The only sovereign nation that is also a continent, Australia is the sixth largest country in the world. With just over 1.9 billion acres in total land area, Australia is quite large and boasts a unique geography and extremely diverse landscape. Due to its location between the South Pacific Ocean and the Indian Ocean, it is also a valuable trading partner and supplier of wood raw materials and wood products to a number of Asian destinations.

Australian Forest Products Industry Performance

Despite its many working forests and active forest industry, Australia is a net importer of forest products and its deficit has increased in recent years due to capacity limitations, the strong Australian dollar and a large supply of wood products available on international markets. In 2015-16, the value of Australian wood product imports was $5.5 billion, while exports were $3.1 billion.

Per a report by Australian Bureau of Agricultural and Resource Economics and Sciences Australia’s forest products industry sales were $22.2 billion in 2015. The forestry sector’s value added impact (which measures the contribution to Australia’s gross domestic product) grew by 1.5 percent to $7.8 billion in 2014–15. This was led by growth in the forestry and logging industries; wood and paper products manufacturing recorded negligible change.

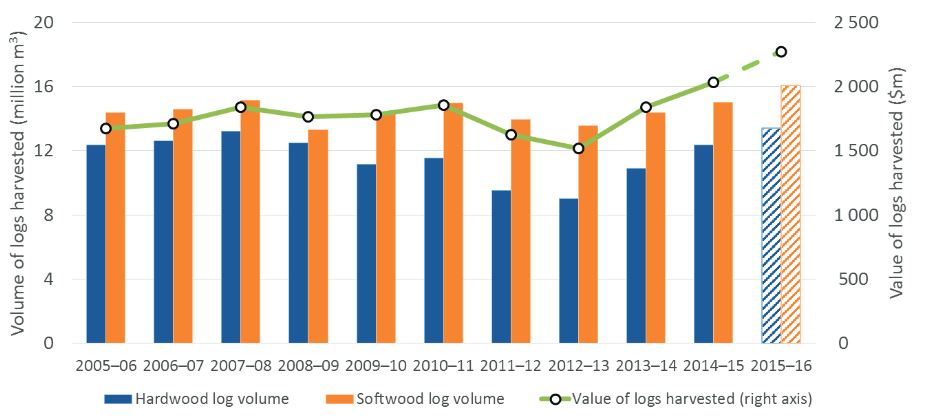

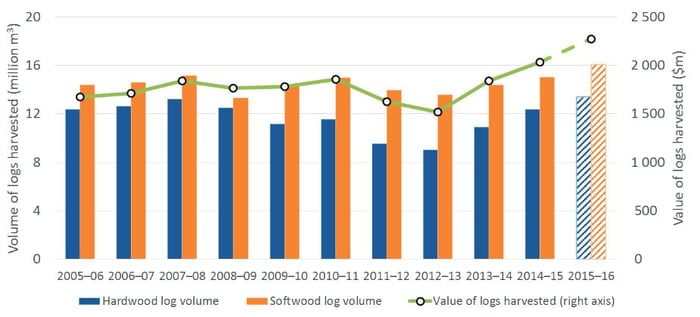

Hardwood log harvest volume was 13.4 million cubic meters in 2016; the total value of hardwood logs harvested was roughly $1.1 billion. Softwood log harvest volume was 16.1 million cubic meters, and the total value of softwood logs harvested was nearly $1.2 billion.

