Australia’s imports of wood products from Russia fell to its lowest monthly level in 28 months, valued at AUDFob1.185 million. The value of imports was 90% lower than in August 2021. Driven by Laminated Veneer Lumber, Russia’s shipments to Australia were in the midst of a boom before Putin’s war put paid to that.

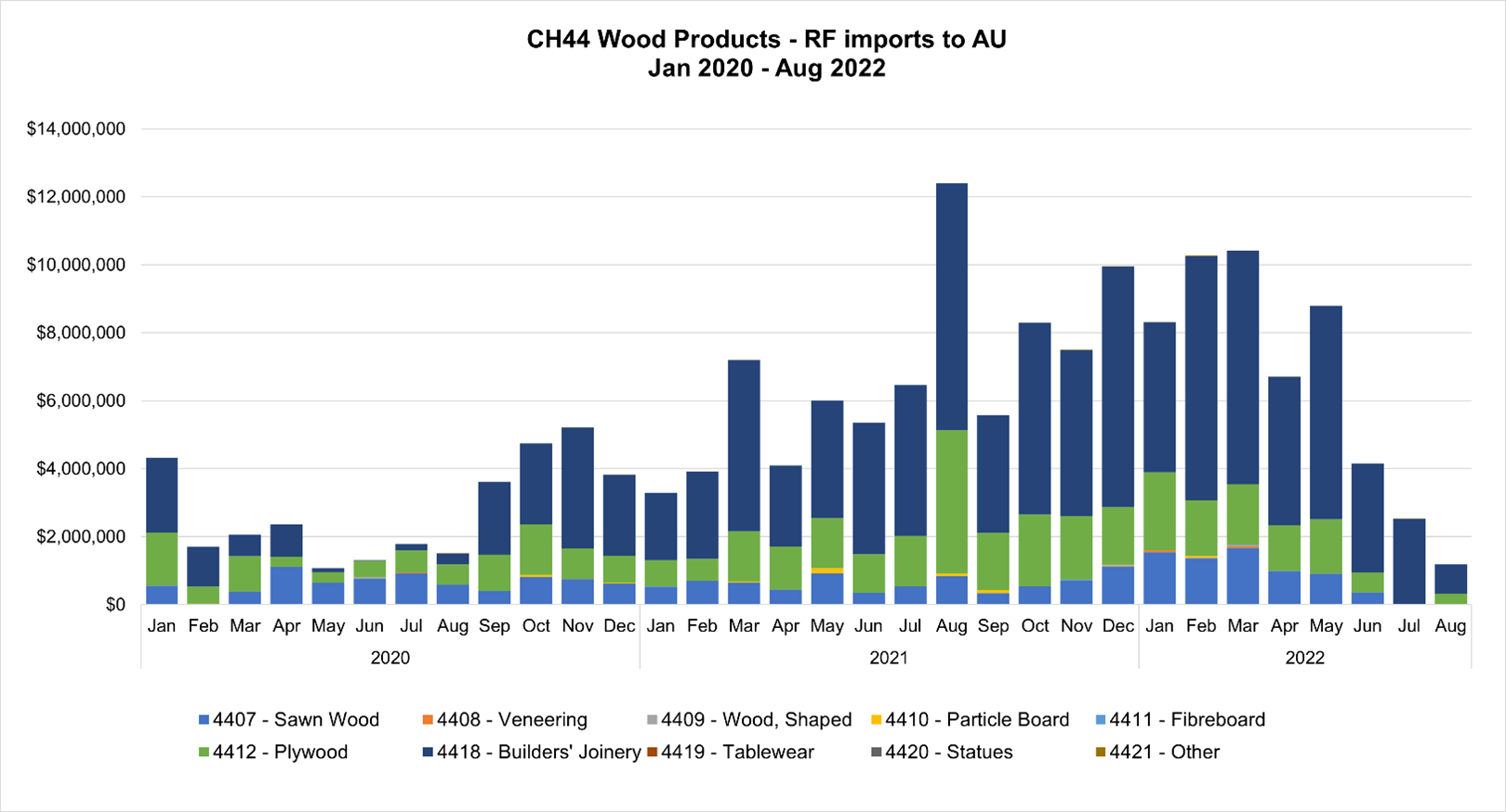

As the chart below shows, Australian wood imports from Russia were valued at AUDFob83.6 million year-ended August 2022, that was up 26.5% on the prior year, but is now rapidly falling away on an annual basis.

Source: ABS, derived and IndustryEdge

Much anticipated, the fall in imports from Russia has accelerated interest in increasing local production. The main target or area of interest is engineered wood products. Russia was the largest supplier of Laminated Veneer Lumber (LVL) until it decided to attack Ukraine in February.

With major certification bodies declaring wood from Russia to be “conflict wood,” sales declined rapidly, with major buyers removing Russian supply from their supply chain. There is little prospect of any Russian supply being in the Australian market by year’s end.

The industry is rife with anecdote and expectation that Russian wood will be “conflict washed” through other countries. That may allow some material to slide past the tariff, but the well-informed buyers are already deep in the supply chain working out what is acceptable and what is not.

Meantime, the strategically minded are working out how to manufacture more structural timber and wood products from the local resource. That’s more likely to be a sustainable solution.

Tim Woods

Tim Woods