3 min read

Forest2Market’s Economic Outlook: Metrics That Matter to the Forest Industry

Joe Clark

:

April 21, 2020

Joe Clark

:

April 21, 2020

Every month, Forest2Market publishes updated forecasting products designed specifically for participants in the forest value chain. The Economic Outlook is a macroeconomic indicator forecast that supplies critical information, context and insight about general economic trends and direction, and the 4Cast supports regional operational decision making for those who buy and sell timber.

With an understanding of economic indicators, future stumpage prices and insight into buying and selling windows (periods in which buyers or sellers hold relative market advantage), subscribers are better able to time sales or purchases, negotiate prices, manage workloads and control inventory levels amid highly uncertain markets. The following commentary is just a sampling from the most recent Economic Outlook for April 2020.

US forest industry performance in February and March was recently reported by both the US government and the Institute for Supply Management.

Industrial Production

Total industrial production (IP) rose 0.6 percent in February (0.0 percent YoY) after falling by a revised 0.5 percent in January (originally-0.3 percent). Manufacturing output edged up 0.1 percent in February; excluding a large gain for motor vehicles and parts and a sizeable drop for civilian aircraft, factory output was unchanged. The index for mining declined 1.5 percent, a sign of weakness in the energy sector; but the index for utilities jumped 7.1 percent, as temperatures returned to more typical levels following an unseasonably warm January.

New orders decreased by less than 0.1 percent (+2.9 percent). Excluding transportation, new orders fell by 0.9 percent (+2.1 percent YoY). Business investment spending also decreased by 0.9 percent (+1.5 percent YoY).

Early data from March suggest manufacturing “has plunged headlong into deep recession,” said Pantheon Macroeconomics’ Ian Shepherdson. E.g., “orders for capital equipment have deteriorated at a rate not seen since data were first available in 2009 as firms stopped investing in machinery,” observed IHS Markit’s Chris Williamson, although he did not quantify the decline. Curtailment announcements by wood products manufacturers are anecdotal evidence supporting Shepherdson’s contention.

