months, to total 562,335 bdmt for the year-ended April 2020.

The chart displays total woodchip exports on a monthly basis.

Australian Woodchips Exports: Jan ’17 – Apr ’20 (kbdmt)

Note: Selected countries

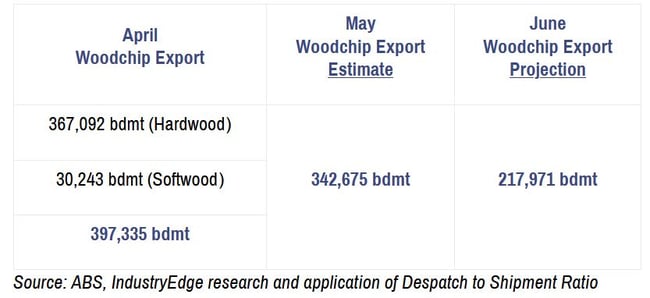

Examined month-on-month, April 2020 saw the monthly export volumes decrease again, after a small lift in March. Combined exports of Hardwood and Softwood were recorded at 397,335 bdmt in April, (367,092 bdmt Hardwood, 30,243 bdmt Softwood). This monthly total sits well below the 477,296 bdmt average monthly export volume for the 12-months to April.

Based on our monitoring of ship movements, we anticipate May’s export volumes will be 342,675 bdmt. We project June’s exports will fall to 217,971 bdmt.

As the latest edition of Wood Market Edge was being finalized, IndustryEdge’s vessel tracking observed only three vessels in transit to Australia and one in port, with 8 departures anticipated in June.

The table below shows Australia’s woodchip export volumes for April, and IndustryEdge’s May estimate and June projection.

The slowdown is definitely on. The question is how long it will last. For more detailed analyses of the Australasian wood market, including specific export data and price movements, visit IndustryEdge or click below.

Tim Woods

Tim Woods