3 min read

Enviva IPO Exemplifies Long-Term Wood Pellet Demand and Growth

John Greene

:

May 11, 2015

As a subset of the forest products industry, the meteoric growth of the industrial thermal wood pellet market—a market that was virtually unheard of just a few years ago—illustrates the need for continued natural resource development in the global economy of the 21st century. As we have learned from our reliance on crude oil over the last 100 years, global demand oftentimes requires intricate, global supply solutions. Ships crisscrossing the oceans, pipelines, fuel “farms” and tanker trucks are all part of the larger delivery model that has made gasoline such a prevalent source of fuel. And it’s a model that has (for the most part) worked. As alternative energy solutions continue to gain ground worldwide, why not apply the same model and methodology to renewable energy raw materials?

Maryland-based Enviva Partners is doing just that. Since its founding in 2004, Enviva has grown to become one of the largest wood-pellet and wood-chip producers in the US by capitalizing on European demand for its product. And business is booming.

As major European utilities such as Drax Power in the UK and Dong Energy in Denmark continue to harness biomass for industrial thermal heating purposes, US-based producers are meeting their needs with wood pellets manufactured primarily in the Southeast. The pellets are then loaded into the hulls of large vessels, shipped to foreign ports, and then transported out to the individual facilities where they will ultimately be consumed in the creation of energy.

According to the U.S. International Trade Commission (ITC), global wood-pellet demand has increased from roughly 2 million metric tons in 2001 to over 25 million metric tons in 2014—an increase of over 1100 percent. Currently, roughly half of the global trade of these pellets is within the EU and in 2013, imports of pellets from non-EU countries was $1.1 billion with the US supplying roughly 45 percent of the total.

Leading an Emerging Market

Enviva has been at the forefront of the wood pellet export trend over the last few years by aggressively growing its core business capacity. The company currently operates six pellet mills throughout the Southeast and has plans to build two new facilities within the next year.

In late 2014, Enviva acquired segment competitor Green Circle Energy and successfully integrated its manufacturing facilities resulting in production capacity of some 2.25 million metric tons of pellets per year. With a forecasted increase of an additional 500,000 metric tons, as well as its own port operations for storage and logistics solutions, Enviva is dominating the US wood pellet supply market.

While Enviva’s success has seemingly come overnight, the company has had substantial private equity backing that has allowed it to capitalize on global opportunities in a timely manner. As the US-based market leader in wood pellet production, it should come as no surprise then, that Enviva’s initial public offering (IPO) on the NYSE last month has effectively put the wood pellet industry on investors’ maps. Upon closing of the initial IPO, net proceeds were $213.6 million and the company plans to use the proceeds to pay down existing expansion debts and for future acquisitions.

Prepare for Market Adaptations

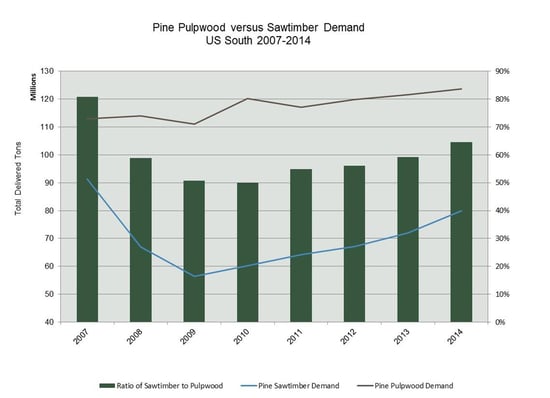

For any organization operating within the larger forest products industry, Enviva’s IPO is significant. It represents the remarkable growth of a burgeoning subcategory and, as with any large-scale shift in demand, the supply side will adapt. As demand for pine pulpwood continues to grow compared to pine sawtimber in the Southeast, landowners seeking regular profits may adjust their harvest regimes to accommodate these needs.

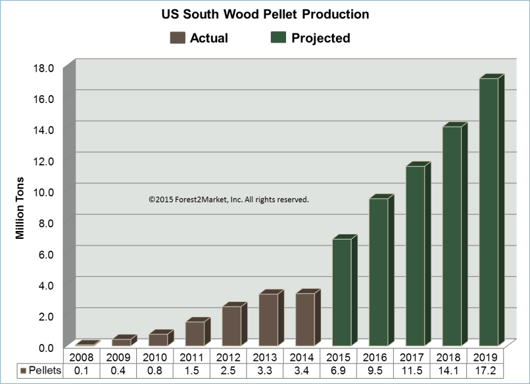

The near-term forecasted European demand for Southeastern-produced wood pellets is striking. As the EU approaches its 2020 deadline of fulfilling 20% of its energy needs via renewable resources, wood pellets will continue to be a major fuel source in the creation of that clean energy. Note the projected 2019 volumes below, which represent a 400 percent increase over 2014 production. As Enviva continues to capture market share, its demand for forest raw materials will also increase.

New Awareness for the Forest Products Industry

For investors and watchers outside of the forest products industry, Enviva’s IPO is also significant in that it raises awareness for the global commitment to renewable energy development. The US has not yet seen a high demand for wood pellets at the utility-provider level, but we don’t have the incentive structure of the EU in place to drive this kind of large-scale change. Nevertheless, Wall Street has been introduced to a new business segment with real, long-term profitability potential—even if the end-product is consumed thousands of miles away.

Enviva’s IPO also creates a rare opportunity for the forest products industry to educate the public about responsible natural resource management. We know from experience that images of clearcut forests or massive logging operations can leave lasting, negative impressions on an unaware public. While the spotlight is temporarily being shined towards an important member of the forest products industry, it’s a chance to talk about sustainability criteria, harvesting practices, and forest growth and protection initiatives. Enviva does an outstanding job of proactively engaging in this type of education by openly displaying its sustainability policy and other operating standards via its website.

Natural resource use and management has been an ongoing challenge since the dawn of human history and, despite the technological marvels available to the average consumer in 2015, our energy needs are still derived from these resources. Enviva is actively helping to diversify our energy solutions by serving burgeoning global markets with US-based forestry products, and news of the company’s recent IPO indicates that the market is just beginning to heat up.