Strong demand for tissue and towel products early in the COVID-19 pandemic, followed by a remarkable run on lumber, has kept the forest products industry at the forefront of many conversations. However, the run was followed by a relentless fire season that burned vast areas of timberland in the Pacific Northwest (PNW).

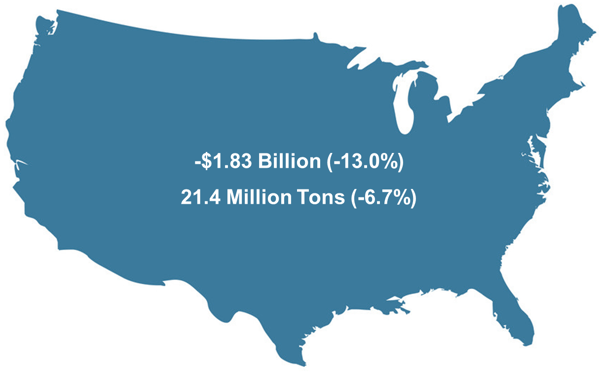

As noted in a previous post earlier in 2020, Forest2Market was commissioned by the American Loggers Council (ALC) to identify just how significant these impacts have been. Forest2Market’s research found that US raw wood material consumption between January-July 2020 was 6.7% less than the same period in 2019 – dropping by 21.4 million tons of material. This resulted in a 13% reduction ($1.83 billion) in value of the delivered wood during the time period.

COVID-19 Impacts to Delivered Wood Raw Material

How has COVID-19 impacted wood consumption in the forested regions of the US?

In the first two installments on this topic, we looked at the wood raw material consumption (harvests and deliveries) for the US South, Northeast, and Lake States regions. The primary goal was to identify key drivers of regional wood supply in the immediate aftermath of the COVID-19 pandemic and how they affected the forest supply chain.

In a region driven by a particularly robust log market, the trend has been somewhat different in the PNW.

Log Trends

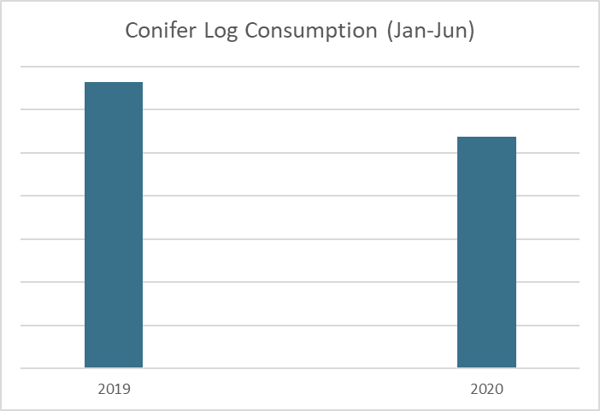

Anticipating a shrinking housing market early in the pandemic, many leading lumber producers began curtailing production - in some cases by as much as 30%. However, what unfolded nationwide in the wake of the lockdowns caught the entire lumber market off guard and triggered an historical run-up in lumber prices. As to be expected, as large producers pulled their foot off the gas, this directly correlated to a substantial drop in log consumption of nearly 20% over the same timeframe compared to the previous year.

Total Fiber Trends

There is often a disconnect between our everyday tissue and towel usage and the working forests that provide the raw material for this consumer staple. However, early in the pandemic when everyone rushed to stock their new home offices (and apparently their garages) with toilet paper, it brought nationwide attention to the forest products industry. While the tissue and towel industry was running at full capacity, demand for printing and writing papers decreased and this sector continues to experience accelerated structural changes.

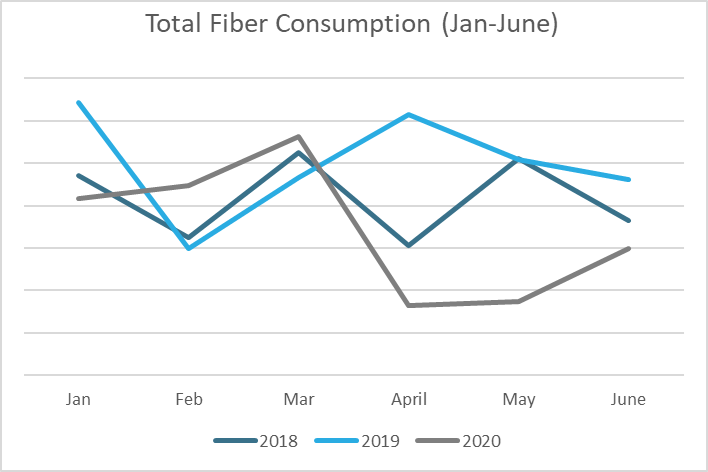

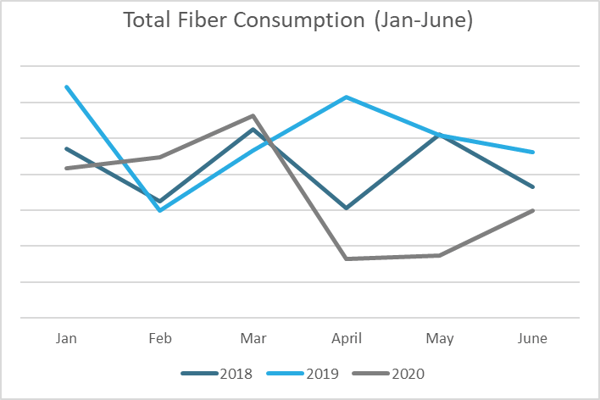

As fewer logs were being sawn in the PNW in 2Q2020, the fiber industry saw a significant reduction in available chip supply (a byproduct of lumber production) compared to the same time period in previous years. Fiber consumption was trending in line with previous years (above average) but with the onset of COVID-19 shutdowns in March, consumption levels plummeted. By April 2020, total fiber consumption was down 26% compared to April 2019. However, we have seen a rapid recovery as regional lumber production began hitting full stride into 3Q.

Outlook

As my colleague Gordon Culbertson recently wrote, there are few key dynamics to watch in the PNW as we progress into 2021.

- Lumber prices are still elevated by historical norms and a strong housing market will likely keep pressure on regional mills to perform at capacity. But economic and political uncertainty remains very high, and a second wave of national lockdowns could gut the economic gains we have made in 2H2020. Such a development would have a compounding impact on the labor market, which would likely crush any demand for new housing in the near term.

- Prices for logs have declined slightly. However, they have likely softened about as much as they can. It was a mild fall in the PNW and once the rain and snow hit in earnest, deliveries will slow, and supply will tighten - even for burned logs. With improved markets, this will apply upward pressure on log prices during 1Q2021.

- The export market has really fallen off this year and it is unlikely to change in the near term. The China export market has nearly vanished, and most regional export companies remain shuttered due to lack of demand. Domestic and export log prices should temper based on increasing uncertainty in the global market, although tight supplies will ultimately dictate just where those prices will settle.

- Taking a longer view, damage to private forests in western Oregon has been severe. Some localized areas may face decades-long gaps in future timber supply resulting from the fires. Damage to mature timber - which forces early harvest - and the loss of many years of immature growing stock will have serious long-term implications for regional log supply.

As we put 2020 to bed and continue to look ahead for new developments and opportunities, it’s important to keep in mind that the PNW forest industry has shown considerable resilience. With fire damage clean up likely to continue for a long while, it may take some time to see a full return to a “normal” log and fiber market.