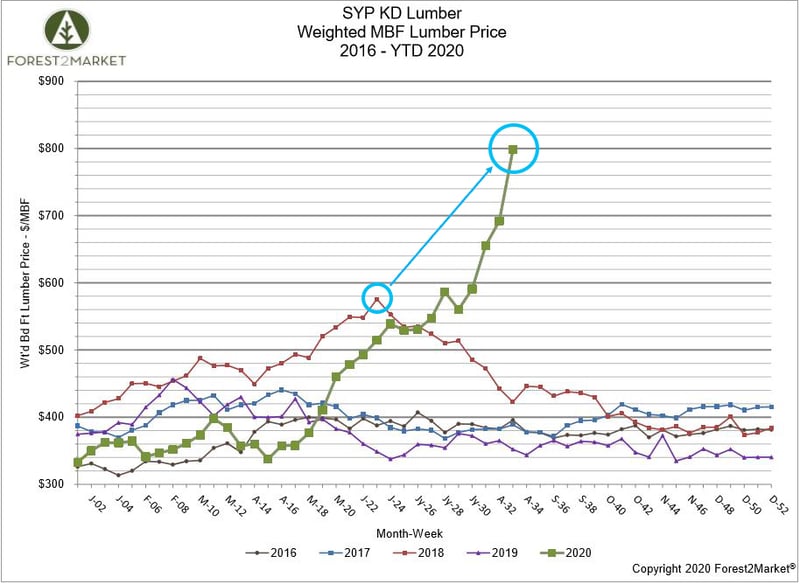

After blasting past the previous all-time high achieved in 2018, southern yellow pine (SYP) lumber prices are now at new record highs... by big margins. To put the number in perspective, Forest2Market’s composite SYP lumber price for the week ending August 14 was $798/MBF, which represents a 39% increase over the previous all-time high of $576/MBF that was achieved in June 2018.

Such a price run-up also prompts a popular question: When lumber prices hit record highs, shouldn’t log costs go up too?

The answer to this question is not as obvious as it may seem. While there is some interplay between log prices and the price of wood products, the association is not a firm one. There are a number of mutual factors that affect both lumber and log prices, but each market also has independent drivers that do not overlap, which is why we oftentimes see a disconnect in prices.

What Metrics Drive Lumber Prices?

The two primary factors that drive lumber prices are housing starts (as well as remodeling/general construction) and lumber inventory.

- Housing starts: Historically, the main driver of lumber prices has been the larger US housing market, which requires a well-oiled supply chain, steady import flows (primarily from Canada) and massive amounts of finished lumber, plywood, oriented strand board (OSB) and other building materials.

- Lumber inventory: The market’s capacity to produce lumber is the other key factor that drives price. Manufacturers must be able to make and stock a number of products in order to meet the demands of the huge construction market.

What Metrics Drive Log Prices?

The two primary factors that drive log prices at both the mill gate and in the forest are the general economic principles of supply and demand.

- Supply of logs (as standing timber): The inventory of standing timber products in a given supply basin must be matched to regional demand for those products. I.e., pulp and paper mills need access to deep inventories of pulpwood, and sawmills need access to sawtimber. In the US South, over 12 billion tons of inventory are currently growing in southern forests; roughly 280 million tons (3%) are harvested and used in the production of wood products each year.

- Demand from mills: Wood products mills require a significant amount of raw material to manufacture their end products. The cost for these materials makes up a vast majority of a mill’s operating costs—up to 75% in some instances. Of the total annual harvest in the South, approximately 145 million tons of wood go to pulp and paper mills as pulpwood; approximately 120 million tons go into dimensional lumber and panel/plywood production as sawtimber; and less than 15 million tons go into the production of wood pellets.

What’s Driving High Lumber Prices Now?

As Pete Stewart recently wrote, southern yellow pine lumber prices have recently surged to new record highs, but they started the year on the low side of the 5-year average. However, prices have since shot up by 140%, and there are three primary factors driving the trend:

- Stronger than expected housing starts and unforeseen demand from the remodel sector

- Capacity and supply chain adjustments

- Market speculation driving uncertainty

The homebuilding sector has experienced significant turmoil since the onset of the COVID-19 pandemic. Housing starts were down 30% in April to a seasonally adjusted annual rate (SAAR) of 891,000 units—well below the historical average of 1.5 million. However, the steep decrease was largely driven by the “lockdown” that kept homebuilding to a minimum during most of the Spring season, especially in states where building was deemed non-essential. Total starts have bounced back since early summer and are currently at a seasonally adjusted annual rate of 1.2 million units.

