5 min read

Australia’s April Housing Approvals Push the Cliff Further Into 2020

Tim Woods

:

June 11, 2020

Tim Woods

:

June 11, 2020

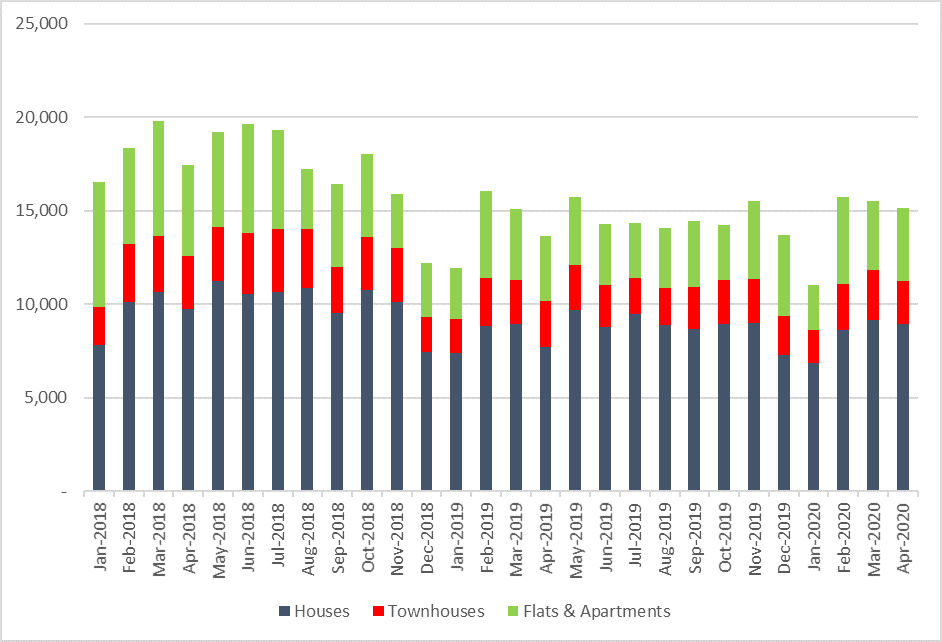

Expectations of a massive decline in dwelling approvals in April moved out another month, as seasonally adjusted approvals declined just 1.8 percent on the prior month. At 15,123 total approvals, the expectation of a fall of more than 10 percent is now anticipated to be delayed into the next few months.

In April, free standing approvals slipped 2.2 percent compared with March, falling back to 8,929 approvals after a particularly strong March. Townhouse approvals were down 12.7 percent, but Flat and Apartment approvals lifted 3.8 percent on March.

The driver for higher than expected dwelling approvals in April was the lag effect between project initiation at one end and specific building approvals at the other. The new consensus is that the approvals data for April is dealing with pre-pandemic housing commitments, some of which were committed in 2019, but most in early 2020.

Australian Dwelling Approvals by Main Type: Jan ’18 – Apr ’20 (Number)

Source: Australian Bureau of Statistics

One current uncertainty is the extent to which higher unemployment and reduced employment security will see some of those approvals be delayed, or not proceed at all. That is a real risk, and one that feeds into concerns about a massive slump in approvals later in the year.

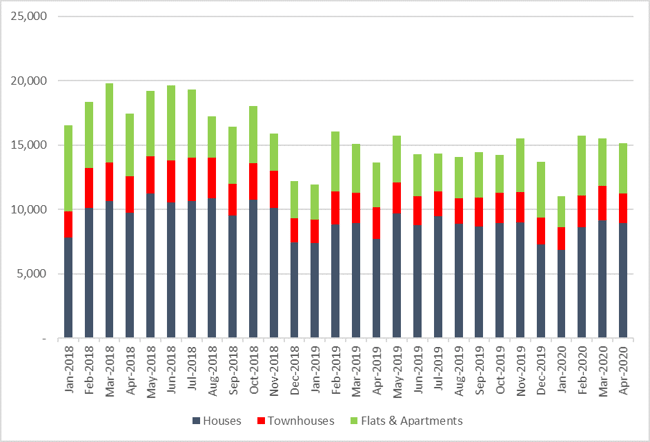

The April data certainly tells us we can now see dwelling approvals as something of a lagging indicator, being perhaps three months out of date. That is about double the time period IndustryEdge and others have modelled recently. It is small comfort we were not alone in expecting April approvals to crash, as we saw in the US housing start data released in late May.

Source: US Federal Reserve, published byForest2Market on SilvaStat360

Source: US Federal Reserve, published byForest2Market on SilvaStat360

The surprise April data for Australian approvals causes us to seek other measures to get a more immediate sense of the market for new dwellings, and therefore the building pipeline. More on that later.

