Forest2Market has closely followed the resurgence of the wood fiber market (and the pine market, specifically) in Brazil over the course of the last several years, which has occurred amid a tumultuous political environment. After a long recessionary period, current domestic market segments like packaging and panels have grown, and the outlook for pine wood products is optimistic.

While some of the political fallout still continues to affect the full recovery of the domestic economy, foreign markets have provided Brazil’s pine industry with a real jolt.

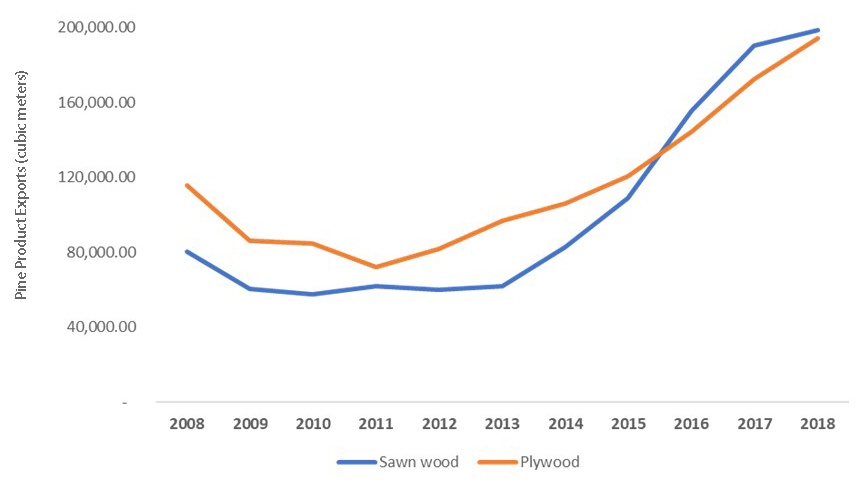

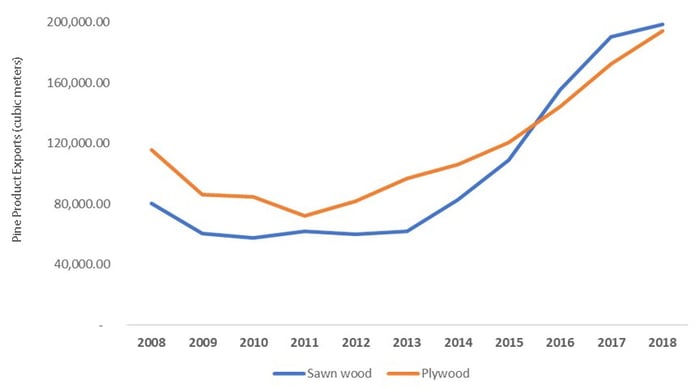

The chart below shows the change in Brazil’s export lumber and plywood volume over the last 10 years. In March 2018, the volume of pine plywood exports reached a record high of just over 200,000 cubic meters (m3), a 22 percent increase over March 2017 and a 36 percent increase over March 2016. The volume of sawn wood exports also set a new record at 210,000 m3, which was the best March performance in the last decade.

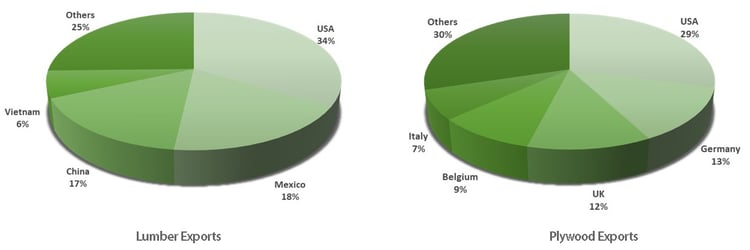

Of the export destinations for these two products in 1Q2018, the United States was the #1 importer. However, the volume that Brazil exports to the US is very small considering the tremendous size of the US construction market; roughly 1 percent of the total volume comes from Brazil.

Based on this data, the current and near-term prospects for the Brazilian pine market are encouraging. While the export market for all Brazilian wood products is driving growth, the domestic market is still in recovery and a number of factors continue to influence this dynamic.

Considerations for Brazil’s export market:

- The main export destination for Brazilian wood products is the US. Based on the uncertainty surrounding the current political climate, trade tariffs, etc. in the US, it is unknown whether or not new trade policies might negatively affect Brazil. Some of the more protectionist measures taken primarily against China may actually benefit Brazil’s wood products exports; however, a new steel tariff would negatively impact the Brazilian forest sector.

- The US is also the main export destination for several European countries that also happen to buy significant forest resources from Brazil. Therefore, US trade decisions have an enormous influence on the entire global market of wood products. In an interconnected global market, all major geopolitical and trade decisions have cascading consequences that ripple throughout the far reaches of the worldwide economy.

- China’s recent efforts to tackle its pollution problem by restricting some paper imports and closing older, dirtier mills should result in additional demand for hardwood pulp and fiber derived from Brazil’s abundant eucalyptus resource. Globally, pulp makers need to expand capacity to meet new demand from Asia, and Brazil’s pulp producers are poised to take advantage of the situation due to their output capabilities and low-cost global position.

- The exchange rate reached a favorable level for Brazilian exporters in recent weeks (3.4 Brazilian reais = 1 US dollar). Many economists believe that this exchange rate will be fairly stable through 2018, which means that the US market will remain profitable for Brazilian producers.

Considerations for Brazil’s domestic market:

- The domestic market is showing clear signs of recovery. However, just as Brazil’s export market is affected by trade decisions made by the US, the domestic market is affected not only by Brazilian trade policy, but also any shifting market dynamics due to changes in the export market. If recent history is any guide, Brazilian politics can be unpredictable and the domestic market will be hardest hit should something catastrophic occur.

- Brazil’s economy grew in 2017 after two years of contraction as investment spending, agriculture and industrial production helped pull the country out of recession. GDP expanded by 1.0 percent during 2017, finishing the year strong with a 2.1 percent jump in 4Q compared to the same period a year earlier. Investment increased 2.0 percent in Q4 from 3Q, and grew 3.8 percent from a year earlier. Industrial activity rose 0.5 percent and 2.7 percent over the same periods.

- Brazil’s economic recovery may be slowed and/or delayed by new or changing government regulations. However, the forest sector (and agribusiness as a whole) have been somewhat insulated from regulatory changes in recent years and this situation is unlikely to change.

Brazil’s forest products industry is entering into a positive phase in the global market cycle. While some of the considerations above may adversely affect this phase, the recent past indicates that global politics and some of the trade disputes that arise are generally temporary. Additionally, Brazil's low-cost position and abundance of fast-growing wood fiber make it an increasingly favorable trade partner in a global economy. Despite US trade policy regarding other nations, Brazil is currently in an advantaged position as a supplier to the US; it is the largest market in the world, and Brazil has plenty of opportunity to further penetrate it.

Marcelo Schmid

Marcelo Schmid