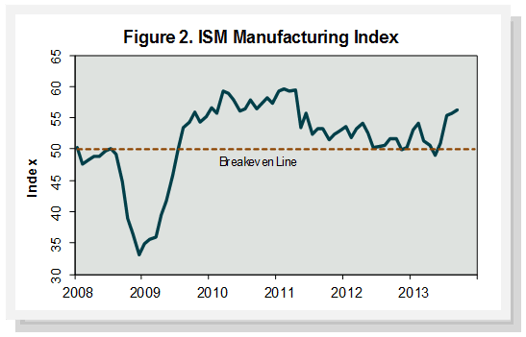

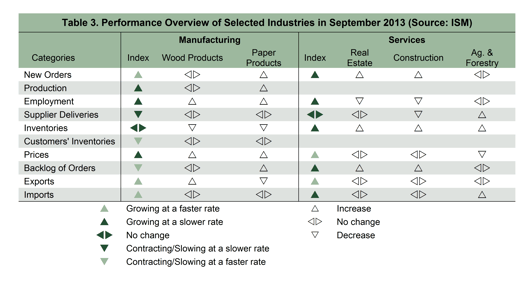

Despite the upbeat headline number, several sub-indices were not quite as positive as in August. New, export and import orders all expanded more slowly, for example (Table 3). Also, a much larger number of respondents indicated they paid higher input prices in September. Employment expanded noticeably, however, which is what contributed most to the PMI uptick.

Details were mixed for the two manufacturing industries we track. Domestic Wood Products manufacturers saw their inventories shrink while new export orders rose; also, more businesses added employees, but the industry saw input prices rise as well. "Raw materials shortages continue," wrote one Wood Products respondent, adding: "General trends are up, which enhances shortage issues." Paper Products manufacturers boosted production and employment in response to higher new orders and order backlogs, as well as diminishing inventories.

Non-manufacturing

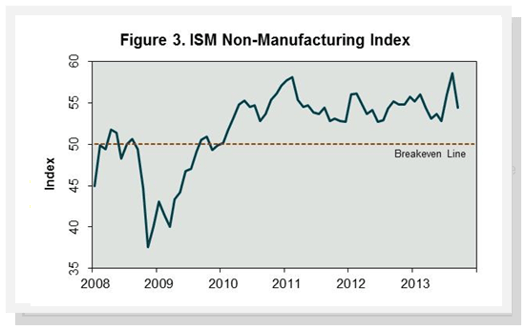

Far fewer service-sector survey respondents reported growth in September. The NMI registered 54.4%, 4.2 percentage points lower than August's 58.6%. The index dropped to its lowest point since May, constituting the biggest one-month decline since March 2009 (Figure 3). "The majority of the respondents' comments continue to be positive," said Anthony Nieves, chair of ISM's Non-Manufacturing Business Survey Committee. "However, there is an increase in the degree of uncertainty regarding the future business climate and the direction of the economy."

Overall activity expanded among the service industries we track. The main negatives were shrinking employment and higher inventories. One Construction respondent warned that "Overall business conditions are slowing -- small manpower decrease of 5%."

Commodities used by either the manufacturing or non-manufacturing industries we track and that were up in price included diesel fuel, caustic soda and corrugated boxes. Gasoline and lumber (pine, plywood products and treated) were down in price.