Positive housing market indicators outnumbered bad ones in June, though sales and future sales fell in the latter category. First, the good news.

- Housing starts: Beating expectations, housing starts increased by 6.9 percent in June to a seasonally adjusted annual rate of 760,000. (Industry analysts had expected just 715,000). The Commerce Department revised May starts from 708,000 to 711,000 (see Table 1).

- Builder confidence: The NAHB/Wells Fargo builder sentiment index reached its highest point since March of 2007, increasing 6 points to 35. Builders responding to the survey say they saw the highest traffic levels seen in five years and the highest sales levels since February 2007 (see Table 1).

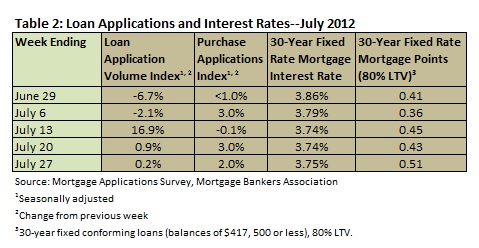

- Interest rates: Interest rates continue to fall; the Mortgage Bankers Association reported that the average rate for 30-year fixed rate mortgages with conforming loan balances ($417,500 or less) fell to 3.74 percent, the lowest rate in the history of the survey (see Table 2).

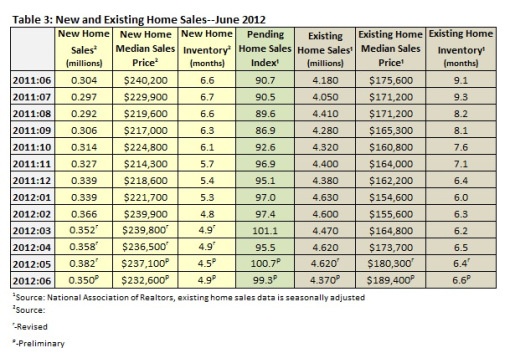

- Home prices: The most recent Case-Shiller Home Price Index (covering May 2012) reported home prices increased by 2.2 percent, following a 1.2 percent increase in April. The National Association of Realtors reported a 7.9 percent annual jump in median existing home prices in June (see Table 3).

- Home equity credit: As banks begin to loosen credit standards for home equity loans and lines of credit, by accepting both lower credit scores and lower loan-to-value ratios, the Harvard University Center for Housing Studies’ Leading Indicator of Remodeling Activity is expected to reach double-digit growth by the first quarter of 2013.

Still, three indicators suggested some retrenchment from May:

- New home sales: In June, sales of new homes fell from May’s rate of 382,000 to 350,000 (seasonally adjusted annualized rate). This is a month-over-month drop of 8.4 percent, though year-over-year June’s number was 15.1 percent above June 2011’s 304,000. The median new home price fell by $4,500 (see Table 3).

- Existing home sales: The National Association of Realtors reported that existing home sales dropped 5.4 percent from May’s 4,620,000 (annualized) to 4,370,000. This remains 4.5 percent above June 2011’s level of 4,180,000 (see Table 3).

- Pending home sales: Pending home sales fell 1.4 percent in June, from a downwardly revised 100.7 in May to 99.3 in June. This is still 9.5 percent above June 2011’s 90.7 (see Table 3).

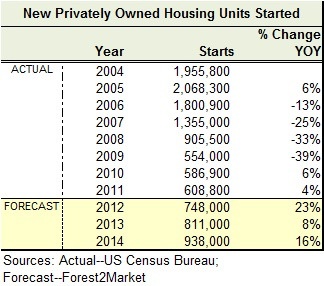

While the news is still mixed for housing, almost everyone believes that the bottom of the housing collapse is behind us, and almost all forecasts are predicting slow improvement over the next three or four years. Forest2Market’s own forecast of housing starts shows (Table 4), a 23 percent improvement for 2012, an additional 8 percent for 2012, and an additional 15 percent increase in the number of starts in 2014.

Table 4

Comments

US South Sawtimber Stumpage Prices–2012 Year

08-01-2012

[...] For more information about the housing market and Forest2Market’s housing start forecast, read Suz-Anne Kinney’s Housing Market Update for June 2012. [...]

Suz-Anne Kinney

Suz-Anne Kinney