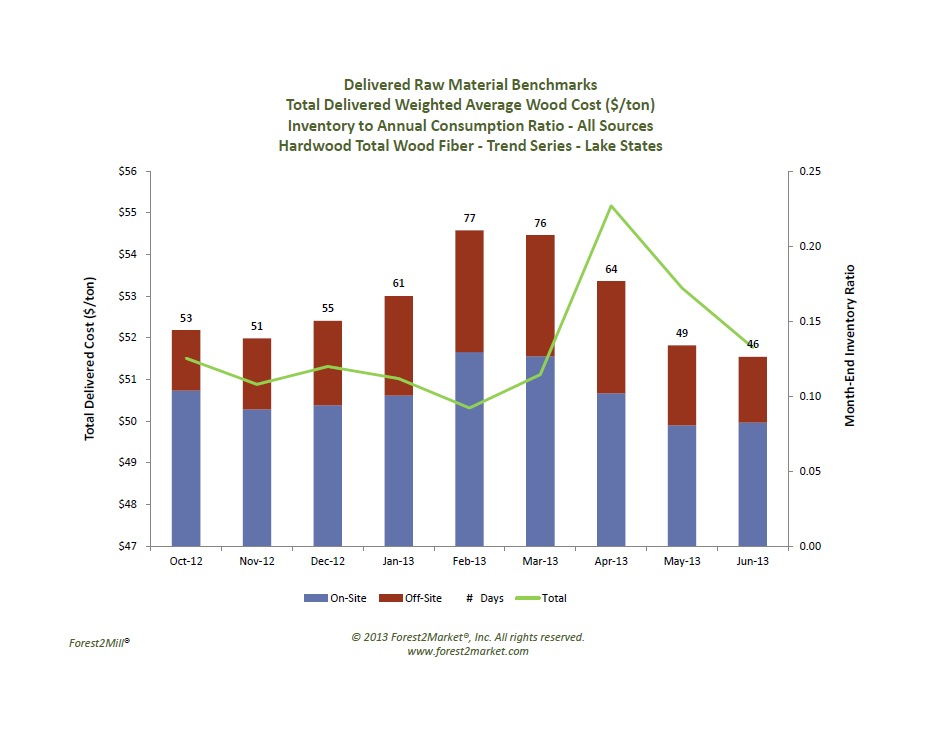

Hardwood and softwood total fiber (chip equivalent) prices displayed steep increases between the close of Q1 and the start of Q2. The effects of spring breakup - increased woodyard transfers and hauling from piledown areas – contributed to a $4.05 per ton increase in average hardwood prices between March and April . As the spring season wore on, hardwood prices fell to $51.77 per ton in June.

Hardwood inventories also fell in response to seasonal factors. At the start of the quarter, inventories started at 64 days then fell to 49 days in May. By June, inventories were at 46 days.

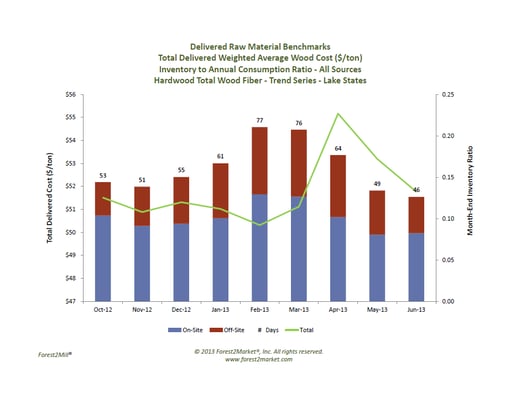

Softwood inventories were relatively unchanged between April and May at 42 and 43 days, respectively, but bumped up to 49 days in June. This trend is typical during spring as available logging capacity focuses on well-drained sites that typically grow pine.

As supply increased, softwood prices fell in response. Prices at the start of the spring season hit a quarterly high of $54.07 per ton in April before falling four percent to end the quarter at $51.93 per ton in June. The end of seasonal road restrictions and increased supply are expected to help moderate prices throughout the summer months.

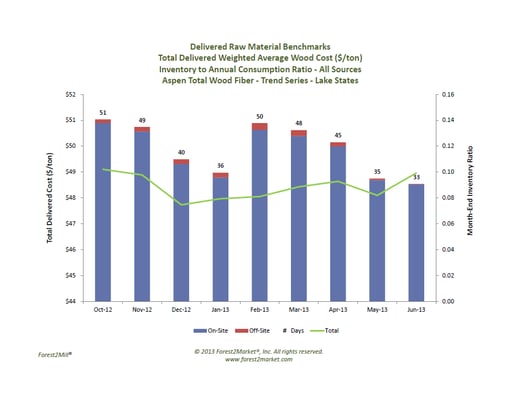

Residual chip pricing for both hardwood and softwood displayed little volatility over the last nine months. Residual chips are typically in steady supply as sawmills operate at a relatively constant rate and are not affected by seasonal factors. Although the increase in housing starts over the past couple of years has caused sawmills to run longer hours, the increased supply of residual chips volume has not yet been significant.

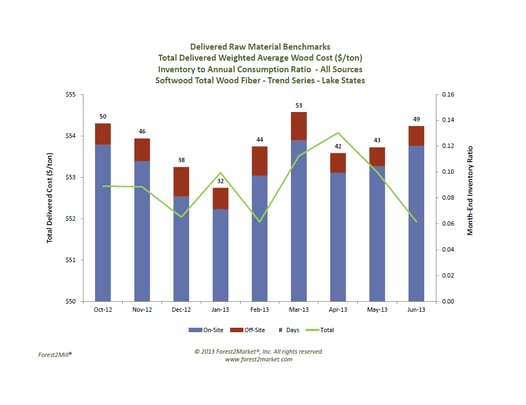

Aspen prices remained relatively constant throughout the quarter, ending at a quarterly high of $48.96 per ton in June. Aspen inventories fell over the quarter, from a 45-day supply in April to 33 days in June.

Pete Coutu

Pete Coutu