Forest industry performance in September and October was recently reported by both the US government and the Institute for Supply Management.

Total industrial production (IP) edged up 0.1 percent in September (-1.0 percent YoY) after falling 0.5 percent in August. For 3Q as a whole, IP rose at a SAAR of 1.8 percent—its first quarterly increase in a year. Manufacturing output increased 0.2 percent in September (3Q: +0.9 percent SAAR). New orders increased 0.3 percent in September. Excluding transportation, new orders rose 0.6 percent (but -0.3 percent YoY, the 22nd month of YoY contractions out of the past 24). Business investment spending, which has contracted on a YoY basis during all but two months since January 2015 (inclusive), fell by 1.3 percent (-3.8 percent YoY).

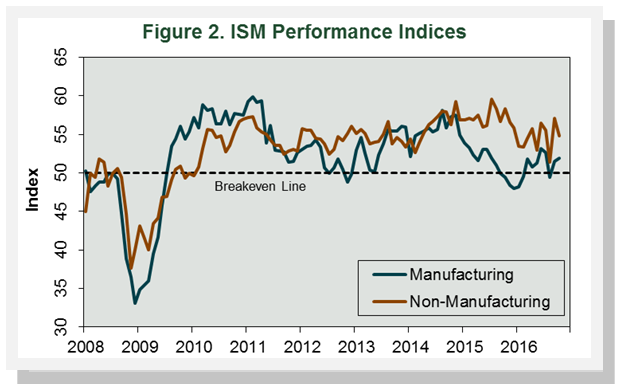

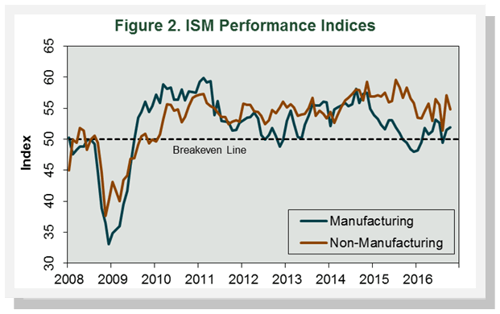

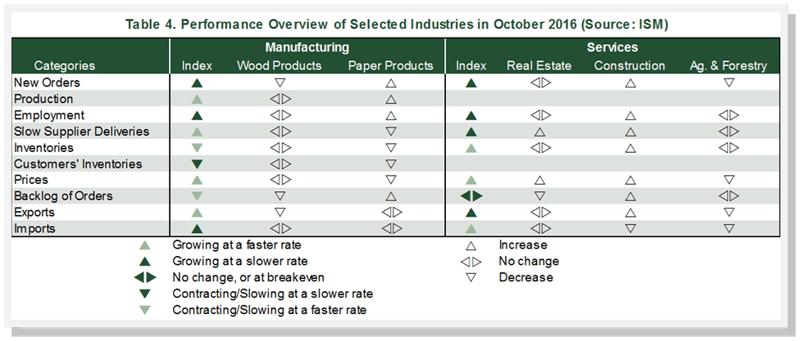

The Institute for Supply Management’s (ISM) monthly opinion survey showed that the pace of expansion in U.S. manufacturing edged upward during October. The PMI rose 0.4 percentage point, to 51.9 percent. (50 percent is the breakpoint between contraction and expansion.) Sub-indexes that suppressed the rise included new orders, inventories, customer inventories, and order backlogs.

The pace of growth in the non-manufacturing sector slowed in October. The NMI dropped 2.3 points, to 54.8 percent. The only sub-indexes with a higher value included inventories, input prices, and imports. As for individual industries, Wood Products and Ag & Forestry contracted; Paper Products, Real Estate and Construction expanded.

The consumer price index (CPI) increased 0.3 percent in September, thanks primarily to gasoline (+5.8 percent) and shelter (+0.4 percent). The CPI rose 1.5 percent for the 12 months ending September, the largest YoY increase since October 2014. Although the food index was 0.3 percent lower and energy -2.9 percent, rent and medical services were, respectively, 3.7 percent and 4.8 percent higher YoY.

The producer price index (PPI) rose 0.3 percent in September, nearly one-fourth of which can be traced to a 5.3 percent increase in gasoline prices. The final demand index increased 0.7 percent YoY, the largest 12-month rise since December 2014’s +0.9 percent.

Joe Clark

Joe Clark