1 min read

Brazilian Pulp Market: Recent Revenue Increases Reverse Trend

Marcelo Schmid

:

June 6, 2017

Marcelo Schmid

:

June 6, 2017

Forest2Market do Brasil recently analyzed Brazilian pulp exports and identified a noteworthy trend. While Brazil exported 3.4 percent more pulp in January/February 2017 compared to the same period in 2016, export revenue was actually down 9 percent compared to the corresponding period in 2016. This performance confirms a trend observed throughout 2H2016 and into early 2017, where pulp exports increased but revenues from those exports decreased.

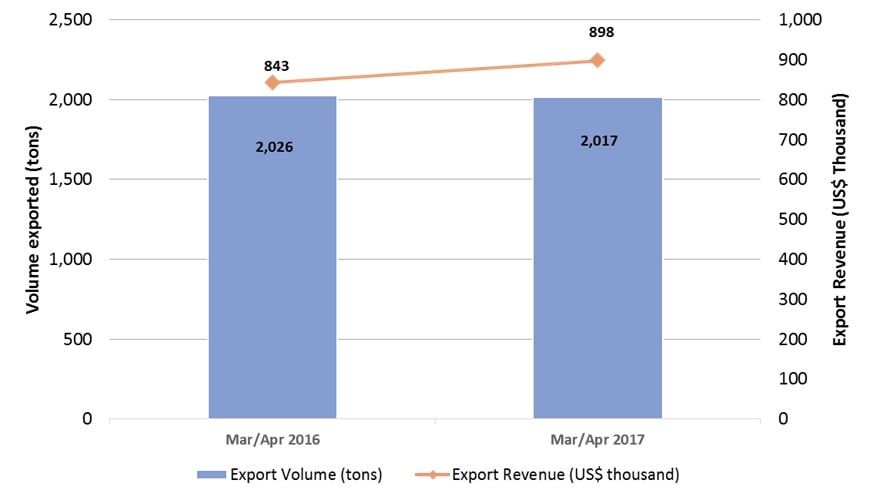

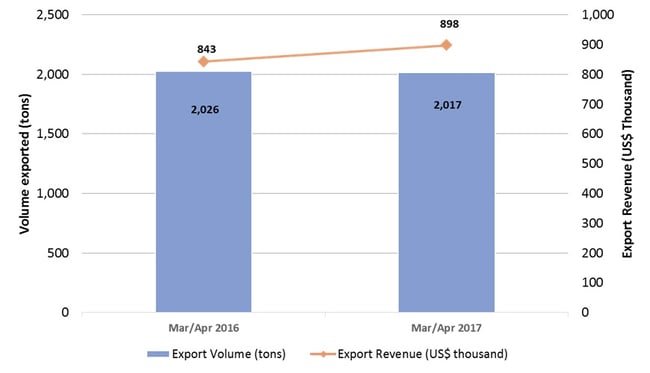

However, an analysis of the second two-month period of 2017 shows a reversal of this trend. The graph below shows a comparison of Brazilian pulp exports during the March/April period of 2017 with the March/April period of 2016. While there is just a slight period-over-period difference in production volume, there was a revenue increase of 6.5 percent in 2017.

It would be short-sighted to presume that this type of revenue increase may signify a lasting change for the remainder of 2017. Nevertheless, the increase can be seen as a direct result of the consecutive increases in pulp prices witnessed on the international market in recent months. At the end of May, Brazilian firms Suzano and Fibria—the two largest producers of eucalyptus pulp in the world—announced that a sixth price increase of 2017 will take effect in June. Suzano will raise prices for the Chinese and US markets by $20/ton and $50/ton, respectively, while Fibria announced a price increase for North American (NA), European and Asian markets of $40/ton for NA and Europe, and $20/ton for Asia.

In the wake of last year’s decrease in revenues, Brazilian pulp companies are taking advantage of increased international market activity due to steady demand. They have also benefited from a delay in operations at OKI, a new Indonesian facility owned by Asia Pulp & Paper (APP). With two million tons of productive capacity, which could reach 3.2 million tons in time, this facility will have a tremendous impact on the market.

For Brazilian producers, the current revenue opportunities will not last forever, although the industry remains optimistic; statements from major domestic producers indicate they are expecting revenues in 2017 to be better than in previous years. APP also recently reported that it will direct all of its pulp in 2017 towards paper production, thereby reducing the additional supply of pulp on the international market. This provides Brazilian producers with a timely, albeit limited, opportunity to generate revenues during the remainder of 2017.