Based on some long-term indicators we track, in March of 2007 we began forecasting a recession. We predicted this recession--which officially started in December of 2007--because long-term interest rates were below short-term interest rates for 90 days, a turn of events that has preceeded every US recession.

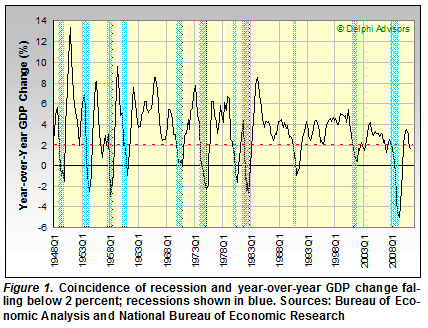

Four and a half years later, we find ourselves in a similar position. Now that the Federal Reserve is holding short-term interest rates at barely above zero, however, the indicator we used in 2007 is no longer valid. This time, we are tracking an indicator that borrows from research published this past spring by Philadelphia Federal Reserve analyst, Jeremy Nalewaik. Nalewaik correlated the onset of recessions with a fall in the year-over-year change in gross domestic product (GDP) below 2 percent (see Figure 1).

Since 1947, whenever the percent change in GDP fell below 2 percent (represented in this figure by the broken red line), the US economy was either already in a recession or soon would be.

The most recent calculation of GDP by the Bureau of Economic Analysis (released August 26, 2011) estimates GDP as growing by an annual rate of just 1.0 percent in the second quarter of 2011. In the first quarter of 2011, real GDP increased just 0.4 percent.

Since 2009, Forest2Market has been projecting that a second recession would strike the US sometime between 2Q and the beginning of 4Q 2011. The historical validity of this recession/GDP indicator and the sub-2.0 percent GDP growth we've seen in 2011 seems to suggest that our forecast is becoming reality and that the US is either already in or approaching another recessionary period.

How long and deep will this recession be? Our models show that it will be both shorter and more shallow than the previous one--though with the amount of global and domestic uncertainty that abounds today, we continue to update our models on a monthly basis to reflect current conditions and fine tune these projections.

Do you think that we're in or headed for a double-dip recession? We'd like to hear what indicators you're tracking.

For more detail about the Economic Outlook.

Comments

Pulp Prices Fall Due to Weak Economy | F2M Market

09-30-2011

[...] both 2011 and 2012 will see negative annualized growth in GDP (see Suz-Anne Kinney’s post, “Is a Second Recession Imminent?”). Based upon this economic outlook, pulp prices are likely to remain below the trend line for [...]

Suz-Anne Kinney

Suz-Anne Kinney