2 min read

Canada Pushes Back, Announces Duties on US Wood Products Imports

John Greene

:

June 14, 2018

Nearly a year after the U.S. Commerce Department announced duties on imports of Canadian softwood lumber, the ongoing global trade saga continues in the wake of the G7 summit in early June. In recent weeks leading up to the summit, President Trump announced new tariffs of 25 percent on steel and 10 percent on aluminum imports from Canada, Mexico and the European Union. Canadian softwood lumber producers have been paying duties on their shipments to the US for nearly a year, spending more than $200 million in 2017, and hundreds of millions more is expected in 2018.

"The United States will not allow other countries to impose massive Tariffs and Trade Barriers on its farmers, workers and companies," President Trump said via Twitter, "While sending their product into our country tax free. We have put up with Trade Abuse for many decades — and that is long enough."

Canadian Prime Minister Justin Trudeau responded with equally tough talk, saying he would impose retaliatory measures with "absolute certainty" in response to President Trump's tariffs on steel and aluminum. "I will always protect Canadian workers and Canadian interests," Trudeau added.

Recent Developments

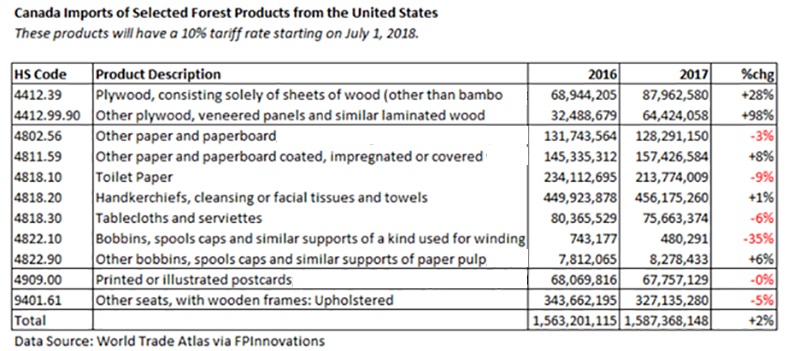

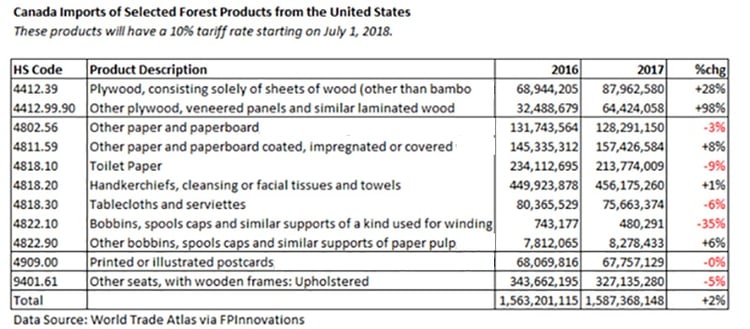

In response to the new steel and aluminum tariffs mentioned above, Canadian Prime Minister Justin Trudeau fired back with counter-tariffs on $16.6 billion worth of US products—everything from yogurt and cucumbers, to appliances and coffee, as well as some wood products. Aside from steel and aluminum, the wood products listed below will have a 10 percent tariff added beginning on July 1, 2018.

Graphic provided by Madison’s

Surging demand for lumber from the US housing sector has driven prices to record highs. “It’s not entirely dissimilar with steel,” said RBC senior economist Nathan Janzen. “Steel prices were already rising before the U.S. imposed tariffs because of the stronger global economy and the stronger industrial sector across North America.”

While the move on Canada’s part appears to be more symbolic rather than malicious in nature, it does raise concerns about long-term trading relationships and a tendency for this type of posturing to escalate needlessly.

Bernard Wolf of Canada’s Schulich School of Business notes that, “On a macroeconomic level, overall these price increases on products… aren’t likely to add substantially to inflationary forces since the products don’t represent a huge portion of the Canadian economy.” But in this case, who really wins in the end? Dr. Wolf added, “The more the retaliatory tariffs force a deviation from an optimum allocation of capital and labor, the worse off the consumer. The longer the tariffs remain, the greater the damage.”

However, when pressed on the matter, President Trump said he ultimately favors the elimination of trade barriers between the United States and its closest allies, adding "Ultimately that's what you want. You want a tariff free. You want no barriers. And you want no subsidies. Because you have some cases where countries are subsidizing industries and that's not fair."