3 min read

Despite a December Dip, Housing Starts Finish 2015 on Forecast

John Greene

:

January 22, 2016

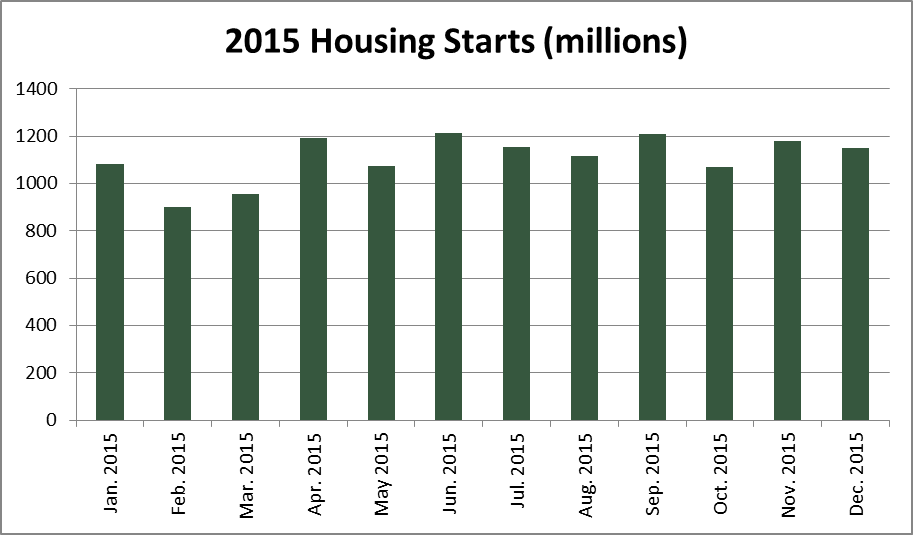

While the housing starts metric stayed on course during December to finish 2015 just above its 1.1 million unit forecast, the final monthly number was surprising and disappointing to economists and industry watchers alike. The lackluster performance followed double-digit gains in November, unseasonably warm weather throughout most of the country for much of December, as well as 45,000 additional construction jobs—all of which was expected to boost activity.

December, 2015 housing starts were at a seasonally-adjusted annual rate (SAAR) of 1,149,000, or 2.5 percent below the revised November estimate of 1,179,000. This number is also 6.4 percent above the December 2014 rate of 1,080,000. Additionally, single-family housing starts were at a rate of 768,000, which is 3.3 percent below the revised November figure of 794,000.

Building permits decreased in December; privately-owned housing unit permits were at a SAAR of 1,232,000, or 3.9 percent below the revised November rate of 1,282,000. Single-family authorizations were at a rate of 740,000, 1.8 percent above the revised November figure of 727,000.

The US Census Bureau report on December housing starts also highlighted the disparity in construction activity across regions. Seasonally-adjusted housing starts by region were:

-

Northeast: +24.4 percent

-

South: -3.3 percent

-

Midwest: -12.4 percent

-

West: -7.6 percent

While the decline in Southern building activity is surprising given the abnormally warm weather in December, the Northeast and South were the only regions to post gains for 2015 on the whole.

Despite the numbers, home builders continue to remain upbeat; The National Association of Home Builders’ sentiment index stayed at 60, unchanged over last month. That said, December’s construction slowdown also comes at a time when potential home buyers are facing the prospect of higher mortgage rates. As we noted last month, the Federal Reserve’s symbolic fractional short-term interest rate hike might affect home buyers in 2016, although the 30-year fixed mortgage rate actually ticked down last week from 3.97 to 3.92.

Ralph McLaughlin, chief economist at the popular real estate website Trulia, wrote that "Compared to historical norms, new construction starts are 75 percent back to normal. Given the tight inventory that we've seen in many housing markets across the country, today's release is a positive sign for new housing starts. For prospective homebuyers, this is a positive sign that we expect some relief of tight inventory, especially in the costly coasts, where starts are up 26.8 percent in the Northeast and 13.4 percent in the West [year over year]."

The larger housing market, in general, continues to be one of the lone bright spots in the US economy. We are still ten months away from electing a new president, but a heightened degree of hesitation exists in an already—and historically—uncertain election year. Consider the following:

-

Weak reports on retail sales, industrial production, exports, inventory and manufacturing surveys suggested a significant slowdown in economic growth at the end of 2015.

-

As of this writing, oil prices are hovering around $28/barrel amid news of a global glut in supply. This represents a roughly 38 percent decrease vs. prices in January, 2015.

-

Consumer prices increased 0.7 percent in 2015, the second smallest December-December gain in the last 50 years.

-

The Dow Jones Index is down roughly 2,000 points in just over three weeks.

-

A strong dollar and an inventory bloat are dampening prices for some core goods.

-

Economic news out of China continues to disappoint; speculators also see March-April as a likely time for China to devalue its currency.

-

Escalating geopolitical tensions in the Middle East, North Korea and Russia, as well as continued unrest and flagging economies in much of Europe threaten growth and recovery; French president Francois Hollande recently stated that France is now in a state of “economic emergency.”

None of these dynamics are conducive for creating an environment that would provide the reasonable certainty to drive economic growth. Despite the evidence, many economists remain optimistic about housing’s ability to remain unscathed by these larger events. Gregory Daco, head of U.S. macroeconomics at Oxford Economics in New York, recently said that some fundamentals are providing strength to the housing market. "Slowly strengthening wage growth, solid employment gains, the gradual release of pent-up demand, and still-low mortgage rates all underpin our expectation of a continued strengthening in housing activity over the course of 2016.”