4 min read

Labor Market Snapshot & Related Developments Impacting US Forest Industry

Forest2Market

:

August 26, 2020

The Bureau of Labor Statistics’ (BLS) establishment survey showed that non-farm employers added 1.763 million jobs in July (+2.0 million expected). Also, May and June employment changes were revised up by a combined 17,000. Meanwhile, the unemployment rate (based upon the BLS’s household survey) receded (-0.9PP) to 10.2 percent under a combination of employment gains (+1.35 million employed) and contraction in the labor force (-62,000).

For perspective, although 9.3 million jobs have been created/recovered since April’s trough, the US economy is still 12.9 million jobs short of February’s peak. As of August 1, over 30 million people were receiving some sort of unemployment/pandemic assistance, which translates to a rate of roughly 20 percent.

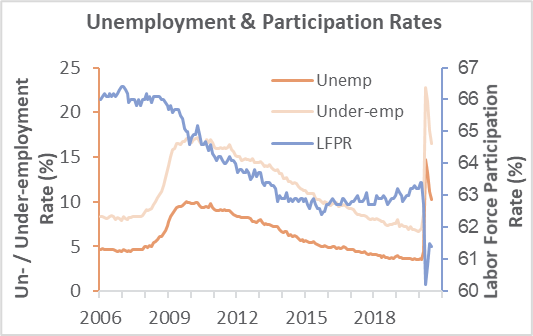

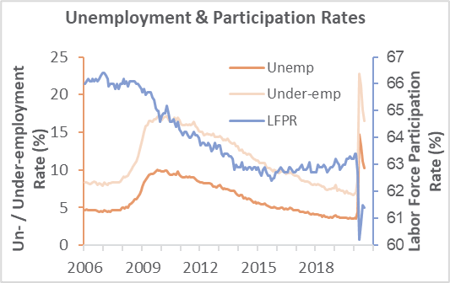

Because the number of job gainers outnumbered the increase in the working-age civilian population by nearly 8:1, the employment-population ratio (EPR) rose to 55.1 percent; i.e., a little more than half of the employment-age population is presently working. However, the number of employment-age persons not in the labor force rose by 230,000 (of which 62,000 left the labor force) to 100.5 million, causing the labor force participation rate (LFPR) to tick down to 61.4 percent. Prior to this pandemic, such low rates were last seen in February 1963 (EPR) and March 1976 (LFPR).

Service-providing industries garnered most of July’s jobs, jumping by 1.724 million—especially leisure and hospitality (+592,000), government (+301,000), retail trade (+258,300), professional and business services (+170,000), other services (+149,000), and health care (+125,500). Goods-producing industries gained a relatively paltry 39,000 jobs, of which 26,000 accrued to manufacturing. That result is perhaps somewhat consistent with ISM’s manufacturing employment sub-index, which contracted more slowly in July.

Correspondence among the subsectors we track was less consistent, however: Wood Products employment retreated by 1,300 (ISM was unchanged); Paper and Paper Products: +2,300 (ISM decreased); Construction: +20,000 (ISM decreased).

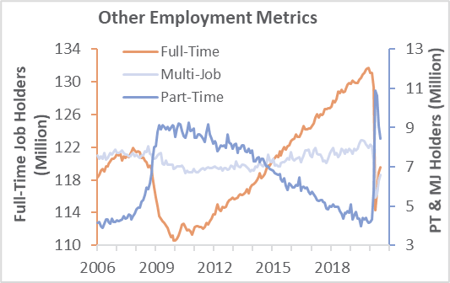

Full-time jobs advanced (+591,000) to 119.5 million. Workers employed part time for economic reasons fell by 619,000 (presumably, in most cases returning to full-time work). Those working part time for non-economic reasons (so-called “voluntary” part-timers) jumped by 655,000 while multiple-job holders rose by 323,000.

With the consumer price index running at an annual rate of +0.6 percent in June, whether consumers are keeping up with inflation essentially boils down to their employment status. Employment taxes withheld from paychecks also suggest the labor market may already be weakening. The amount withheld in July rose by $5.3 billion, to $194.5 billion (+2.8 percent MoM; -7.8 percent YoY); that dollar amount is less than one-third of June’s increase.

While 51 percent of small business owners surveyed by the National Association of Small Business (NFIB) reported hiring or trying to hire in July, 44 percent of all respondents were able to find few or no qualified applicants. “This summer has been a challenging time for small businesses,” said NFIB’s Bill Dunkelberg. “Unemployment insurance and government reopening regulations… are causing further obstacles to small businesses.”

Not only are businesses challenged in their search for qualified employees, but in other cases they are having to either lay off workers for a second time or at least warn of possible impending layoffs. Moreover, a Cornell University study found this second round of layoffs was concentrated “in states that have not been experiencing recent Covid-19 surges, relative to those in surging states.”

Labor-Related Developments Impacting the Forest Industry

Our Friends at Forest Resources Association (FRA) have been keeping track of policy developments impacting the US forest industry and its workforce since the onset of the COVID-19 pandemic. Recent labor-related information per FRA’s Issue Updates includes:

Logger Relief Legislation

In early August, FRA reached out to Members of Congress and encouraged them to cosponsor the Loggers Relief Act (S.4233, HR 7690). Senators John Cornyn (R-TX) and Roger Wicker (R-MS) have signed on to the Senate version of the legislation. The House legislation sponsored by Congressman David Rouzer (R-NC-7) now has 14 cosponsors with Congressman Bruce Westerman (R-AR-4) adding his name to the cosponsors list this week. The provisions of the legislation would provide grants to logging and trucking businesses that can demonstrate that their companies were impacted by the COVID-19 pandemic.

Paycheck Protection Program

The Paycheck Protection Program (PPP) ended on August 8. Overall, the program approved lending of more than $517 billion in 5.2 billion separate loans. The amount of remaining funding was $133.9 billion. A report of PPP program can be found here.

Congressional Schedule and COVID Relief

In the wake of the White House and Senate and House negotiators failing to make substantial progress on talks to forge a deal on additional pandemic relief legislation, Congress will be in recess until September 8. Of course, the House and Senate could both be called back if there is a breakthrough in negotiations, but that currently appears unlikely.

Last weekend, President Trump issued several memoranda and executive orders to attempt to address some of the issues under discussion in the pandemic relief negotiations. At this point, it is unclear what impact these actions will have as there is disagreement over the reach of Executive Branch authority and the legality of these actions.

September promises to be a busy month for Congress, particularly on the appropriations front. Funding for the federal government expires on October 1, and the Senate has not yet started its Fiscal Year 2021 appropriations process. When legislators return after Labor Day, both Chambers will be in session through September and then the House recesses until after the election. The Senate is scheduled to stay in town one more week (early October), and then it will also recess until after the election.

Rural Forest Markets Act

Senators Debbie Stabenow (D-MI) and Mike Braun (R-IN) introduced the Rural Forests Markets Act, S.4451. America’s forest owners have a vital role to play in addressing climate change. The Rural Forest Markets Act will encourage family forest owners to voluntarily participate in emerging carbon markets that reward family and small landowners for adopting conservation practices that store carbon and reduce greenhouse gases.

Healthy Forests Restoration Act

On August 5, Senators Steve Daines (R-MT) and Diane Feinstein (D-CA) introduced bipartisan forest management reform legislation. The provisions of the Healthy Forests Restoration Act would increase the active forest management of federal forests, and the bill aims to reduce litigation of U.S. Forest Service decisions. The goal of the legislation is to improve forest health and lessen wildfire risk, which includes establishing a grant program to encourage biomass removal from National Forests.