Forest industry performance in August and September was recently reported by both the US government and the Institute for Supply Management.

Total industrial production (IP) decreased 0.4 percent in August (-1.1 percent YoY), offsetting most of July’s +0.6 percent. Manufacturing output also declined 0.4 percent, erasing July’s gain. New orders increased 0.2 percent in August. Interestingly, YoY comparisons of seasonally adjusted ex-transportation data were negative (-1.6 percent)—the 22nd consecutive month of YoY contractions—but not-seasonally adjusted estimates reflected a 0.7 percent increase. New orders for non-defense capital goods excluding aircraft, a proxy for business investment spending, rose by 0.9 percent (-0.9 percent YoY). Business investment spending has contracted on a YoY basis during all but two months since December 2014.

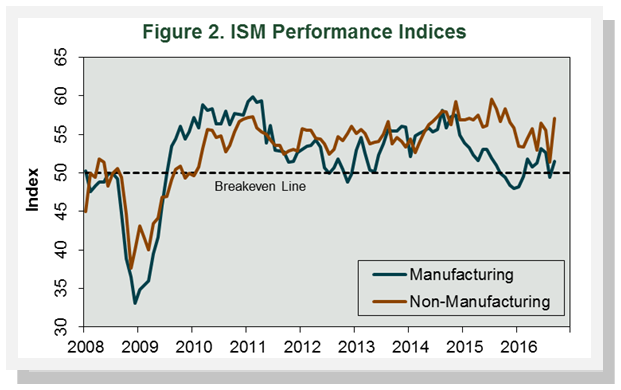

The Institute for Supply Management’s (ISM) monthly opinion survey showed that US manufacturing edged back into expansion during September. The PMI increased 2.1 percentage points, to 51.5 percent. (50 percent is the breakpoint between contraction and expansion.) Slow supplier deliveries and new export orders were the only sub-indexes with lower values in September than in August.

The pace of growth in the non-manufacturing sector jumped in September. The NMI registered 57.1 percent, 5.7 percentage points higher than the August reading. Slow supplier deliveries was the only sub-index with a lower September value.

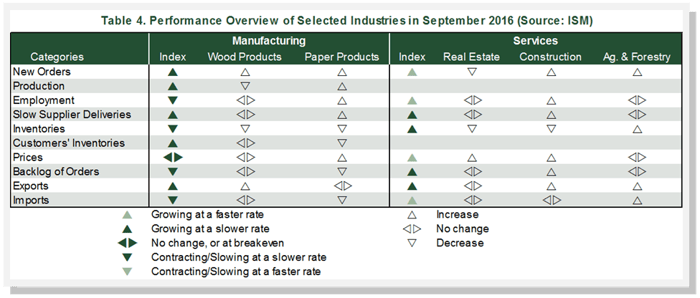

Wood Products and Real Estate contracted while Paper Products, Construction, and Ag & Forestry expanded.

The consumer price index (CPI) increased 0.2 percent in August. The driver was a 0.3 percent increase in the all items less food and energy index—the largest rise since February 2016—thanks to advances in shelter (+0.3 percent) and medical care (+0.9 percent). The all-items index rose 1.1 percent YoY, as the energy index slumped 9.2 percent but rent jumped 3.8 percent and medical care services +5.1 percent. “The economy may not be firing on all cylinders, but growth is enough to spark a little more inflation than we thought,” said Chris Rupkey, chief economist at MUFG Union Bank.

The producer price index (PPI) was unchanged in August (and YoY) as a 0.1 percent advance in the index for final demand services offset a 0.4 percent decrease in final demand goods. The not seasonally adjusted indices for forest products were as follows:

- Pulp, Paper & Allied Products rose 0.3 percent (-0.1 percent YoY)

- Lumber & Wood Products: +0.4 percent (+1.7 percent YoY)

- Softwood Lumber: +1.5 percent (+7.3 percent YoY)

- Wood Fiber: -0.5 percent (-0.9 percent YoY)

Joe Clark

Joe Clark