6 min read

Brazil Feedstock Supply and Price for Asian Biomass Consumers

Marcelo Schmid

:

March 22, 2017

Marcelo Schmid

:

March 22, 2017

As biopower markets in Asia mature, the increased competition for wood pellets and chips will provide opportunities for suppliers of these materials around the globe. Because biomass pellets can be made with low-cost wood raw materials and the cost of shipping is low, the number of potential suppliers is significant. Biopower producers in Japan and South Korea will require a secure and consistent supply of both pellets and chips, sometimes from multiple suppliers in multiple geographies. As a result, they will require strong procurement strategies, supply chain risk assessments, cost analyses, supplier diligence processes and contract negotiation strategies.

This is the fourth installment of our series on global supply regions that currently, or could in the future, supply Asian biopower markets. Part 1 focuses on the US South, Part 2 covers the US Pacific Northwest, and Part 3 covers British Columbia.

When we talk about global wood fiber supply, several factors make Brazil a naturally strong competitor, including growing rates, costs and labor just to name a few. What are the primary barriers that must be overcome to make Brazil a viable supplier to Asian biomass markets?

Much like the US, the timber market in Brazil is unique in that it is comprised of different growing regions with different characteristics. At Forest2Market do Brasil, we think of the Brazilian market as three distinct regions:

- A consolidated region, composed mainly of the southern states of Rio Grande do Sul, Santa Catarina, Paraná and São Paulo—where there are strong sawmill, pulpwood pine and pulpwood eucalyptus markets (São Paulo)—and Minas Gerais (eucalyptus for bioenergy) and the northeast coastal area (eucalyptus pulpwood).

- The new frontiers, represented mainly by the pulpwood market of Mato Grosso do Sul.

- The “very new” frontiers, which are composed of the northeast and northern states of Maranhão, Piauí, Tocantins and west Bahia.

All of these regions together represent a total planted area of about 8 million hectares (20 million acres). This diversification of the Brazilian forest sector is one of the reasons why the country is considered to be one of the best locations in the world to invest in forestry.

Forest Plantations and Productivity

The area of planted trees for industrial purposes in Brazil totaled 7.8 million hectares (19.3 million acres) in 2015, an increase of 0.8 percent over 2014. Eucalyptus plantations covered roughly 5.6 million hectares (13.8 million acres), mainly located in the states of Minas Gerais (24 percent), São Paulo (17 percent), and Mato Grosso do Sul (15 percent). Over the last five years, the growth of planted eucalyptus area increased by 2.8 percent. Mato Grosso do Sul has surged in this market with 450,000 hectares (1.1 million acres) planted over the last five years.

Brazilian forests are recognized worldwide for their high productivity rates; the country has the highest productivity (volume of wood produced per unit area, per year) and the shortest rotation (period between planting and harvesting) in the world. The average productivity of eucalyptus plantations in Brazil—as reported by forest products companies—is 36 m³/ha per year, while pine plantation productivity is 31 m³/ha per year. The typical rotation for pulpwood is roughly 6-7 years, and 12-15 years for sawtimber. These high production rates are the result of continuous investment by companies in the Brazilian forest industry to improve forest management practices.

Pellet and Chipmill Supply

The production of industrial-grade wood pellets and chips is not common in Brazil. Unlike the US South where it is possible to find over 100 wood-fiber pulping and pelletizing mills, there are just a few Brazilian companies dedicated to producing pellets/chips. Generally speaking, chips are produced for the market as an alternative only when there is no other higher valued market for other forest resources.

The supply that is typically delivered to a pellet or chipmill consists of small-diameter, tree-length logs classified as “pulpwood,” or “energywood,” as well as the top portion of higher-quality logs classified as “sawtimber.” Like US South, while sawtimber is not typically delivered to pellet mills, the wood chips created as a by-product of the sawmilling process are.

Recently, one of the largest wood panel companies in the country, Duratex, disclosed that it sees eucalyptus chip exports to Japan as a potential alternative during the economic recession that has affected wood panel consumption and Brazilian GDP. The primary concern at this point is the logistical costs.

