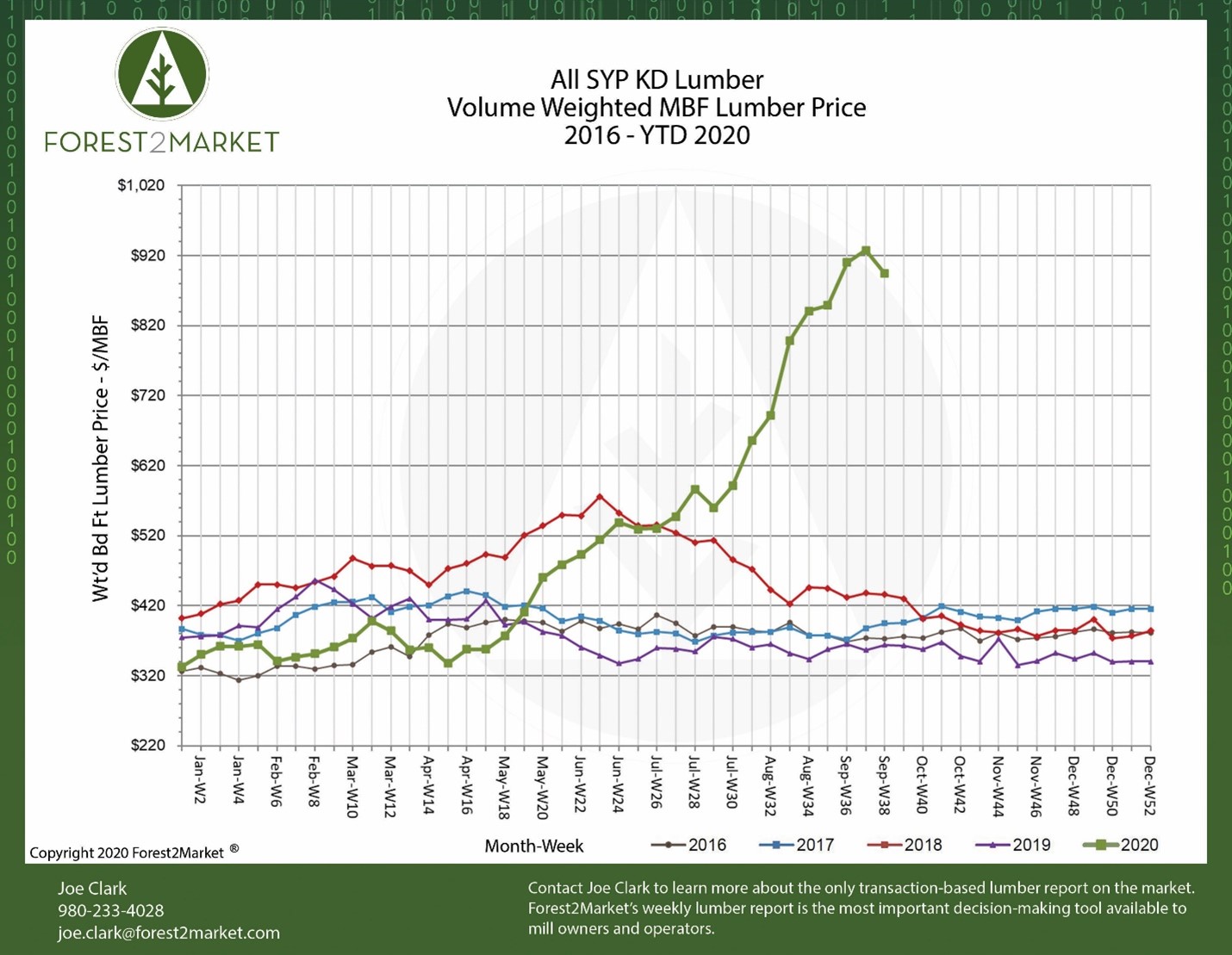

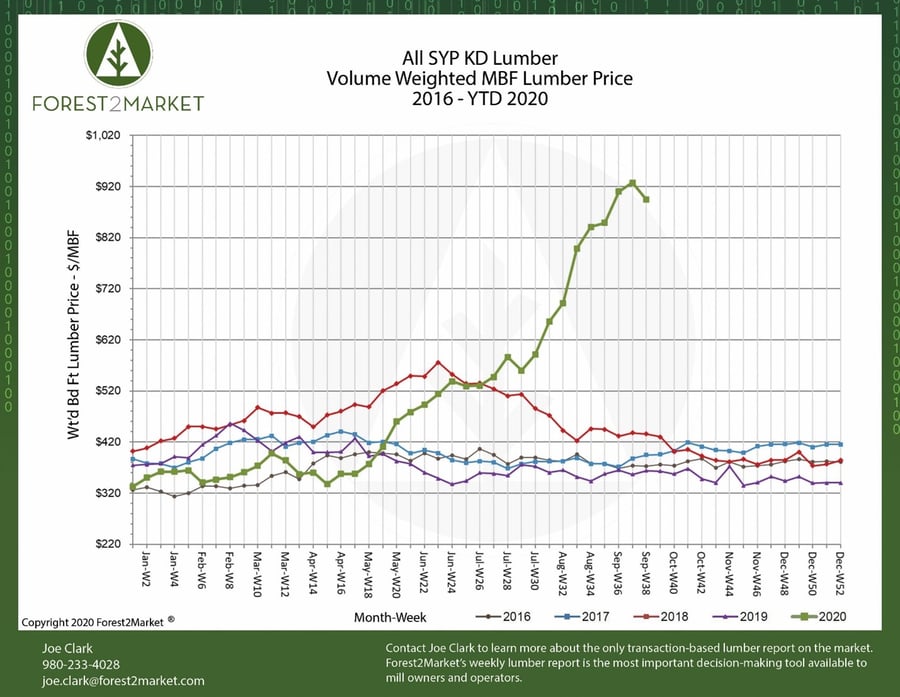

After eight consecutive record-breaking weeks culminating in an astoundingly high price, southern yellow pine (SYP) lumber prices finally reversed course in mid-September. Forest2Market’s composite SYP lumber price for the week ending September 18 (week 38) was $895/MBF, a 3.6% decrease from the previous week’s price (and all-time high) of $928/MBF, but an amazing 146% increase from the same week in 2019. Other price trends observed throughout what has become the most chaotic year in recent history include:

- 1Q2020 Average Price: $360/MBF

- 2Q2020 Average Price: $442/MBF

- 3Q2020 Average Price: $738/MBF

- YTD Average Price: $507/MBF

Needless to say, the North American sawmill supply chain has been under a lot of pressure since the COVID-induced “lockdowns” that began in March. Industry capacity has been maxed throughout the summer as wholesalers and distributors snatched up every board they could find, and the trend has not been unique to the South.

Market Snapshot & Outlook

As Pete Stewart wrote last month, stronger than expected housing starts and unforeseen demand from the remodel sector caught the market off guard during the peak of the national lockdowns:

“As production capacity has fluctuated, demand patterns have changed, and the lumber manufacturing sector has been chasing a moving target ever since early Spring. For wholesalers and purchasers of finished lumber, who typically buy inventories many weeks in advance, the situation has created a sense of desperation that has resulted in panic buying. They, too, have been chasing a moving target as they try to secure a share of limited inventories while staying one step ahead of the competition and maintaining build schedules. When this kind of panic grips a commodities market, it oftentimes spins into a speculative scenario in which prices deviate significantly from intrinsic values.”

This combination of events resulted in a tremendous gap in the market, and the supply chain has not had the opportunity to rebalance. While we are now five months removed from the onset of the lockdowns, the finished lumber sector is facing a new challenge as production in the PNW and western Canada has been impacted by devastating wildfires, which have claimed dozens of lives and inflicted significant damage to communities, homes and businesses, and timber resources in the region.

Though order files remain full, the most recent data and market information suggest that lumber prices may have peaked and are now beginning to wane. As producers continue to react to market signals and are better able to match production to current demand trends, the supply/demand relationship is likely to equalize and the North American lumber market will find its footing.