Source: Australian Bureau of Agricultural and Resource Economics and Sciences

Source: Australian Bureau of Agricultural and Resource Economics and Sciences

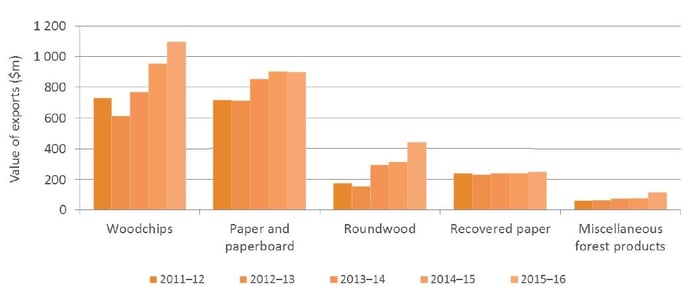

Australia’s Wood Products Exports

Wood product exports increased 11 percent from $2.8 billion in 2014–15 to $3.1 billion in 2015–16. This growth was primarily driven by increases in the value of woodchip and roundwood exports. Despite the exclusion of softwood woodchip exports from the latest data, the reported value of woodchip exports reached a record level of $1.1 billion in 2015-16. Hardwood woodchips, which have historically accounted for the majority of total woodchip exports in value terms, totaled $1.0 billion. Roundwood exports totaled $438 million, and miscellaneous forest product exports were $110 million.

Source: Australian Bureau of Agricultural and Resource Economics and Sciences

Source: Australian Bureau of Agricultural and Resource Economics and Sciences

Australia’s top export destinations in 2015–16 were China, Japan and New Zealand, which together accounted for over two-thirds of Australia’s total wood product exports. The value of wood product exports to China reached $1.3 billion in 2015–16. Exports to China alone accounted for 43 percent of Australia’s total wood product exports, 57 percent of total chip exports and 90 percent of total roundwood exports in 2015–16.

Japan was Australia’s second largest export destination with exports valued at $427 million in 2015–16. Exports to Japan were almost entirely comprised of woodchips and accounted for 14 percent of Australia’s total wood product export value and 37 percent of total woodchip export value.

Exports to New Zealand in 2015–16 were $317 million, accounting for 10 percent of Australia’s total wood products exports by value. The major commodities exported to New Zealand included paper, paperboard, and other related paper products, which accounted for 25 percent of Australia’s total paper and paperboard export value.

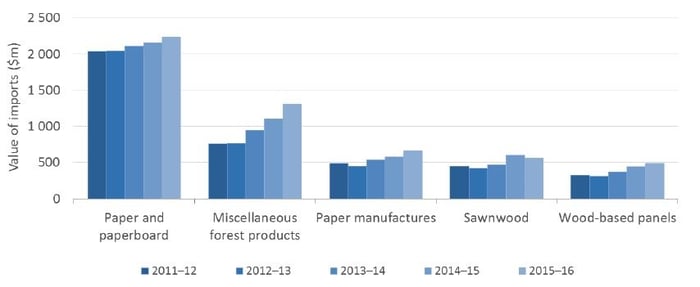

Australia’s Wood Products Imports

The value of wood product imports to Australia increased by 7.3 percent in 2015-16 to $5.5 billion. This was primarily the result of growth in the value of imports of paper and paperboard, miscellaneous forest products, paper manufactures (other related paper products) and wood-based panels.

The value of paper and paperboard imports increased 3.6 percent to $2.2 billion in 2015–16. This was driven by a 20 percent increase in imports of household and sanitary paper from $254 million in 2014–15 to $305 million in 2015–16, and a 16 percent increase in imports of packaging and industrial paper from $728 million to $845 million.

The value of miscellaneous forest product imports increased by 18 percent from $1.1 billion in 2014–15 to $1.3 billion in 2015–16. The value of wood-based panel imports increased 11 percent in 2015–16 from $439 million to $489 million. The largest increases were recorded in plywood and medium density fiberboard, which both increased by 14 percent in 2015–16.

Source: Australian Bureau of Agricultural and Resource Economics and Sciences

Source: Australian Bureau of Agricultural and Resource Economics and Sciences

Compared with its exports—75 percent of which travel to just three countries—Australia tends to import wood products from a wider range of countries. In value terms, roughly half of Australia’s total wood product imports in 2015–16 were from China, New Zealand and Indonesia.

Imports from China totaled $1.5 billion in 2015–16 and were comprised primarily of paper and paperboard ($597 million), miscellaneous forest products ($402 million) and paper manufactures ($312 million). Imports from Indonesia totaled $495 million, and the top imports were miscellaneous forest products ($243 million) and paper and paperboard ($146 million). Imports from New Zealand totaled $673 million in 2015–16 and were primarily comprised of sawnwood ($200 million), paper and paperboard ($166 million) and miscellaneous forest products ($108 million).