Ownership/Supply Chain Characteristics

All timberland in Brazil is owned by private landowners (vertically-integrated forest products companies, non-industrial private forest [NIPF] landowners and timber investment management organizations [TIMOs]). Unlike the US South, almost 60 percent of the Brazilian forest belongs to forest products companies; 34 percent belongs to companies in the pulp and paper industry, 14 percent belongs to the charcoal-fired steelworks industry, 6 percent belongs to the wood panel and laminate flooring segments and 4 percent belongs to the solid wood products segment.

The independent forest owners and producers (small- and medium-sized) who invest in planted trees and sell roundwood own roughly 29 percent, and financial investors—generally through TIMOs—own only about 10 percent of the planted trees in Brazil. Attracted by the great potential of the country’s forests, these investors began operations here just over ten years ago by participating in specialized forest asset funds. Participation should grow in the near term, especially since the restrictions related to land acquisitions by international companies in Brazil will soon be reduced.

Currently, some regions in Brazil have a wood surplus, which could potentially be channeled to biomass production. These regions include:

- Minas Gerais: This state boasts the largest eucalyptus planted area in the country at 1.4 million hectares (3.5 million acres), most of which is used by the local charcoal-fired steelworks industry. Over the last 3 years, this industry has struggled and witnessed the bankruptcy of several mills and a subsequent decrease in wood demand. Currently, thousands of hectares of plantations are without demand and the local trade association (Associação Mineira de Silvicultura – AMS) sees bioenergy as an outlet for these forest resources. However, Minas Gerais is not located near a port, which creates logistical complications.

- São Paulo: One of the most traditional forest producing states in the country, São Paulo has the second largest planted forest area in Brazil—primarily used for pulp and panel production. Although the pulp market is performing well, the panel market in Brazil is struggling, and this has forced a number of companies to close. While theseforest resources are available for other uses like bioenergy. However, like Minas Gerais, São Paulo’s largest forests are too far from ports to make pellet/chip exports economically feasible.

- Mato Grosso do Sul: In the last 6 years, this state has seen an enormous expansion in its planted forest area as a result of efforts made by the state government to stimulate the planting of eucalyptus. However, the state didn’t incentivize mills at the same level it did the forest investment sector, and there is currently a surplus of about 200,000 hectares (494,000 acres) of eucalyptus standing in the forest. Mato Grosso do Sul also has the same issue as Minas Gerais and São Paulo in that it is not near any shipping ports and creates logistical challenges for exports.

- Rio Grande do Sul: The southernmost state in the country has 308,000 hectares (761,000 acres) of eucalyptus plantations and 184,000 hectares (455,000 acres) of pine plantation. Due to internal policies developed over the last 15 years, the state has few wood consumers: one large pulp mill owns the largest part of the eucalyptus planted area, and a few small- and medium-sized sawmills are spread throughout the state. These wood markets are difficult to access, and some investors in the state are having difficulty selling their forest land. Forest2Market do Brasil believes that more than 80 thousand hectares (198,000 acres) of eucalyptus fiber are available. These resources could potentially be channeled to the international bioenergy market, as the location of the state is the most logistically advantaged among all Brazilian states with a wood surplus.

Feedstock Costs

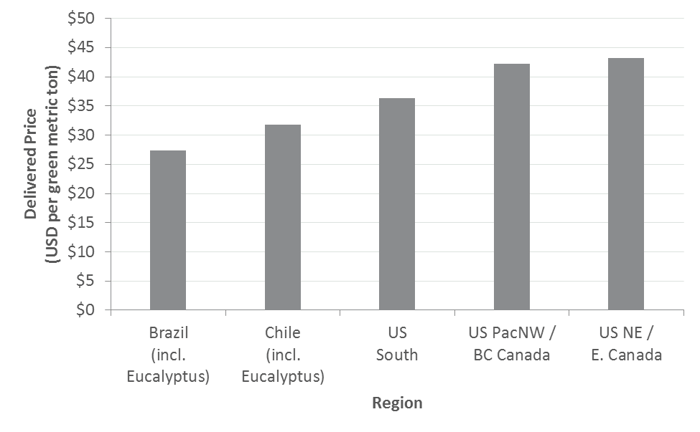

Even considering the infrastructure and logistical challenges, as well as the lack of dedicated chips and pellet plants, Brazil has the lowest wood fiber cost in the world, which makes the country very competitive when compared to other regions (Figure 1-1). As noted above, the primary reason for this market advantage is Brazil’s high growth rates.