As many sawmills watched the economic shutdown unfold in late 1Q2020, they were forced to make some tough decisions almost overnight. Based on what appeared to be a total collapse in demand, lumber manufacturers had to do their best to match production to a huge shift in that demand, and many producers closed or curtailed their operations as a reaction.

By the time mid-April rolled around and US lumber output had slowed, Canadian lumber shipments to the US—which make up a significant chunk of US supply—were also down by nearly 20%. What was anticipated to be a huge drop in demand was really just a short-lived dip as the remodel sector buoyed overall demand during the worst of the global shutdown.

This combination has resulted in a tremendous supply gap in the market.

Will Higher Timber Prices Follow?

The current run-up in finished lumber prices is a temporary reaction due the uncertainty caused by an extraordinary event: COVID-19. History generally demonstrates a similar catalyst and subsequent reaction when prices peak, as they did in June 2018 when a combination of bad weather and transportation issues pinched Canadian lumber flows during stocking season. By the time the supply chain corrected itself, lumber prices dropped precipitously and were within the range of the 5-year average by August.

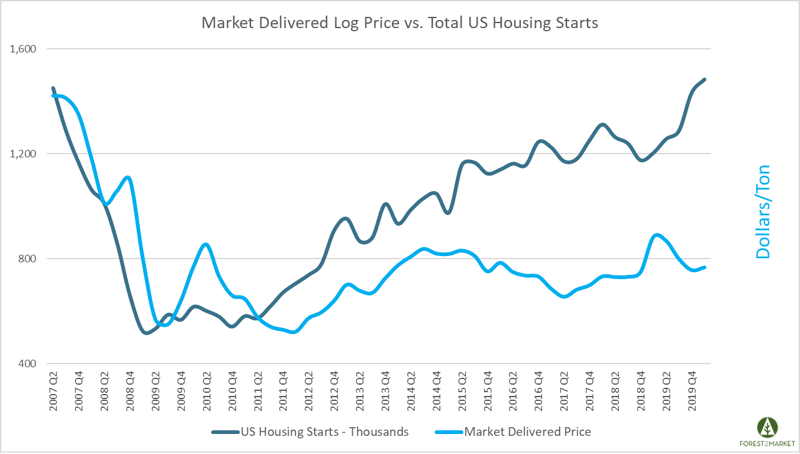

As a heavily traded commodity, market prices for lumber react to a series of events on a daily basis, and the reactions may be short-lived. But the market for trees is vastly different, and it is less connected to daily lumber price volatility than one might think. In the US South, the inventory of standing timber has risen unimpeded since the onset of the Great Recession in 2007, which has resulted in an oversupplied market.

A number of mills were forced to adapt and improve efficiencies in the immediate aftermath of 2007, and many landowners simply pulled their timber off the market in hopes that prices would trend upward in the future. However, the oversupply of wood fiber combined with improved mill efficiencies has kept log prices suppressed, even as demand for lumber surges and sawmill production continues to increase after the “lockdown.”

After dropping suddenly at the onset of the Great Recession, pine log prices have remained pretty steady across the US South over the last decade. There was an uptick in prices in early 2019 that coincided with lengthy and extreme periods of wet weather across the South, which impeded harvesting operations and put upward price pressure on supply. But trends for 2020 show prices for certain products inching down once again.

The COVID-19 pandemic continues to send shockwaves throughout the global economy, and the situation is highly fluid. Trade agreements (particularly with China) are constantly evolving, imports from Canada are shifting, etc. Based on its deep inventories of wood raw materials, labor pools, competitive operating costs, transportation conditions, haul distances, etc., it is likely that the forest industry in the US South will continue to grow and increase its share of global production volumes.

Additional sawmill capacity will help to reduce the large oversupply of standing timber throughout the region, and the rise in log consumption will begin to affect prices for all timber products. When the market begins to signal this change, as it has in certain wood basins in the south, timberland owners need to have a firm grasp of their resource values, and procurement managers and project investors in the region must maximize their supply chain efficiencies in order to maintain profits.

Joe Clark

Joe Clark