5 min read

Japanese Renewables Poised for Growth with New, International Investment

John Greene

:

June 13, 2017

Earlier this year, we compiled a series of blog posts that provided a comprehensive view of the nascent Japanese biomass market, which has emerged in the wake of the 2011 Fukushima Daiichi nuclear disaster. Soon after the Fukushima event, Japan increased its use of fossil fuel imports for thermal generation, leading to an increase in in-country electricity prices and greenhouse gas (GHG) emissions. Japan is now at a critical juncture and is proactively changing course in its energy production systems.

Since the Fukushima crisis, the Japanese government has had the dual objective of shifting power away from nuclear generation while at the same time expanding its energy portfolio to include more renewables—an enormous task by an scale. Consider Japan’s reliance on nuclear energy prior to 2011:

- Fifty-four (54) operational nuclear reactors generate about one third of Japan's power.

- After the Fukushima event, the government ordered the closure and immediate review of the safety of the remaining reactors.

- Today, just four reactors are operational; eleven are in the process of being decommissioned across Japan.

In an effort to jumpstart the incorporation of renewable technologies, the government established a renewable electricity goal, pledging that between 25 - 35 percent of its electricity will be generated from renewable sources by 2030. In order to reduce fossil-fuel reliance, Japan also introduced a feed-in tariff (FIT) system in 2012 to promote the growth of renewable energy.

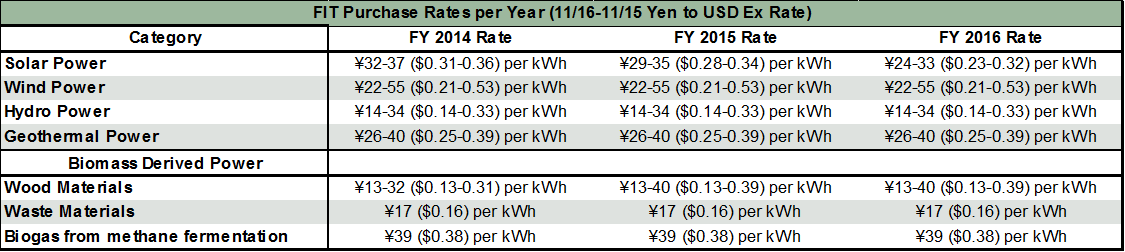

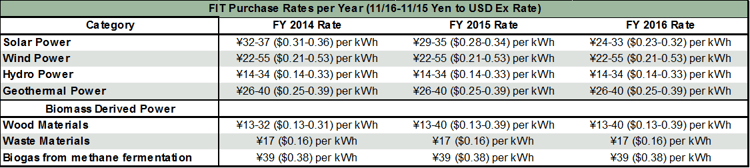

The FIT system essentially forces power companies to buy electricity generated from renewable energy sources at set rates provided by the Minister of Economy, Trade and Industry (METI) for a period of 10 to 20 years. Operators of electric utilities can recover costs incurred by the purchase of renewable electricity by invoicing consumers a surcharge in addition to the amount usually charged for the supply of electricity. The following table highlights the METI FIT annual rates and specified periods.

Renewable Opportunities

Japan has an isolated power generation structure and does not import or export electricity; it is comprised of a system of relatively insulated grids controlled by local utility monopolies. Therefore, a “one-size-fits-all” solution is simply not feasible. But such a configuration presents a number of new opportunities to incorporate renewable technologies, where these systems can operate sustainably without stressing capacity. Consider the surge in solar photovoltaics (PV) use since 2011:

- The solar PV share of electricity production in Japan rose from only 2.7 percent in 2015 to 4.3 percent in 2016.

- In 2H2016, solar PV ’s contribution to Japan’s energy mix accounted for more than 5 percent of all electricity generation.

- Japan is forecast to have 8 gigawatts (GW) of solar installations in 2017, which is more solar capacity than any country other than Germany and China.

