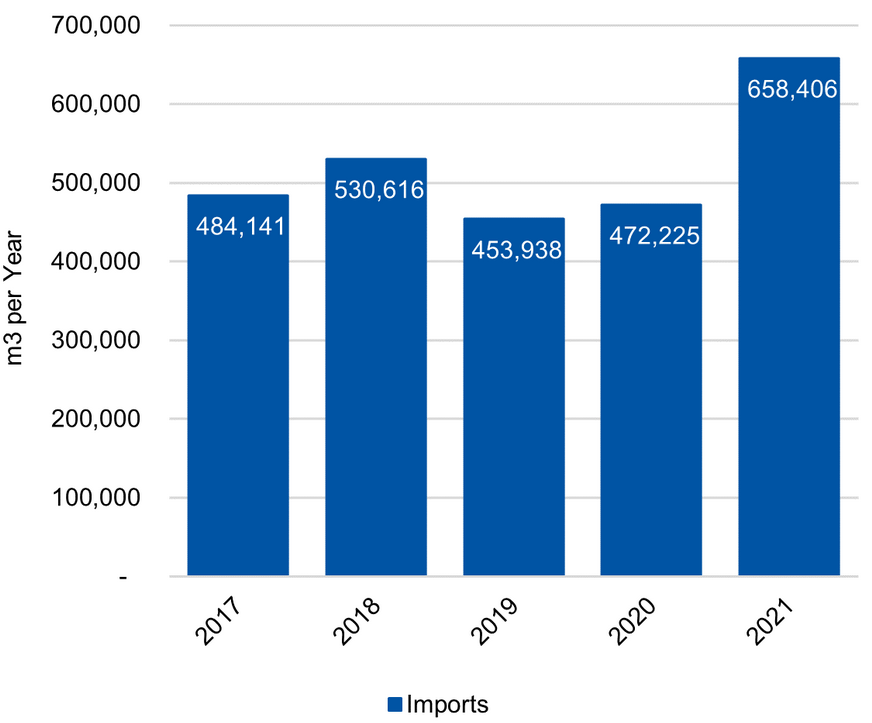

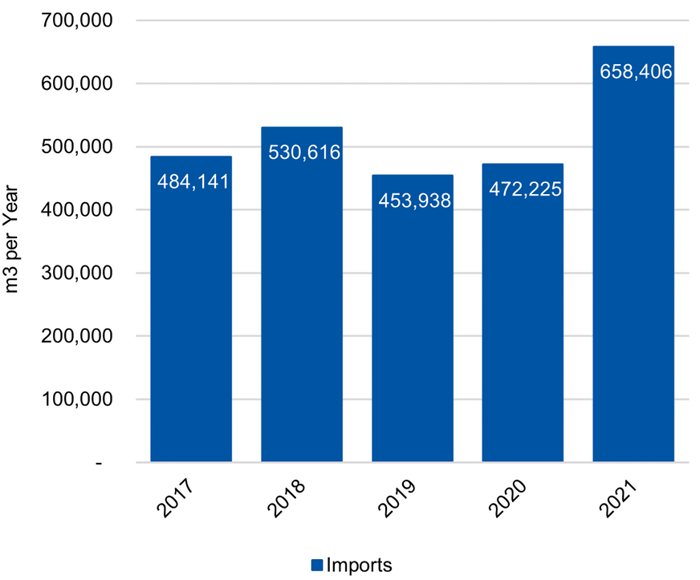

Australia’s imports of plywood lifted 39.4% in 2021, rocketing to total 658,406 cubic meters (m3) for the year. The latest data is available to subscribers on the Wood Market Edge online platform and can be visualized or downloaded 24/7.

In most respects, a big rise in imports is no shock. The rapid development of the giant housing pipeline has required supply of all materials to be supercharged. However, as the first chart shows, the rise in total plywood imports has been stellar over the last year.

Australian Annual Plywood Imports: 2017 – 2021 (m3)

Source: ABS & IndustryEdge

Source: ABS & IndustryEdge

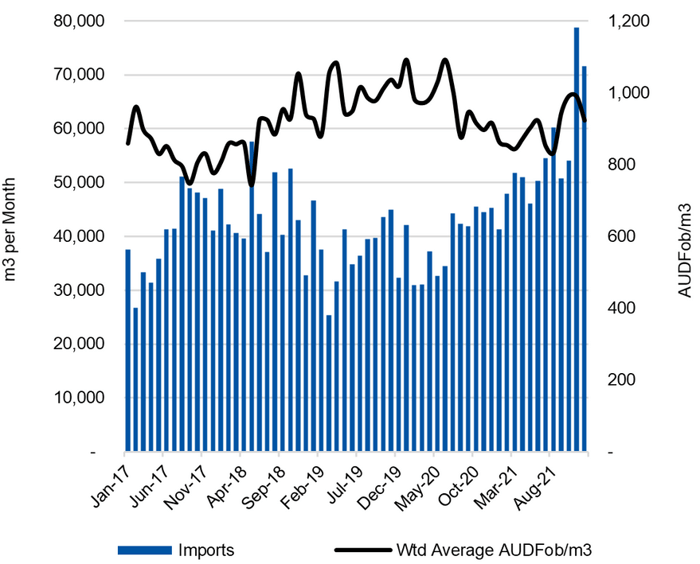

As subscribers began examining the data late last week, IndustryEdge was asked to review the most recent import data – to check that the data was correct. The data was, and is, accurate. The reason IndustryEdge was asked to check can be seen in the second chart: imports in November roared upwards to almost 79,000 m3 and in December were modestly lower at nearly 72,000 m3!

The chart also shows that although the average import price has suffered a little as volumes have grown rapidly, it was still at AUDFob923/m3 in December, stable with the price of a year earlier.

Australian Plywood Imports: Jan ’17 – Dec ’21 (m3 & AUDFob/m3)

Source: ABS & IndustryEdge

Source: ABS & IndustryEdge

Though supplies of building materials, labor and other resources are very challenging right now, the current boom offers valuable insights. One of those for the plywood market is that in aggregate, Australia is highly dependent upon imported products to supplement local supply. That is even more the case for other engineered wood products like LVL, CLT and Glulam. This data is perhaps giving the supply chain a clear indication of just how extensive that reliance can become.

The question of most interest might well be, is this an over reliance, and if so, what can be done about that?

Other questions the detailed data and downloadable data files answer include: Which countries have increased their supply? What are the relative differences in prices between countries, and by grade? Which grades are growing fastest, into what states, and from what ports?

Of course, further analysis is desirable, and the Wood Market Edge online platform provides a growing array of data and resources to assist subscribers to analyze a wide range of forestry and wood products markets. The IndustryEdge team is available to assist the supply chain to understand markets in great depth and global breadth.

Tim Woods

Tim Woods