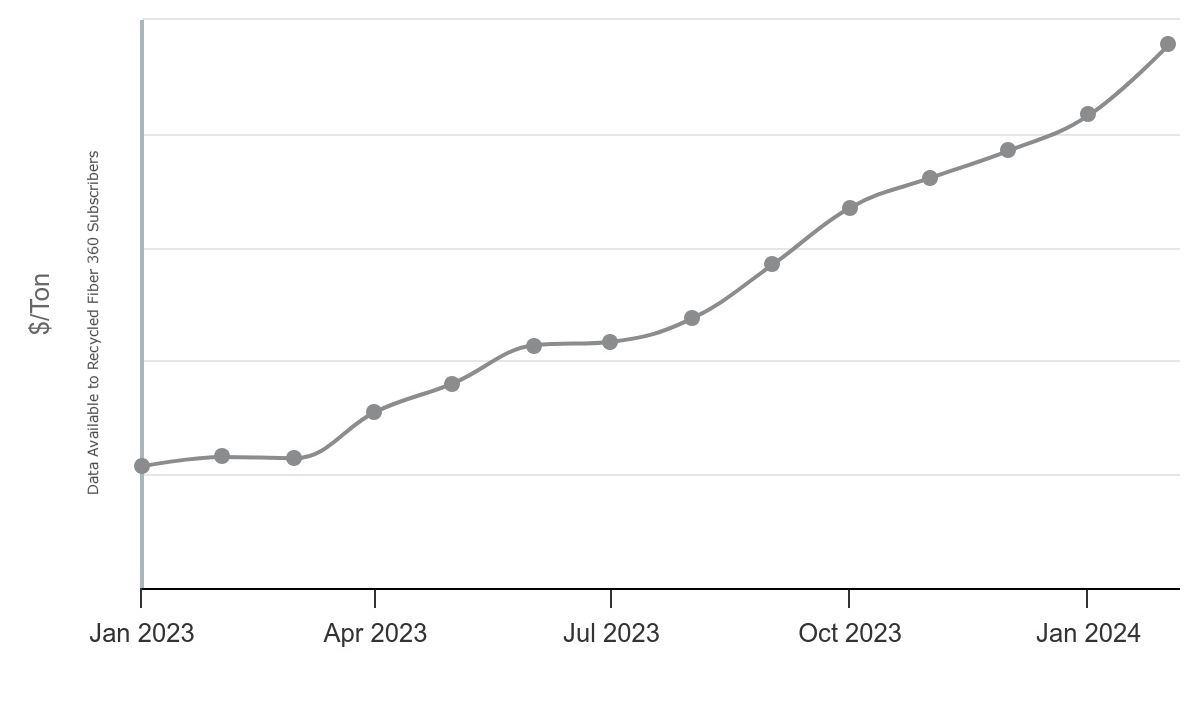

Wood fiber costs for Brazilian pulpmills have shot up substantially over the past two years. Wood Market Prices has continued to track these costs, and the line keeps rising.

The most recent reporting shows an even further spike in those prices. Our data shows that Brazil's cost increases outpace the overall global price index.

Pricing Jump Shows Post-Pandemic Recovery Back to Average Prices

Brazil has continued to become a major producer of pulp and paper in the global marketplace. In fact, it now claims the title of #3 biggest global producer of P&P. Because of this growth, demand has surged for wood resources throughout the country.

Across 2022 and so far in 2023, wood costs for pulpmills in Brazil steadily increased as the market recovered. Prices for softwood and hardwood pulplogs doubled in two years in US dollar terms (slightly less in the Brazilian Real).

The surge came after prices reached an almost 20-year low in late 2020. We have seen significant increases in wood fiber costs over the past few years. Despite the big changes in price, current levels are actually close to average for the past two decades.

Eucalyptus Pulplog Prices Continue on Decade-Long Upward Trend

Prices (in Brazilian Real) for eucalyptus pulplogs have trended upward for about a decade. They increased faster in the past three years by as much as 97% from the 1Q/20 to the 1Q/23.

For most of the past ten years, the US dollar has strengthened against the Real. This resulted in wood fiber costs trending downward (in USD). However, in the past two years, the exchange rate remained relatively stable.

Brazilian Wood Fiber Prices Are Most Volatile of All Major Countries

Brazilian wood fiber costs have fluctuated more than any other country tracked by Wood Resources International over the past 35 years. Looking back to 1988, eucalyptus prices averaged less than $35/bdmt. Between 2003 and 2011, the prices increased continuously and peaked at an all-time high in 2011.

After this high, a nine-year downward trend followed until bottoming out at a 16-year low in 2020. Since that turning point, prices have steadily grown to reach their highest levels since 2014 in the 1Q/23.

Brazilian Prices Rose Faster than Global Hardwood Fiber Price Index

Relative to the Global Hardwood Fiber Price Index (HFPI), Brazilian wood fiber prices increased faster over the past two decades. The HFPI has increased about 40% since 2000. Conversely, eucalyptus log prices in Brazil have increased almost 200% over the same period.

Why have Brazil's wood fiber costs gone up more sharply than the global average? Increased competition for logs, longer transportation distances, and higher labor costs all contributed to this difference.

Brazil, World Leaders Aim to Restore Lost Trees in Amazon

In forestry news, Brazil continues developing policies and procedures to legitimize forestry in areas where illegal logging was rampant. The country has already committed to restore up to 12 million hectares of degraded or deforested lands by 2030.

This move comes as Brazil’s new president, Lula da Silv, responds to forest damage done by his predecessor Jair Bolsonaro. One example of this work addresses illegal deforestation fueling trade to China.

The US is also impacting some change in Brazil in terms of forest restoration. In April, President Biden announced $500 million in aid to Brazil’s Amazon Fund. Under Bolsanaro’s reign alone, Brazil lost a chunk of rainforest the size of Denmark. Support from the US will directly aid in purchasing seeds and determining the logistics to achieve Brazil’s 2030 goals.

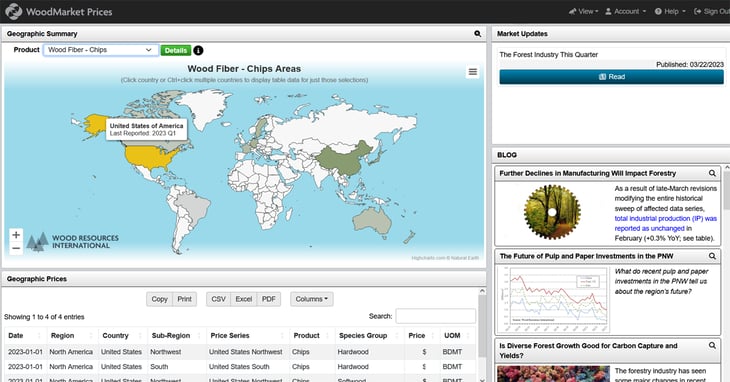

Global Insights and Pricing Data from WoodMarket Prices

Wood Resources International from ResourceWise provides crucial insights, developments, and shifts across all major global wood markets. Our flagship product, WoodMarket Prices, offers an all-in-one online solution for news, data, and more.

We provide unique pricing indices which give you accurate cost data critical major wood products in the industry. The platform covers an extensive range across regions such as North and South America, Asia, Oceania, and Europe.

Tracking since 1988, our data is unparalleled in quality and historical accuracy. With trending news, global trade flows, and market commentary, WoodMarket Prices offers a powerful set of tools for your business. You can use this information to develop better plans and strategies that are grounded in real-world market data.

Learn more about WoodMarket Prices and how it can benefit your decision-making.

Håkan Ekström

Håkan Ekström