What the approvals data also means is that we now have to push the cliff further away, to perhaps July for approvals and August and beyond for a major decline in building activity. In the context of a JobKeeper program due to end in September, and a quite limited housing sector stimulus package, we can safely assert that most of the pain is yet to come.

Housing stimulus package carefully targeted

The Government’s $688 million ‘Home Builder’ scheme, announced in early June, is either carefully targeted or too narrow, depending on your perspective. Our view is that whether it is too narrow or not, it has been carefully targeted.

Here is why.

The scheme provides only for new homes for owner-occupiers valued up to $750,000 or renovations valued between $150,000 and $750,000, with an end value below $1.5 million. It delivers a $25,000 grant that relies on at least $150,000 being contributed by the grant recipient. It is targeted to middle and lower-income families, whose combined income has to be below $200,000 per annum ($125,000 for singles). Grants are only available for contracts signed between 4th June and the end of December.

It takes a while for most households to collate $150,000, either in cash or debt, and most of us take a while to make momentous financial decisions. Most households on $200,000 or less are not going to have $150,000 readily available, so if they are to take up the grants, they need to be well advanced in their planning. That means the scheme is focused on investment by households that are already close to ‘approval ready’.

That is, we think the target group for this activity includes those who have been assembling their money and their loans and who need that little bit of extra stimulation to pull the contract trigger.

For renovations, the minimum spend is $150,000. That is a lot of building activity and it limits the extent to which the grants will be used for alterations and additions to existing homes.

Ultimately, we think it is likely the current Home Builder scheme will prove to be insufficient in breadth and depth to make a massive difference to the housing sector.

The entire sector faces an abrupt cliff-face around about September.

As a result, we anticipate at least two more rounds of significant stimulus in the construction sector, operating on different time horizons. One is likely to support social housing, and we would not be shocked to see funding applied to regional areas. The other is likely to be an extension of anything already announced, possibly operating in the first half of 2021, to support projects that are not yet shovel ready.

Loan activity provides a clue to borrower behavior

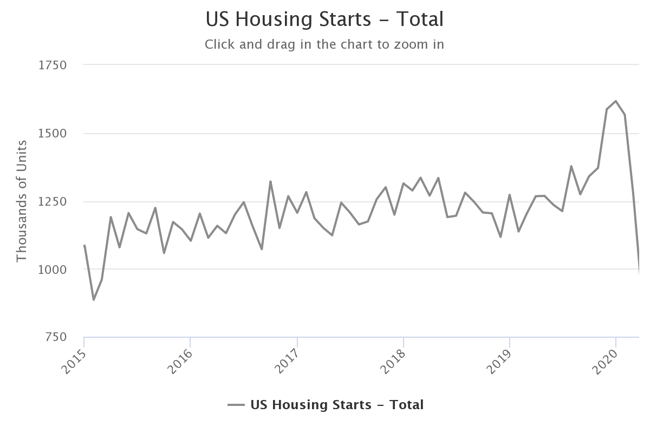

In April, the value of finance for new houses was $5.188 billion, up a very solid 7.0 percent on the prior month, but the always fickle alterations and additions activity fell 13.2 percent to AUD0.620 billion. Overall, that meant the value of loans for housing activity reached $5.809 billion, a rise of 4.4 percent on the prior month.

It is true – and we can see this in the chart – that finance values had been a little patchy month-on-month for housing activity, over the last few months. That always happens when markets are turning (either up or down). The waves of certainty and uncertainty don’t point in any one direction. However, the trend for new housing was up, unlike the data for the non-residential sector, which was pointing down.

Value of Building Approvals by Activity Type: Jan ’18 – Apr ’20 (AUD ‘000)

Source: Australian Bureau of Statistics

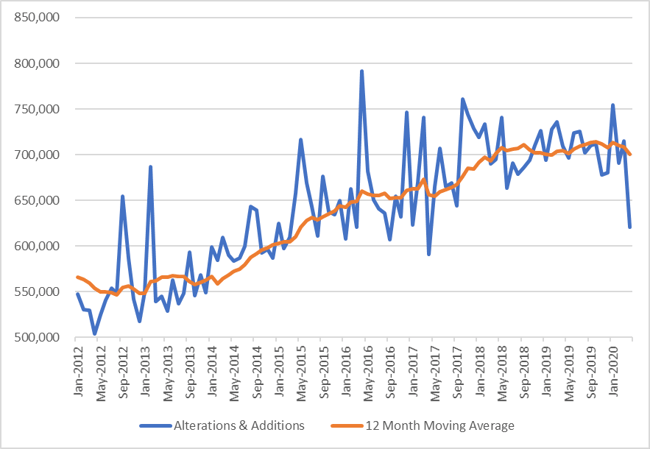

Our reason for examining this data is to get a clue about what may be happening in the future. It is possible that the best clue comes from Alterations & Additions finance data. A decision to renovate, in part or in full, can be made or changed more easily than a new dwelling purchase. The pipeline is shorter and the pathway to finance is often less challenging. So, we can look to Alterations & Additions finance in April to see if there is a downturn we can isolate, that may be linked to the pandemic.

