Forest industry performance in November and December was reported by both the US government and the Institute for Supply Management.

Total industrial production (IP) tumbled 0.6% in November (-1.2% YoY). It was the ninth month in 2015 with MoM IP declines, as well as the biggest MoM drop since March 2012. Historically, YoY declines in IP have often been associated with recessions.

Manufacturing output was unchanged in November, as gains in nondurable goods offset decreases in durable goods and other manufacturing. Wood Products output was unchanged (+1.4% YoY) while Paper rose by 0.2% (-1.5% YoY).

Capacity utilization (CU) for all industries retreated 0.7% (-2.6% YoY) to 77.0%. Manufacturing CU edged down to 76.2%, a rate 2.3 percentage points below its long-run average.

- Wood Products dipped 0.2% (-1.0% YoY) to 70.8%

- Paper advanced 0.2% (-1.1% YoY) to 82.6%

Capacity at the all-industries and manufacturing levels moved higher:

- All-industries: +0.1% (+1.5% YoY) to 138.4% of 2012 output

- Manufacturing: +0.1% (+1.3% YoY) to 139.1%

- Wood Products: +0.2% (+2.5% YoY) to 160.4%

- Paper was unchanged (-0.3% YoY) at 116.9%

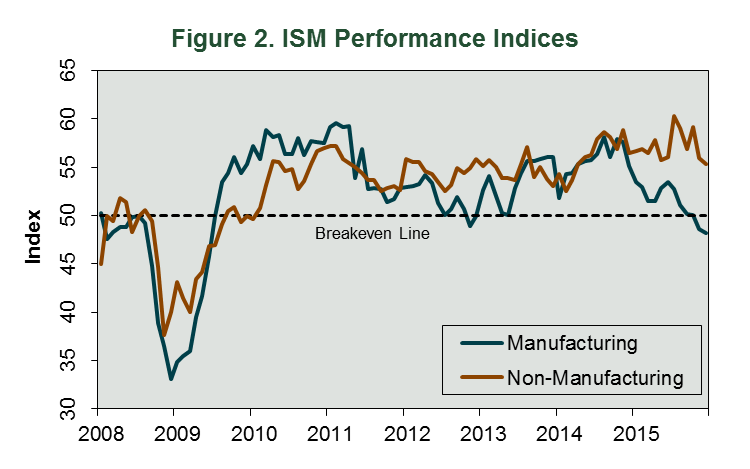

Manufacturing and Non-manufacturing Surveys

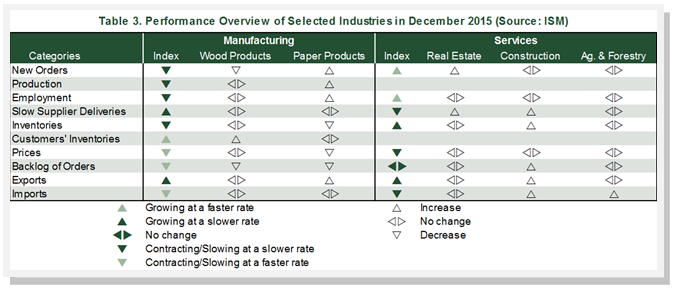

The Institute for Supply Management’s (ISM) monthly opinion survey showed that the U.S. manufacturing sector contracted further in December (Figure 2). The PMI decreased 0.4 percentage point, to 48.2%—the lowest reading since June 2009. (50% is the breakpoint between contraction and expansion.) Notable changes to internals included another contraction in the employment index, a small expansion in exports, and further erosion in imports. Wood Products contracted on declines in new and backlogged orders, while Paper Products expanded on higher new orders, production and employment (Table 3).

The pace of growth in the non-manufacturing sector marginally slowed in December. The NMI edged 0.6 percentage point lower, to 55.3%. Important internals (e.g., new orders, employment and exports) strengthened, however. Real Estate and Construction reported increased activity, whereas Ag & Forestry was unchanged.

Click to edit your new post...

Joe Clark

Joe Clark