Pine Pulpwood Demand

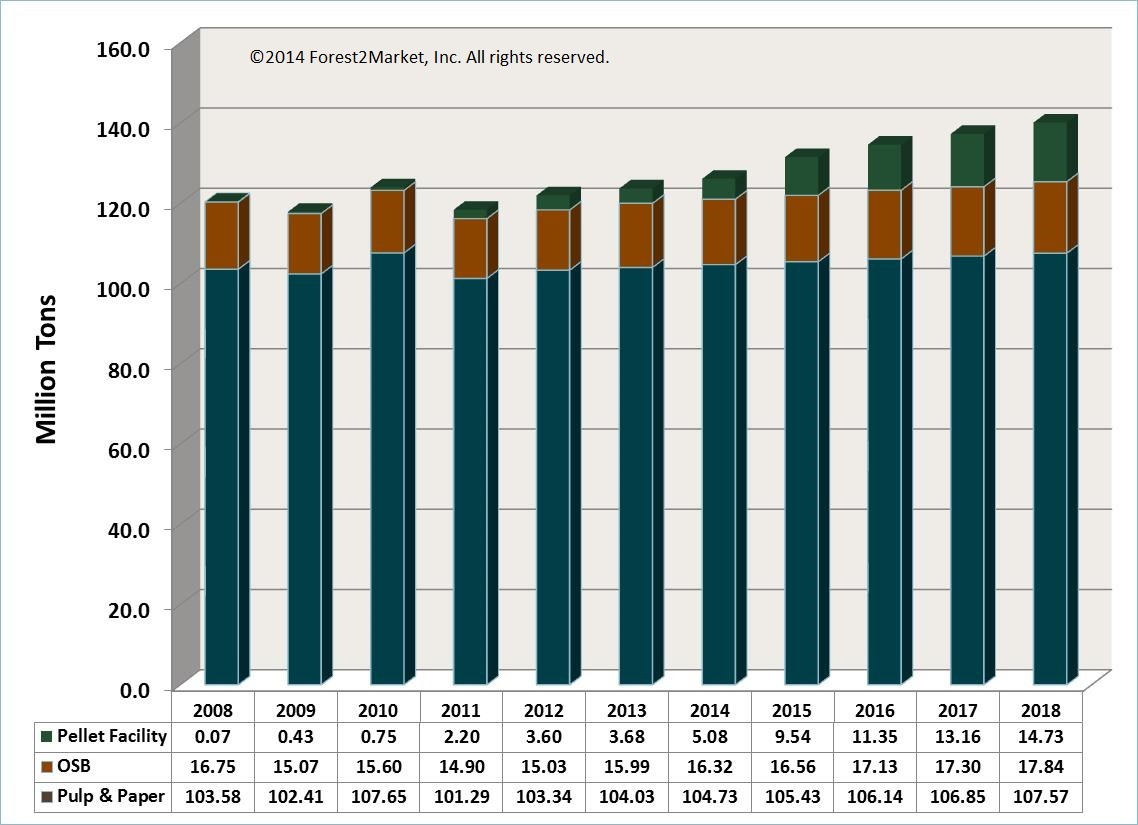

The pulp and paper industry consumes roughly 100 million tons of pine pulpwood every year. In the 1990s, OSB was introduced to the construction industry, and the pulp and paper industry had its first real competition for wood supply. Since then, OSB mills have been consuming approximately 20 million tons of pine pulpwood a year. The following graph tells the story of pine pulpwood demand in the US South and of how the industrial wood pellet market emerged as a consumer of pine pulpwood over the last five years.

As this figure illustrates, very little demand from pellet manufacturers existed in pine pulpwood markets in 2008. In 2013, we expect that demand totalled 3.7 million tons, with a potential to approach the consumption levels of OSB mills—20 million tons—by 2020.

We estimate that demand for pine pulpwood in the South will increase by 11 percent in the next five year period (2014-2018), driven by higher demand for packaging, containerboard, fluff pulp, OSB and wood pellets. (Note: pellet production is not the sole source of increased demand in the market.) This will drive consumption from 120 million tons per year to 140 million tons per year.

Hardwood Pulpwood Demand

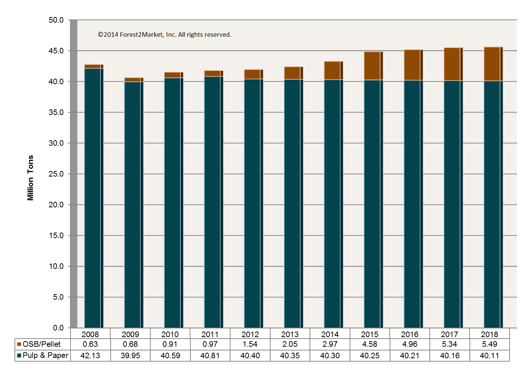

Hardwood pulpwood consumption is significantly lower than pine pulpwood consumption, with the pulp and paper industry consuming 40 million tons, and the OSB and pellet industries combined consuming an additional 2 million tons. (Forest2Market cannot report these figures individually as a result of anti-trust guidelines.)

We expect that demand for hardwood pulpwood will increase by 5 percent during the 2014-2018 period, primarily the result of increased wood pellet manufacturing capacity. As a result, consumption levels will rise from 42 million tons per year to nearly 46 million tons per year.

Comments

02-07-2014

I don’t understand the preference for pine pellets over hardwood, when hardwood is a cleaner fuel. Do you have any insight into the preference for pine?

Thank you,

Comments

09-05-2014

I’ve got 75-100 pines trees on my property near Maryville, Tn., some 80’ tall and some large diameter, nobody wants them. With demand projected to increase, one would think a company would be in the area taking them out. Everyone I talk to would like to have them removed.

Suz-Anne Kinney

Suz-Anne Kinney