The red-hot softwood lumber market has garnered a lot of attention over the last two years. Inquiring minds from Main St. to Wall St. have been interested in the rapid rise of finished lumber prices, as well as the relationship between timber prices and lumber prices and the inner workings of the forest supply chain in general. For those of us in the forest products industry, the last two years have created excellent opportunities to educate the public around these topics and, most importantly, about the benefits of sustainably managed working forests.

One question we hear pretty regularly from those specifically interested in lumber manufacturing is this: How does a mill’s management team know which logs to use to optimize production, and how do they determine a log’s value?

It’s a good question that, like many across the forest products supply chain, is not as simple as it might seem.

Modern Sawmills

Sawmill managers continually seek to maximize the profit made from each log purchased in order to outperform their competitors. Like any manufacturer, a simple prescription for this is to keep raw material costs as low as possible while maximizing revenues. Since log cost is by far the largest operating cost for a modern sawmill - upwards of 70% in some cases - resourceful log procurement is imperative.

Modern lumber mills are highly efficient, but they still require a significant amount of raw material in the form of sawtimber (logs). For example, a new southern sawmill producing 250 million board feet (MMBF) of lumber with a yield of 1 MBF per 4 tons of logs will consume a million tons of logs each year.

At such a massive scale, how can sawmills maximize efficiencies?

Buying the right log size: The best-in-class dimension lumber mills throughout the US South seek the ideal log size for their particular mill and equipment setup, and they proactively work to buy that log on the market. This is a key driver in competitive southern sawtimber markets. The most accurate method mills use to track and verify their procurement strategies is to measure truckloads of logs at the scale house as they arrive, where they take average small-end-diameter (SED), pounds per linear foot (PLF), and stems/ton measurements. All of these measurements will give the mill manager a good understanding of whether or not they are purchasing the ideal log.

Not overpaying for the right sized log: A common calculation top-tier mills use when evaluating the price they can pay for logs is derived through a break-even analysis or “return-to-log” (RTL) calculation. An RTL calculation, in very general terms, is an effective way for sawmills to determine the value of a log based on the products that can be produced from that log minus the cost of production:

Total Revenue ($/MBF)

– Total Cost ($/MBF)

Obviously, if the RTL calculations come back negative, adjustments need to be made. Paying too much—even for the perfect log—will quickly put any mill at a market disadvantage. After determining an ideal log size, mills must then identify the maximum price that can be paid for these logs in order to operate efficiently and profitably.

Drivers in RTL calculations

Because lumber mills produce a number of marketable products aside from smooth 2x4s, several factors go into the above calculation that determine the value of a log from the mill’s point of view. The first consideration is the potential revenue that each log can generate.

Total revenue resulting from the sale of numerous products:

Finished products (lumber)

- Byproducts

- Residual chips

- Shavings

- Sawdust

- Bark/wood fuel

Aside from the already high raw material cost, there are additional variable and fixed costs associated with the manufacturing process:

Variable Costs

- Log cost

- Log yard (inventory) cost

- Sawmill operating costs

- Labor

- Drying

- Planing

- Shipping

- Maintenance costs

Fixed Costs

- General & administrative costs

- Procurement & sales staff

- Depreciation

- Interest

- Corporate fees

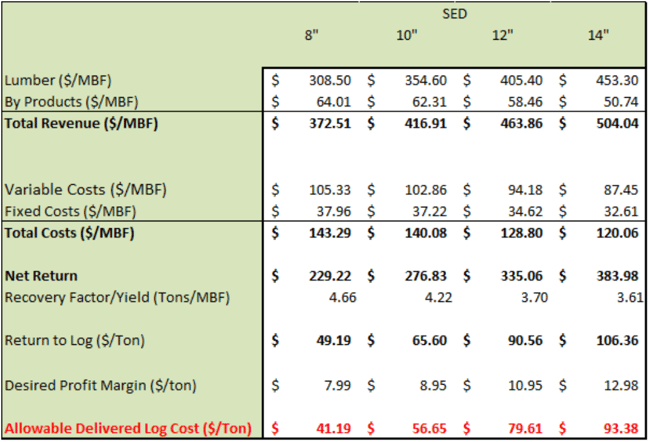

As shown in the example below, the end result of the RTL calculation is the maximum delivered price a mill can pay for a specific log size while accounting for manufacturing and day-to-day operations costs. Procurement foresters can use this information to negotiate prices with suppliers. They can also use this information to determine the maximum stumpage price they can pay a landowner after harvesting and freight costs are considered.

Basic Example of RTL Calculation

However, the RTL calculation doesn’t provide insight into ideal log prices to maximize profit. Once mill managers have a sound understanding of log value to their unique mills, they can then take the next step of comparing the individual value of a log versus how the market values that log. While certain log sizes may be worth one price to a particular mill facility, the market may command a different price.