ISM & IHS Markit Surveys

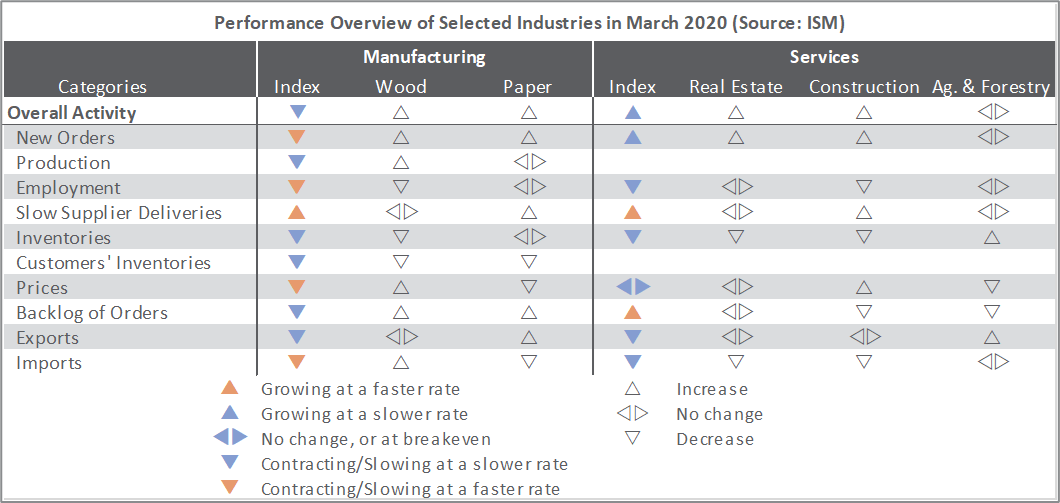

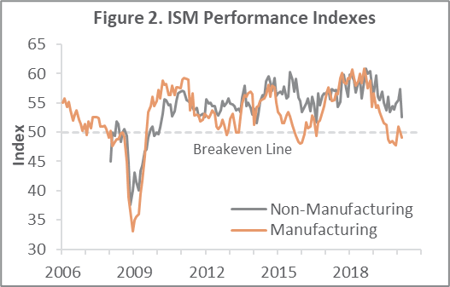

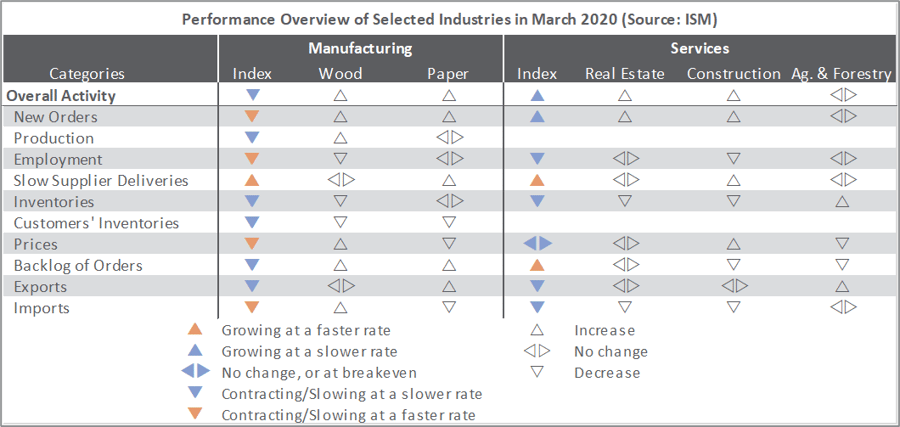

The Institute for Supply Management’s (ISM) monthly sentiment survey showed US manufacturing in contraction during March. The PMI registered 49.1 percent, down 1.0PP from February. (50 percent is the breakpoint between contraction and expansion.) Except for a surge in slow deliveries (+7.7PP), all sub-indexes were negative (and generally more so than in February). Declines in new orders (-7.7PP) and input prices (-8.5PP) were particularly noteworthy.

The pace of growth in the non-manufacturing sector exhibited marked deceleration (-4.8PP, to 52.5 percent). Except for a jump in slow deliveries (+9.7PP), other sub-indexes were either less positive or outright negative. Of the industries we track, however, only Ag & Forestry did not expand. Common themes among respondent comments included the collapse in oil’s price, and demand volatility and supply-chain disruptions related to the virus.

Findings of IHS Markit’s March surveys were reasonably consistent with (but much more pessimistic than) their ISM counterparts.

“Business activity slumped to the greatest extent for more than a decade in March as efforts to contain the spread of the COVID-19 pandemic intensified,” Chris Williamson wrote. “The survey indicates that the [U.S.] economy contracted an annualized rate approaching 5 percent in March, but with more measures to fight the virus outbreak being taken this decline will likely be eclipsed by what we see in 2Q.

“Employment and prices charged for goods and services are already being slashed at rates not seen since 2009 as companies seek to aggressively cut costs and discount charges in the face of collapsing revenues,” Williamson continued. “The policy response to the economic damage from the virus has already been unprecedented, but the collapse in business expectations for the year ahead tells us that companies are expecting far worse to come.”

Consumer & Producer Price Indexes

The consumer price index (CPI) rose 0.1 percent in February (+2.3 percent YoY). Increases in the indexes for shelter (+0.3 percent) and food (+0.4 percent) more than offset a decline in the energy index (-2.0 percent). Along with the index for shelter, the indexes for apparel, personal care, used cars and trucks, education, and medical care were among those that increased in February. The indexes for recreation and airline fares declined over the month.

“Panic buying has led to price increases for some goods, but falling demand is more likely to force companies to cut prices,” wrote MarketWatch’s Jeffry Bartash. “It’s already happening with gas and plane tickets.”

The producer price index (PPI) fell 0.6 percent in February (+1.3 percent YoY). A 0.9 percent decrease in prices for final demand goods (including a 6.5 percent drop in the gasoline index) accounted for 60 percent of the decline in the final demand index; the index for final demand services moved down 0.3 percent.

In the forest products sector, index performance included:

- Pulp, Paper & Allied Products: -0.5 percent (-2.3 percent YoY)

- Lumber & Wood Products: +0.8 percent (-0.5 percent YoY)

- Softwood Lumber: +3.9 percent (+4.4 percent YoY)

- Wood Fiber: +0.1 percent (-2.5 percent YoY)

Interestingly, February lumber futures increased 6.5 percent from January’s average (compared to +0.8 percent in the broader Lumber & Wood Products index cited above) while March lumber futures fell 21.5 percent relative to February’s average. More recently, we note that after dropping below $260 on April 1, futures prices have surged higher, increasing by 24 percent through April 10, but still are 26.6 percent below February’s average.

“Looking ahead, the disinflationary impact from the virus and the crash in oil prices will exert even more downward pressure on prices,” Oxford Economics’ Lydia Boussour wrote.