Mill inventory levels are a perennial challenge in Eastern North America, a region that includes the Lake States/Central Canada and the US Northeast/Eastern Canada subregions. In fact, the seasonality of wood supply in the region is the most significant factor mills must take into consideration when planning for a consistent supply. While the specific inventory plan at each mill depends on a variety of other factors as well, the wood production system must not only generate a sufficient volume of supply, but the timing of the volume coming to market is also critical.

With the exception of a short-lived spike in April 2019, wood fiber prices have been pretty flat in Eastern North America over the last two years, which is somewhat surprising given the economy that has demonstrated a strong pace of growth. However, despite flat pricing over the last several months, the regional forest industry has been testing the limits of the wood production system over the last two quarters.

The result? The regional market is close to experiencing a repeat of a supply/demand scenario in 2014 that saw wood fiber prices skyrocket.

What Happened in 2014?

Meticulous hardwood inventory management is key to understanding market pricing for all regional fiber in Eastern North America. Hardwood inventories increase significantly in the winter to include as much as 80 days’ worth of system-wide inventory designed to last through the spring season. It is equally important for the system to maintain a minimum of 35 days’ worth of hardwood inventory during the rest of the year so that winter surge capacity is not stressed beyond its capabilities.

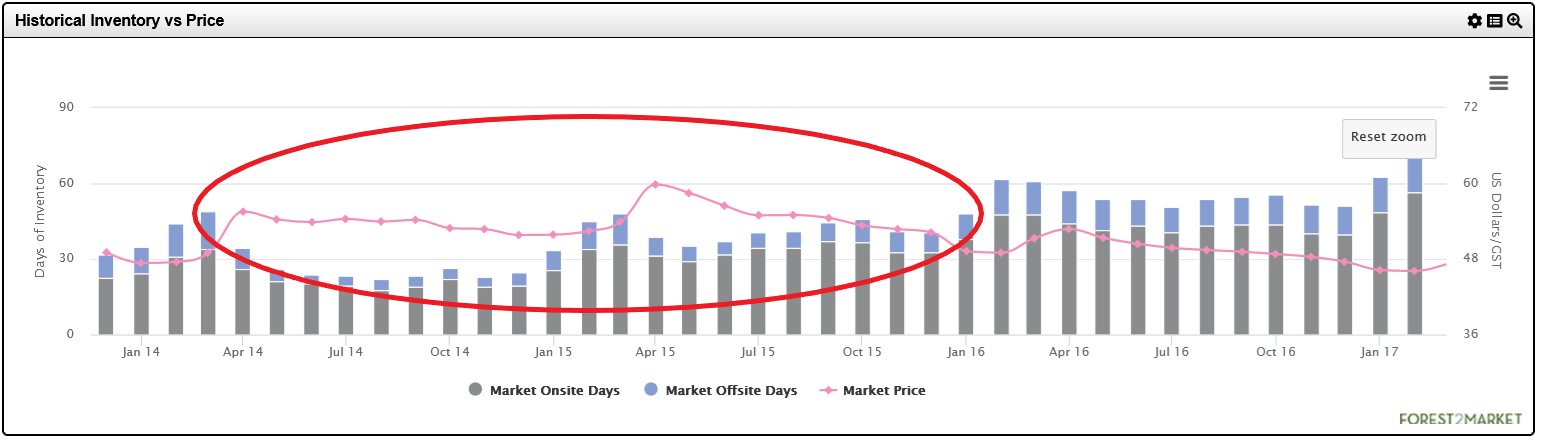

When analyzing the end-of-quarter hardwood inventory data over the last several years, there is a clear pattern of Q1 inventory building—typically 70-80 days’ worth. However, when inventories dipped below 30 days in 2Q2014, prices spiked over 20 percent during the following year before leveling off in late 2016, as noted in the chart below. Having healthy Q4 and Q1 inventories is key to making sure the “surge” logging and trucking capacity needed for late winter can handle the inventory build required for adequate inventories in the following spring/summer.

There is oftentimes discussion about limited logging and trucking capacity due to the seasonality of harvests in the region, but this is really more a need of managing “surge” capacity at the right time of the year. A December freeze-up allows for winter logging operations to commence, and a normal cold winter ensures harvesting crews can access enough timber to account for surge capacity. Not only is a surge needed in harvesting and trucking, but large inventory space is also needed to store the necessary fiber to get a mill through the spring season.

Current Risks

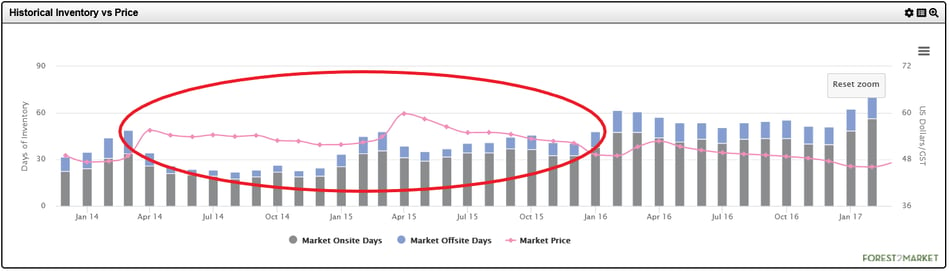

When analyzing days of inventory and price over the last several months, a trend is developing that is similar to what occurred in 2014: market onsite days of inventory have been in the low to mid-30s over the last several months—a seasonal period where mills typically maintain levels in the upper 40s and 50s. Market offsite days of inventory have been equally thin. We’re now beginning to see an increase in price in combination with low inventory levels, which is a situation procurement teams in the region hope to avoid at all costs.

As we kick off 2020, will Eastern North America find itself in a fiber supply shortage like the one experienced in 2014/15? We’ll have to see what happens as the winter season further develops. As the weather begins to turn warm in March and into 2Q, the potential for a wet summer could also impede harvest activity in a region that is experiencing an increase in risk exposure. Since inventories are now low by historical norms, this is a dynamic that regional mill facilities must monitor in the coming months to avoid a scramble to secure fiber at significantly higher prices.

Pete Coutu

Pete Coutu