Figure 1-1 Global Pine Pulpwood Price (in metric tons)

According to Forest2Market do Brasil data, the cost of delivered wood chips in Brazil is roughly US$41-$43 per green metric ton. The primary in-country market for these chips is the food production and crop industries, which use chips for heat and drying purposes. However, considering the logistical and administrative costs related to exporting these chips, the average minimum FOB price in Brazil is around US$148 per dry metric ton.

Wood costs in Brazil make up a smaller portion of the final product’s delivered price when compared to the US South, however, logistics represents the single largest cost component in Brazil. For Asian biomass consumers, the best opportunities in Brazil lie in identifying available fiber that is close to the coast and ports where the transportation costs would be more competitive. Based on the country’s current wood market situation, Rio Grande do Sul is the most advantaged location for exporting wood pellets and chips.

Brazil-based wood products company TANAC has constructed the first wood pellet manufacturing facility near the Rio Grande port. The company has a long-term agreement with Drax Power Limited, part of the UK-based Drax Group, for the supply of wood pellets. Aside from the TANAC facility, there is also a successful chip project run by Mita but, like TANAC, the project is only feasible due to its unique product offering and geographical location. Based on Forest2Market do Brasil data, the extreme minimum price for delivered chips to Rio Grande do Sul is one of the most competitive in the country at roughly US$120/dry metric ton (FOB).

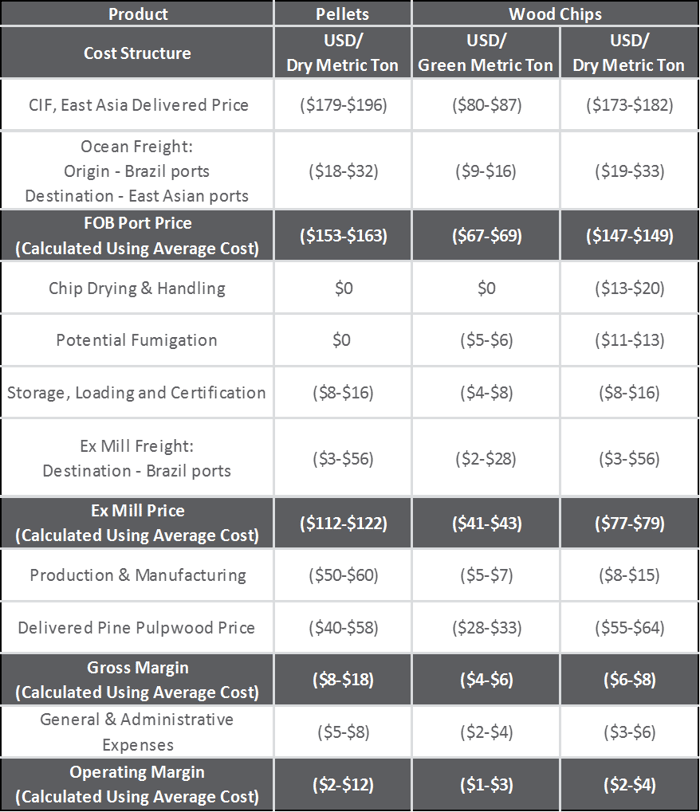

The following table shows the cost components associated with producing and exporting pellets, as well as both green and dry wood chips from Brazil to ports in East Asia. Under current conditions, the costs for exporting these materials to East Asia from Brazil are comparable to those from the US South. Brazil holds the clear advantage on wood costs, but is disadvantaged by transportation costs. The transportation leg of the supply chain inside of Brazil can potentially be improved by construction of pellet/chip facilities closer to the raw material and through better infrastructure. However, the ocean leg of the supply chain is more problematic. Current sea-freight costs are relatively low by historic standards, so any change in the shipping environment is likely to adversely affect costs in that segment.