Together, all renewable energy sources represented 14.2 percent of Japan’s electricity production during 2016. Hydroelectric power represented the largest share of renewable energy, followed by solar, biomass, wind and geothermal. In areas of specific utilities, there are some days when the share of renewable energy provides as much as 80 percent of the electricity demand. Because biomass power is less dependent on weather conditions than wind or solar, the Japanese government wants to triple the total power generation capacity of biomass from 2014's levels to 7.28 million kilowatts by 2030, according to Nikkei Asian Review. And both Japanese and international investors are poised to take advantage of this opportunity.

Biomass Generating New Investment

The introduction of the FIT system sparked a boom in construction of Japanese solar farms since 2011. But as they have become less profitable with progressive cuts in the tariff, the focus in the renewable energy industry is shifting towards other technologies. Japanese financial services company Orix, which currently operates roughly 110 megasolar facilities, aims to diversify into developing geothermal and biomass plants. Orix is now the fourth-largest independent power supplier in Japan to non-residential users, and has approvals for 920 megawatts (MW) worth of solar capacity, of which 510 MW is operating.

But Yuichi Nishigori, head of the company's energy division said that that solar expansion is gradually slowing due to a lack of suitable sites for new projects and cuts to the solar tariffs. "We are slowly running out of land such as old factory sites and access to power grid networks," Nishigori said. "I suspect it would be difficult to raise capacity much further for the next few years. We could acquire solar plants that have already been built, but we aren't considering that because the prices are expensive."

And other major international investment firms are entering the market as well. Japan Renewable Energy (JRE)—a Japanese solar power company established by the Goldman Sachs Group—announced plans to expand its operations and invest 40 billion yen ($365 million) in biomass power plants at 10 or more locations by 2020. The total power generation capacity of those facilities is projected to reach 70,000 kilowatts.

Goldman Sachs established JRE in 2012 as part of its investment in renewable energy, and it currently operates 27 megasolar plants and two wind farms across the country. JRE will start building its first biomass plant in the coming weeks in the city of Kamisu. The 24,400-kilowatt facility, which will cost roughly 10 billion yen ($91 million), is expected to generate 200 million kilowatt-hours of electricity a year by burning biomass in the form of wood chips.

Other Biomass Projects

Because of its small, fractured energy grid, a number of Japan's current biomass power plants run on waste wood from construction. However, imported fuel is eventually expected to become dominant in the long term. Per Nikkei Asian Review, other Japanese companies are also investing heavily in biomass for both power generation and manufacturing processes.

- Sumitomo Corporation currently imports roughly 200,000 tons of chips and other wood-based fuel a year from Canada and Vietnam, and is planning to increase that figure to 1 million tons by 2019. Sumitomo has imported high-quality wood chips for papermakers for years, and hopes to use those connections to secure lower-quality chips abroad to sell to power plants at home.

- International trading firm Itochu is planning a substantial increase in imports of wood-based fuel to 1.2 million tons annually by fiscal 2019. It also plans to procure palm kernel shells and other materials from Southeast Asia.

- Paper trading company Kokusai Pulp & Paper announced that it will start importing palm kernel shells this spring in partnership with a company in Southeast Asia. With demand for paper decreasing in Japan, Kokusai plans to sell fuel to papermakers that are branching out into the biomass power market.

- Japanese electricity supplier erex currently plans to triple the amount of palm shell and other biomass purchases to 300,000 tons in fiscal 2017.

As we noted in our earlier coverage of this market for wood and biomass, Japanese buyers maintain strict criteria for wood pellet/chip sustainability and quality. With a concern for reliability of supply, Japanese firms are willing to sign long-term contracts with producers that are able to guarantee supply quality and stability. Per a newly-released report from the USDA, Japan recently implemented the Clean Wood Act, which is designed to ensure that both domestic and imported wood is harvested legally. The act was implemented on May 20 and impacts most wood raw materials including logs, lumber, furniture and wood pellets, although some products made from recycled wood (particle board) are excluded.

In the wake of the Fukushima incident, Japan has a clear understanding of what’s at stake when it comes to national energy production. As the country continues to transition away from both nuclear and fossil energy sources and into more renewables, the Japanese government is making a concerted effort to stimulate the growth in this sector while ensuring legal, sustainable supply. With a long-term demand for biomass and the administrative framework in place to facilitate it, Japan’s changing energy system will continue to create new opportunities for both national and foreign investment.