PLF Visualization

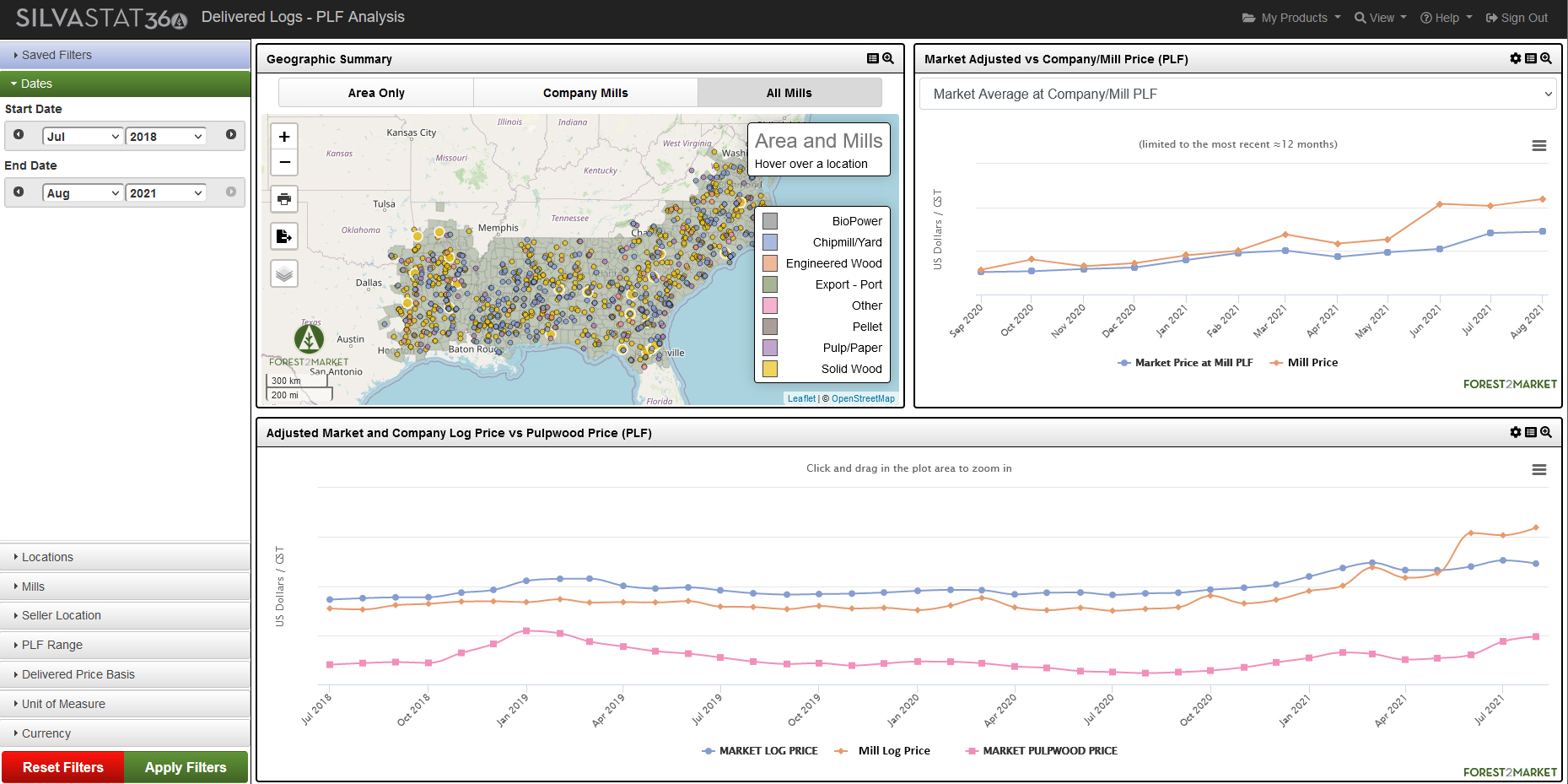

Forest2Market’s new PLF Visualization (available via SilvaStat360) provides interactive charts and tables that help users visualize geographies and the data that correspond to their mill facilities, including historical PLF data on product, price and volume. Procurement managers can use this information to better compare their company-wide and individual mill log specifications and prices to the market by filtering data to fit their unique log profiles. This increases market transparency and allows procurement teams to identify areas where they can improve buying strategies that will drive profitability. Subscribers can use this tool to:

- Identify CNS and pulpwood price deltas

- Track price changes and identify trends in a dynamic market

- Determine specific pricing for preferred logs

- Gain efficiency in raw material sales or acquisitions

- Quantify raw material revenues/procurement costs by component

- Measure results against the broader market

- Identify performance improvement opportunities

Many mills across the country have been implementing RTL calculations for quite some time but as lumber markets have remained highly unstable over the last two years, these types of evaluations are a necessity. Adding even more complexity to the situation, southern timber prices are now higher than they have been in 14 years, and more price volatility is likely to occur in the coming months.

Comprehensive analyses of a mill’s revenue/costs based on detailed log sizes and accurate market data helps management teams develop log procurement strategies that increase profitability and long-term success – regardless of market conditions. Forest2Market’s new PLF visualization can provide southern sawmillers with unparalleled transparency into their timber markets – down to their preferred log size - which will drive better decision-making, better cost management, and improved performance and profitability.

Joe Clark

Joe Clark