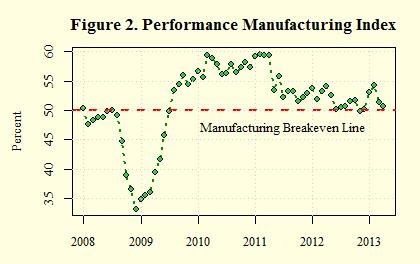

The manufacturing sector remained in expansion in April for the fifth consecutive month, although it just crossed the line between expansion and contraction. The service sector grew for the 40th consecutive month.

The Performance Manufacturing Index (PMI) registered 50.7%, a decrease of 0.6% from March’s reading of 51.3% (Figure 2). New orders, production, employment, backlog of orders, exports and imports all increased in April, while supplier deliveries, inventories, customers’ inventories and prices slowed.

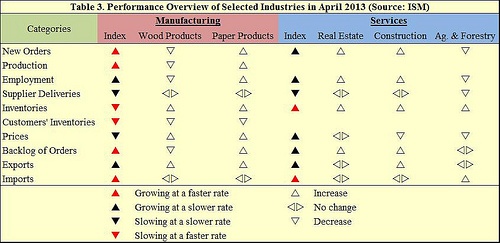

Among the manufacturing industries, the paper products industry reported in expansion, ranking sixth, while the wood products industry contracted in April (Table 3). The wood products industry slowed down due to weak performance in new orders, production, employment, customers’ inventories and backlog of orders. Expansion in the paper products industry was based on stronger performance in new orders, production, supplier deliveries, inventories, prices and exports (Table 3).

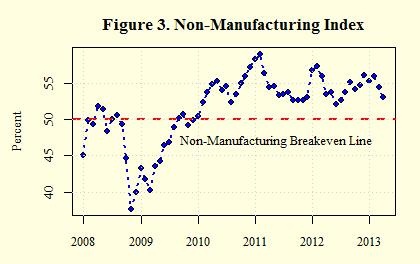

The Non-Manufacturing Index (NMI) grew for its 40th consecutive month at 53.1% in April, 1.3% lower than March’s 54.4% reading (Figure 3). This reflected a continued growth at a slightly slower rate. Among the indices, employment, inventories, prices, backlog of orders, exports and imports expanded. Of the 14 non-manufacturing industries, Construction, Real Estate and Ag & Forestry, ranked fourth, ninth and thirteenth, respectively.

Comments

07-30-2013

I agree the inventory drop is positive; however, the inventory to sales ratio remains at a high level, i.e., 1.43. This points to a faster fall off in sales versus the inventory decline. One area of concern in the I/S data was the increase in the I/S ratio for the consumer discretionary categories on a year over year basis as noted in my post yesterday.Keep up the good work you publish on your site.David

Suz-Anne Kinney

Suz-Anne Kinney