3 min read

Is Holding Inventory a Viable Method for Hedging Recovered Fiber Costs?

Forest2Market

:

September 13, 2011

One option that recovered fiber mills have for hedging volatile fiber prices is to increase the number of days of inventory they have on hand when prices are lower. How does a mill determine, though, whether carrying additional days of inventory is actually saving them money? Because of the cost of holding more inventory, recovered fiber mills should analyze a series of factors before making this decision. These factors include :

- Location: How close is the mill to its sources of fiber?

- Competition: Are there other recovered fiber consumers in the market? Is the mill in an area with strong export activity?

- Transportation: What is the road infrastructure? Is there rail service?

- Forecasted operating rate: At what percentage of capacity will the mill be running?

- Warehouse availability: Is adequate storage capacity available in close proximity to the pulper? Does the warehouse have an adequate sprinkler system for the additional inventory? If trailers are used for storage, will the inventory be used prior to the 21 days specified by the ISRI Paper Stock Domestic Transaction guidelines for accepting, rejecting or downgrading fiber?

- Time of year: Is a holiday that would require inventory build due to transportation limitations and processing plant holiday schedules approaching? Is seasonal bad weather approaching?

- Fiber generation outlook: Will seasonal or economic factors affect generation in the near term?

Because the answers to these questions vary by mill, no single answer to the question of whether to build inventory exists. If a mill has an optimal environment, in which adequate storage is adjacent to the pulper, the savings realized when holding additional inventory could be minimal. Like with all other fiber purchases, costs would include fiber, freight and the cost of capital. When a mill’s circumstances diverge from this optimal setting, however, the costs could quickly outstrip any savings realized from holding more inventory. If the additional inventory is stored in another area of mill, for instance, additional labor and handling costs will be necessary. If storage is offsite, the costs accumulate more quickly. These additional costs include :

- Cost per square foot for warehouse space (bale weight must be taken into account as different bale weights/sizes require different square footage requirements)

- Costs of the additional handling necessary (offload and reload)

- Transportation costs to mill

- Additional insurance cost

- Security, if applicable

In addition, the more the bales are handled the more susceptible they are to breakage and fiber loss. This loss generally falls somewhere between 1-5 percent. The additional inventory will also require rotating over a longer period of time than inventory acquired in a more timely fashion. Other potentially costly factors include :

- Dirt accumulation over time can raise dirt count on paper machines (a dirt count exceeding limits can cause downgrades or even disqualification with respect to grade-dependent quality specifications on a paper machine).

- Aging paper and inclement weather require additional handling.

- Higher inventory levels could increase a mill’s fire risk.

Let’s look at a hypothetical example, one that shows the potential costs of holding additional inventory.

The mill: A 750 tons per day (TPD) mill typically holds 7 days of inventory on hand or 5,250 tons.

The decision: Mill management decides to increase that inventory by 3 days or 2,250 tons. The recovered fiber cost is $150/ton and the freight costs are $22.50 per ton.

The question: What is the cost of holding this additional 3 days of inventory, and is it saving the mill money overall?

To answer these questions, three cost categories should be examined: incremental working capital costs, incremental storage costs and the cost of fiber loss during the storage due to additional handling.

Incremental Working Capital Costs

The working capital requirement to purchase the additional inventory is $388,125 (2,250 tons at $172.50). The financial cost of carrying inventory is typically expressed as an opportunity cost and estimated by using the business’s cost of capital. In this case, if the mill’s cost of capital is 8 percent, the financial carrying costs would equal $2,588 per month.

Incremental Storage Costs

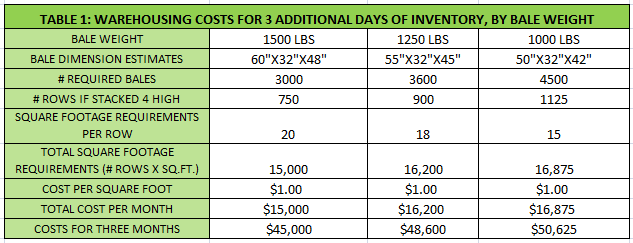

The costs associated with storing additional inventory vary depending on bale size. If the mill’s average bale weight is 1500 lbs., the additional inventory equates to 3,000 bales. (Typical weights and storage costs are shown in Table 1.)The cost of carrying this inventory for a month is $15,000.

*Does not include a square footage allowance for aisles/fire lanes; bale dimensions are estimated.

Cost of Fiber Loss

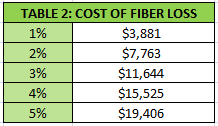

Excess handling for the additional inventory is likely to increase fiber loss, in the amount of 1-5 percent. Table 2 outlines the cost of this fiber loss for our example.

Total Cost of Carrying an Additional 3 Days of Inventory for 3 Months

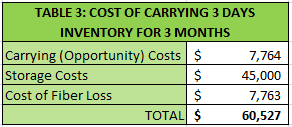

Assuming a conservative 2 percent fiber loss, the total carrying costs of the additional 3 days of inventory for this mill are outlined in Table 3.

The impact on mill cost would be $60,527, bringing the cost of these tons to a total of $448,652 ($388,125 + $60,527) or $199.40 per ton. This is 15.6 percent more than the landed cost of the fiber. Even if we exclude the inventory carrying cost (or opportunity cost), the incremental tons cost $195.95 per ton, which is still 13.6 percent more than the landed fiber cost.

As this example shows, laying in the additional inventory is only an effective hedge if the landed fiber cost rose more than 13.6 percent (or 15.6 percent if opportunity costs are considered) during the three month period. Otherwise, the inventory build would be detrimental to the mill’s bottom line.

Comments

09-15-2011

Barbara, very interesting article. I see your price level for material at $172.00 In today`s market with low output of material, would you not agree that having inventory would be logical?

David