2 min read

Managing Wood Costs during Winter Months in Eastern North America

Pete Coutu

:

January 18, 2018

Pete Coutu

:

January 18, 2018

For companies operating in the forest industry, managing raw material costs can pose a significant challenge that requires constant attention to make meaningful operating improvements. Wood fiber costs are the single largest cost component for participants in the forest products industry, whether it’s a solid wood product or a pulp-derived product.

The general process for securing this wood fiber is essentially the same in every part of the world—from the US to Brazil, and from Europe to Australia: Grow trees, harvest trees, skid and load trees, transport trees, merchandise trees and, finally, utilize trees to make value-added, wood-based products like lumber or paper.

However, unique regional differences in the supply chain are very real; access to wood fiber can vary wildly from region to region. For instance, the US South and Brazil supply chains are dominated by an easily accessible plantation style of management, while the supply chain in the Pacific Northwest (PNW) must account for drastically varying types of terrain. The US North (from Minnesota to Maine) and much of Canada are dominated by seasonal variations in deliveries that drastically affect access to fiber and related supply chain costs.

Managing Costs & Planning Ahead

Unlike the US South, the seasonality of timber harvesting is a significant driver of price in the northern US and Canada. When it comes to properly managing wood fiber costs in Eastern North America, it is critical that wood procurement managers are knowledgeable about inventory management and planning, and they must have a sound understanding of the regional market for wood during the critical winter harvesting season.

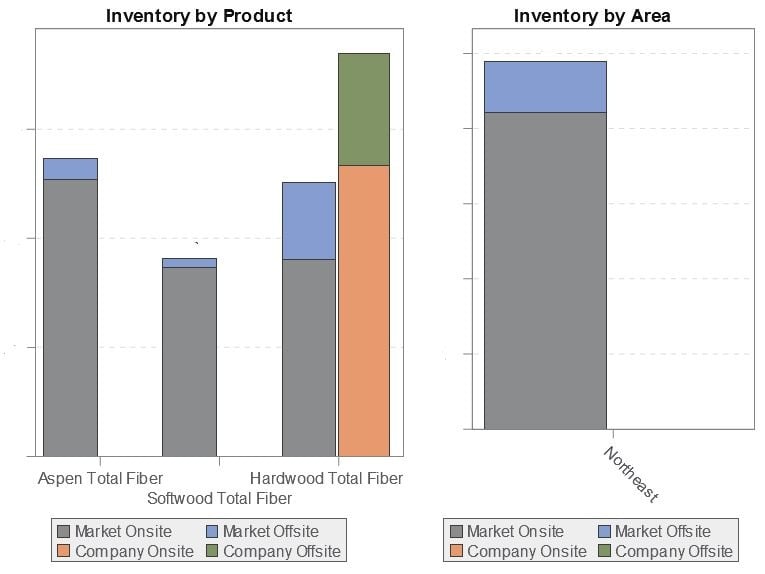

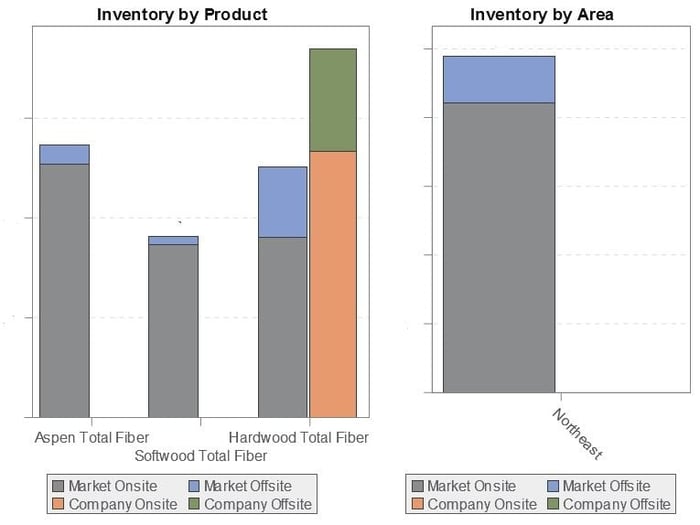

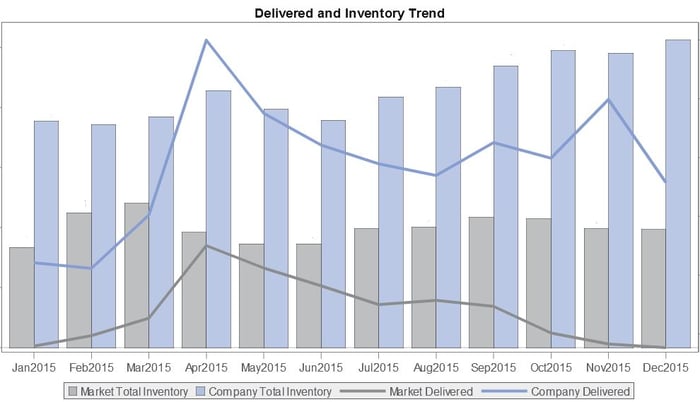

As I described in my blog post from July 2017, due to the seasonal weather extremes in Eastern North America, hardwood inventory management is key to market pricing for all fiber. To demonstrate how dynamic the business environment can be, inventories in Eastern North America rose from lows of 38 days overall (35 days hardwood) in May/June to 48 days overall (56 days hardwood) in October.

Turning this data into actionable intelligence is the critical next step to understanding how to operate during the winter months in Eastern North America. Winter logging is crucial in the region; a surge capacity is required to achieve the nearly 80 days of system-wide inventory required to make it through the spring “mud” season. It is equally important for the system to maintain a minimum of 30 days’ worth of hardwood inventory during the rest of the year so that winter surge capacity is not stressed beyond its capabilities.

Measuring this metric requires a look back at the history of inventory in the Great Lakes region, the Northeast US and Canada over the last several years and analyzing the data. Are each of these areas prepared to add 30 - 40 days of additional inventory to the system given the stresses and strains of surging deliveries in the next 60 - 90 days? Most importantly, is your mill facility positioned to add the needed inventory for your specific situation given the market conditions that exist?

Wood procurement is ultimately a combination of inventory management and risk analysis, and the right data make all the difference when managing the risks associated with supply chain costs. Forest2Market’s new business intelligence platform, SilvaStat360, brings the most relevant data into a single platform to provide on-demand insights that allow you to better manage supply chain costs by analyzing historical inventories and resulting market price trends. For forest products companies in the Great Lakes region, the Northeast US and Canada, SilvaStat360 provides market transparency to help turn this data into actionable intelligence and optimize inventories, purchases and costs based on individual risk tolerance, historical weather patterns, and mill vs. market inventories.

Raw material inventory management is often practiced by identifying a set of monthly targets that varies by month, but does not change over time. SilvaStat360 can help you make adjustments to inventory based on real-time data, which allows you to free up working capital in inventory and avoid unnecessary inventory holding costs. The dependable market data of SilvaStat360 provide valuable intelligence in a region of the world where the weather has such an impact on wood fiber accessibility and the ability of your mill facility to maintain seamless operations.