Down 13.2 percent on the prior month, total Alterations & Additions finance was $0.620 billion in March, the lowest monthly total since April 2017, which in hindsight, and as the chart below indicates, looks like an aberration.

The downturn in April is probably not an aberration, however. In fact, the 12-month moving average smoothes the data out and shows the trend was flat anyway. Now it is not flat, it is on its way down.

Value of Loans for Alterations & Additions: Jan ’10 – Apr ’20 (AUD ‘000)

Source: Australian Bureau of Statistics

One month of poor data, on one indicator, does not tell us all we need to know. But if the value of loans for Alterations & Additions in April is anything to go by, the months ahead will be very challenging for the housing sector.

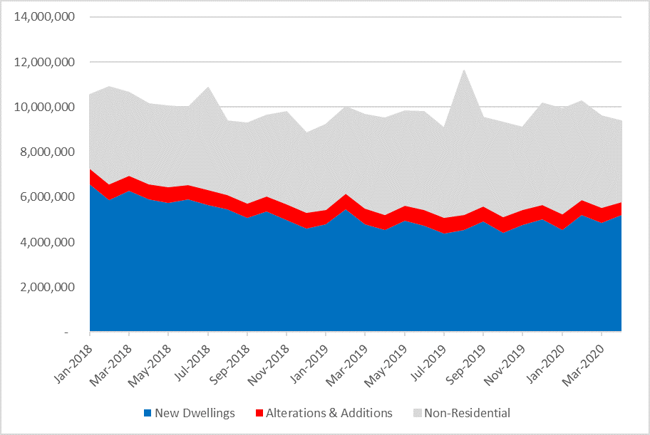

Houses continue to outperform in most states

For all that it is difficult to get past the pandemic and the uncertainties it brings, there are fundamentals and trends that are also important. One of those is the significance of houses, compared with all other formats.

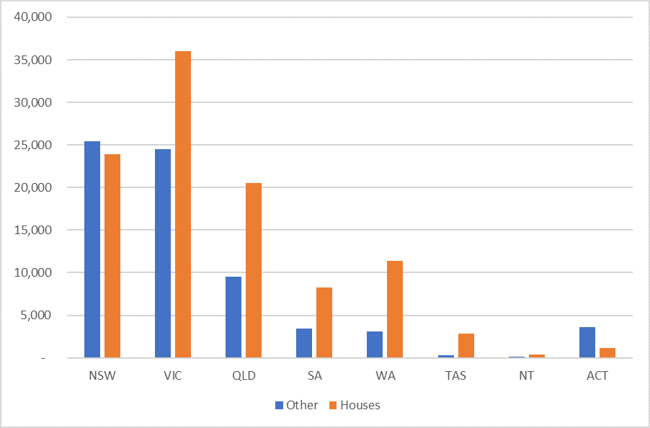

The trends continued over the year-ended April 2020, with houses accounting for almost exactly 60 percent of all approvals. As the chart shows, of the larger states, only New South Wales saw other housing format approvals higher than houses, and even then, not by much.

Approvals of Houses v. Other Formats by State: Year-Ended April 2020 (Number)

Source: Australian Bureau of Statistics

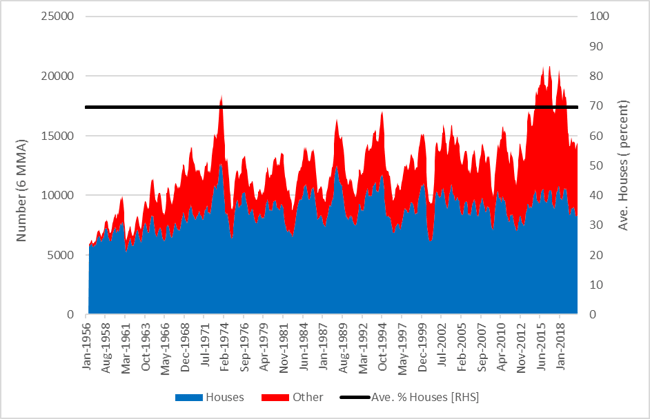

In fact, when we examine this data over all time periods, at a national level, the trend is even more pronounced. Since the Melbourne Olympics in 1956, houses have averaged 69.6 percent of total approvals.

Approvals of Houses v. Other Formats: Jan 1956 – Apr ‘2020 (Number & percent)

Source: Australian Bureau of Statistics

When the pandemic ends, the stimulus kicks in or some other condition causes the next housing upturn, traditional houses will be the mainstay of the recovery.

This analysis was originally prepared by IndustryEdge for the Frame & Truss Manufacturer's Association of Australia.