Forest industry performance in November and December was recently reported by both the US government and the Institute for Supply Management.

Total industrial production (IP) declined 0.4 percent in November (-0.6 percent YoY) after edging up 0.1 percent in October (Table 3). Manufacturing output (NAICS basis) was unchanged (+0.4 percent YoY). Meanwhile, new orders decreased 2.4 percent (but +1.2 percent YoY). Business investment spending was also mixed: rising by 0.9 percent MoM, but -1.5 percent YoY. Business spending has contracted on a YoY basis during all but two months since January 2015.

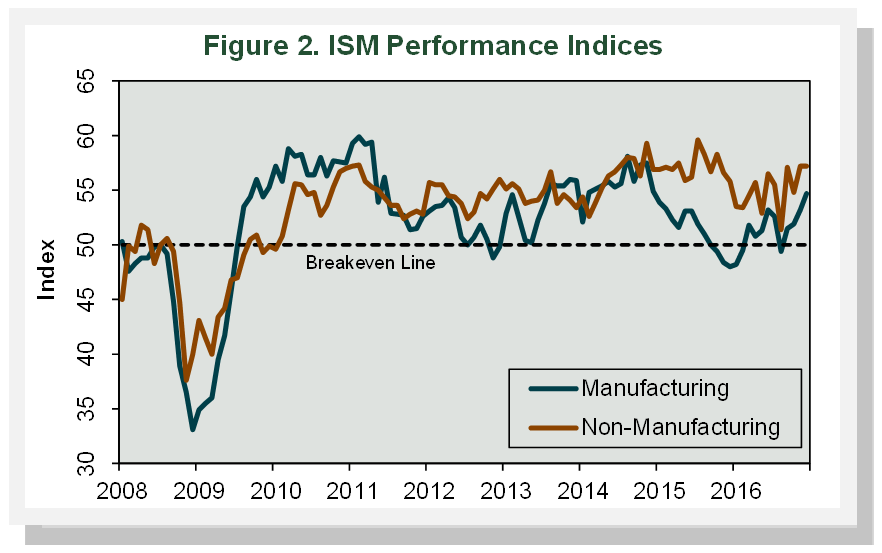

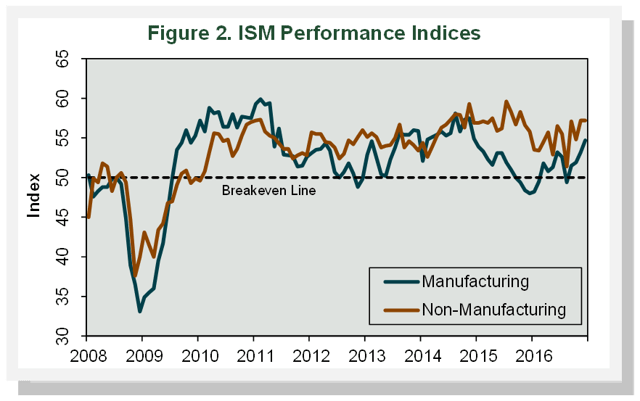

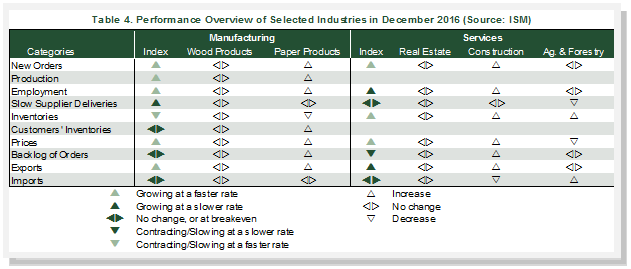

Countering the weakness in the data discussed in the previous section, the Institute for Supply Management’s (ISM) monthly opinion survey indicated that the pace of expansion in US manufacturing sped up during December. The PMI registered 54.7 percent, an increase of 1.5 percentage points. (50 percent is the breakpoint between contraction and expansion.) The most noteworthy change in the PMI sub-indexes was the jump in input prices. December’s pace of growth in the non-manufacturing sector (NMI) was unchanged at 57.2 percent. Only order backlogs fell below the breakpoint in the NMI survey.

Paper Products and Construction expanded while Ag & Forestry contracted; Wood Products and Real Estate were not mentioned at all.

The consumer price index (CPI) rose 0.2 percent in November, once again primarily because of increases in the shelter (0.3 percent) and gasoline (2.7 percent) indexes. The all-items index was also 1.7 percent higher for the 12 months ending November; the YoY all-items increase has been accelerating since July’s reading of +0.8 percent. Rent and medical services were both 3.9 percent higher YoY.

The producer price index (PPI) increased 0.4 percent in November (+1.3 percent YoY, the largest rise since November 2014). Over 80 percent of November’s advance in the final demand index was attributable to a 0.5 percent rise in prices for final demand services—especially costs paid by retailers. The index for final demand goods increased 0.2 percent.

Forest products-related PPIs were mixed in November:

- Pulp, Paper & Allied Products: +0.2 percent (+0.2 percent YoY)

- Lumber & Wood Products: -0.5 percent (+1.4 percent YoY)

- Softwood Lumber: -1.1 percent (+3.9 percent YoY)

- Wood Fiber: -1.4 percent (+0.6 percent YoY)

Joe Clark

Joe Clark