On the heels of October’s improbable 25 percent surge, new residential construction in the US experienced a steep drop in the month of November. Economists had forecasted that housing starts would slip to a 1.23 million-unit rate last month coming off October’s previously-reported 1.32 million pace. Despite soaring stock prices, recently-released data shows weak retail sales and industrial production in November, and the plunge in groundbreaking activity could result in fourth-quarter GDP forecasts being trimmed yet again. The Atlanta Federal Reserve is forecasting GDP rising at a 2.4 percent annualized rate in 4Q2016 after increasing at a brisk 3.2 percent rate in 3Q.

Housing Starts, Permits & Completions

Housing starts plummeted 18.7 percent to a seasonally adjusted annual rate (SAAR) of 1,090,000 units in November. Single-family starts accounted for 828,000 units, which is 4.1 percent below the revised October figure of 863,000. The volatile multifamily segment sank 45.1 percent to a SAAR of 259,000 in November.

Single-family permits rose 0.5 percent to a rate of 778,000 units in November, while multifamily permits dropped 13 percent. Privately-owned housing completions were 15.4 percent above October’s estimate of 1,054,000 units.

Regional performance reversed course across the board in November, as confirmed by the US Census Bureau report. Seasonally-adjusted housing starts by region included:

- Northeast: -52.1 percent; (+44.8 percent last month)

- South: -9.3 percent; (+17.9 percent last month)

- Midwest: -14.2 percent; (+44.1 percent last month)

- West: -22.1 percent; (+23.2 percent last month)

"Single-family starts declined from a robust level in October but still remain very solid," said National Association of Home Builders (NAHB) Chief Economist Robert Dietz. "Though rising mortgage rates could be a headwind for housing, we expect single-family production to continue on a long-run, gradual growth trend. Meanwhile, the multifamily sector, which has been volatile in recent months, is expected to level off at a solid rate as that market finds balance between supply and demand."

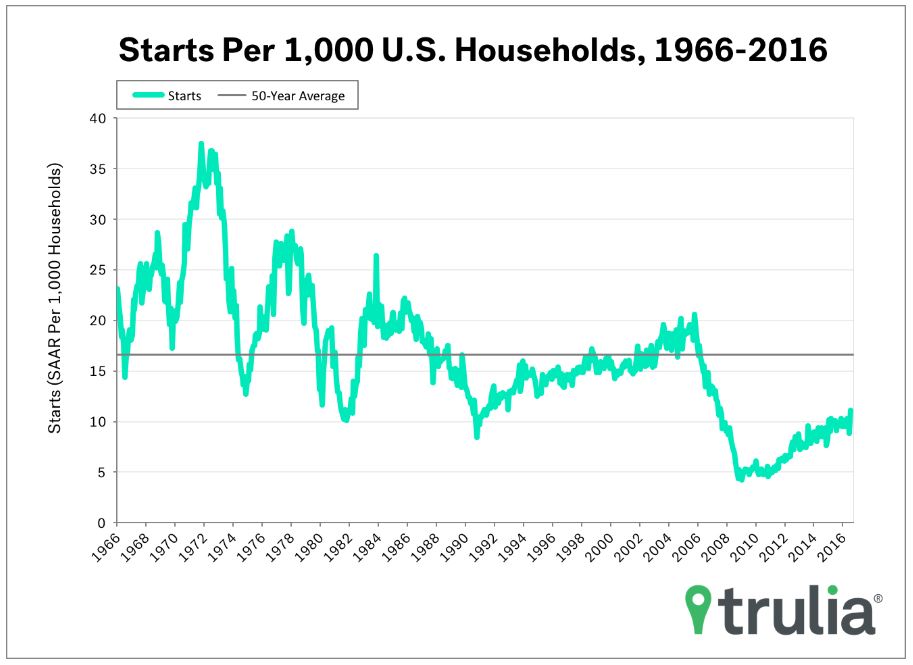

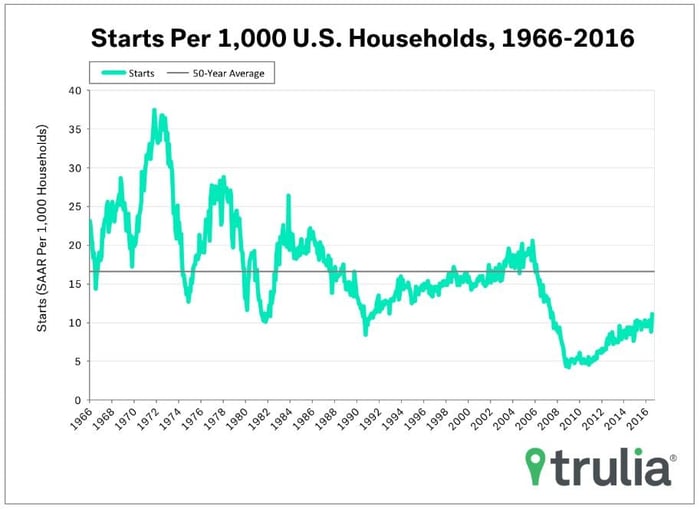

Trulia, an online marketplace serving the real estate industry, has compiled an informative chart detailing housing starts activity over the last 50 years, which also includes a 50-year average. Accounting for the number of households in the US, housing starts are only about 66 percent of their 50-year average.

Mortgage Rates & 2017 Outlook

The 30-year fixed mortgage rate jumped in November from 3.47 to 3.77. This is the second highest monthly rate of the year (January: 3.87), and it represents an 8.6 percent increase over October’s rate, which is significant given the very shallow monthly changes we have seen since the Q12016.

American markets are reacting to an anticipation of faster business expansion and improved performance from President-elect Donald Trump’s policies. As of this writing, the Dow Jones Industrial Average (DJIA) is nearing 20,000, which was unfathomable just a few weeks ago. But the recently-announced quarter-point increase in the federal funds rate by the Federal Reserve Board will likely change some of the terms by which consumers can borrow money or access credit. Long-term fixed mortgage rates, which generally are pegged to yields on US Treasury notes, are creeping up in response to the FED announcement.

Despite the lackluster housing starts numbers from November, a separate NAHB report shows a significant improvement in homebuilder confidence in the month of December. The report said the NAHB/Wells Fargo Housing Market Index jumped seven points to 70 in December, reaching its highest level since July of 2005.

"Year-to-date, single-family starts are up 9.6 percent and the overall trend in this sector remains positive," said Ed Brady, chairman of the NAHB. "Builder sentiment is strong and we can look forward to growth in the single-family market in the year ahead as the industry adds workers and lots and Washington policymakers provide regulatory relief for small businesses."

There is a lot of positive economic anticipation surrounding the January transition of power in Washington. While this improved outlook is certainly welcomed and long overdue, some of the optimism is likely to wane as reality sinks in during 1H2017. The larger housing market will continue to play an important role in keeping the economic engine running despite the temporary month-to-month hiccups.

“Though November’s drop is disappointing news for the housing market, we’re confident that housing starts will continue their slow and steady rise through 2017 and beyond,” noted Ralph McLaughlin, chief economist at Trulia, an online marketplace serving the real estate industry. “Yesterday’s large jump in homebuilder sentiment is a good sign that they think so too. More starts in 2017 will be welcome news for homebuyers who have been stymied by a supply-constrained market over the past few years.”