Forestry-related industry performance was mixed in September and October, with wood products falling or stagnant and paper products expanding slightly.

Industrial Production

Total industrial production (IP) got back on track, jumping 1.0% in September after stumbling (-0.2%) in August. Total output increased 3.2% for 3Q as a whole, about on par with the average quarterly increase since the end of 2010. In addition:

- Manufacturing output rose 0.5% in September after falling by 0.5% in August.

- Wood Products fell 0.8% and Paper rose by 0.2%, extending the -0.2 and +0.6% respective performances in August.

- Construction showed a 0.4% increase after being unchanged in August.

- Consumer Goods reversed most of August’s -0.7%, increasing by 0.5% in September.

Total industrial capacity utilization advanced by 0.7% relative to August, 1.3% above its prior-year levels but 1.0% below its long-run (1972-2013) average. Total capacity utilization is among the metrics used to measure “economic slack,” and is thus part of the Federal Reserve’s interest-rate calculus. These latest readings indicate that while there had been some tightening in utilization during prior months, those concerns were not materially heightened in September. The capacity utilization rate for manufacturing rose by 0.3% in September (to 78.1%). Wood Products capacity utilization dropped by 1.3%, while Paper rose by 0.4%.

Manufacturing capacity expanded by 0.3% in September. Wood Products capacity extended its upward trend with another 0.4% rise. Paper, on the other hand, contracted by 0.2% yet again—to its lowest point since January 1986.

Manufacturing and Non-manufacturing

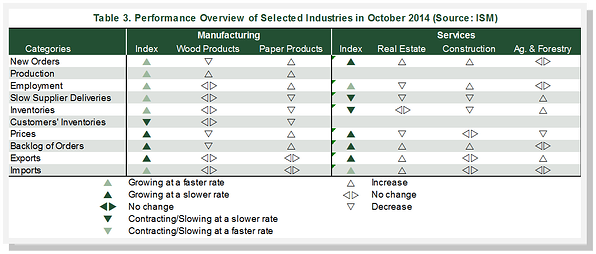

The Institute for Supply Management’s (ISM) monthly opinion survey showed that expansion of economic activity in the U.S. manufacturing sector recouped during October the ground lost in September. The PMI jumped back to 59.0%, an increase of 2.4 percentage points (50% is the breakpoint between contraction and expansion). The pickup in activity was primarily supported by increased new and backlogged orders, and slower supplier deliveries—possibly implying suppliers may be having difficulty keeping up with orders (Table 3).

Wood Products was unchanged, as increased production was offset by declines in new and backlogged orders; “production is oversupplying demand,” one respondent indicated, “and prices have softened.” Paper Products’ expansion, by contrast, exhibited widespread support among the sub-indices.

The pace of growth in the non-manufacturing sector retreated again in October. The NMI registered 57.1%, 1.5 percentage points lower than in September; only the employment and imports sub-indices rose. All three service industries we track reported expansion in October, although Ag & Forestry’s support among the sub-indices was not that meaningful.

It is interesting to note that while ISM’s NMI and Markit’s U.S. Services PMI paralleled each other in October (i.e., growth slowed), ISM’s PMI and Markit’s U.S. Manufacturing PMI diverged (i.e., ISM accelerated while Markit slowed to a three-month low). Time will tell which organization’s assessment of U.S. manufacturing is more accurate.

Suz-Anne Kinney

Suz-Anne Kinney