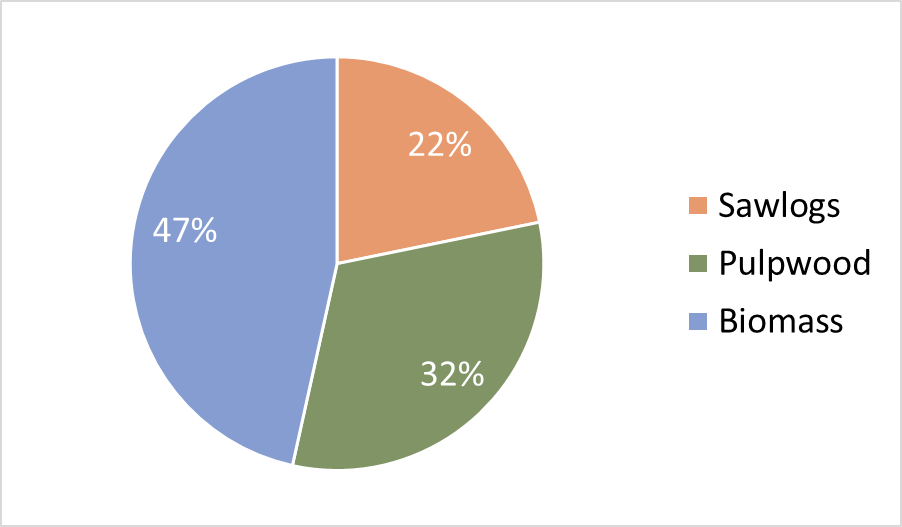

In New Hampshire, nearly half of the volume of wood harvest goes to biomass markets. With the recent veto of legislation to support some of the wood energy plants that utilize this biomass, the future of that market is in question.

With the loss of pulp markets in Maine and New Hampshire in recent years, biomass has become an increasingly important market for low-grade wood in the Granite State. Using data collected as part of New Hampshire’s timber tax, nearly half of the wood harvested goes to biomass markets[i]. Biomass has long been an important part of the mix of markets accessed by New Hampshire landowners and loggers, and the percentage may have even increased slightly in the last couple years with the loss of some pulp mills in neighboring Maine.

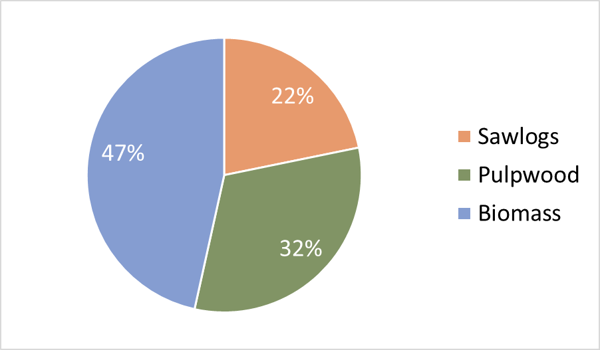

Figure 1. New Hampshire Timber Harvest, by Product Type

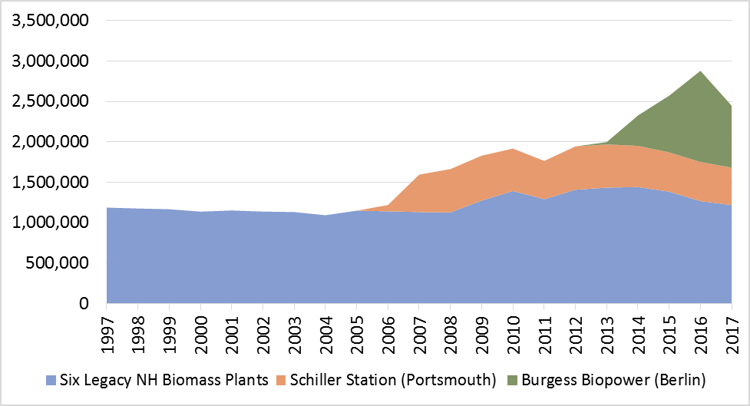

New Hampshire biomass facilities fall into a few distinct groups:

- The majority includes six “legacy” plants in the state that were built in the 1980s with a combined generation capacity of just over 100 MW; most have operated continuously over the past several decades. These facilities are located in Bethlehem, Whitefield, Bridgewater, Springfield, Tamworth, and Alexandria (idled in 2017).

- In 2006, a 50 MW coal unit at Schiller Station in Portsmouth was converted to wood. This plant—as well as several fossil fuel power plants—was recently sold to Granite Shore Power as part of a legislatively mandated divesture of generation assets by the utility Eversource (formerly PSNH). As a condition of sale, this facility is expected to operate for at least a year; continued operations after that will depend upon market conditions.

- In 2013, operations began at Burgess Biopower, a 75 MW power plant in Berlin, NH built at the site of a former pulp mill.

Combined, these biomass electric plants used roughly 2.5 million green tons of biomass in 2017. Most of this came from forestry operations, but some was sawmill residuals that provide an important outlet as these mills capture the opportunity of currently strong lumber markets.

Figure 2. Annual Biomass Fuel Use, New Hampshire

Biomass power plants in New England are struggling to operate. With wholesale electricity prices falling, the revenue from selling power isn’t enough to offset the cost of wood fuel and operations. Recognizing how important these markets are to landowners, loggers and the entire forest industry value chain, the New Hampshire legislature this year passed two bills to support continued operations of these power plants:

- Senate Bill 577 provided a three-year extension to an existing power purchase agreement (PPA) between Burgess Biopower NH and Eversource, the state’s largest utility. The rates paid in this PPA are well above current market rates and are expected to allow the plant, a market for about 800,000 green tons annually, to continue operations for at least three more years. New Hampshire Governor Sununu signed this bill into law.

- Senate Bill 365 sought to support the state’s six legacy biomass plants, which use a combined 1.2 million green tons of wood fuel annually. This legislation requires the state’s utilities to offer the legacy biomass plants PPAs at a formulaic price, above wholesale but below retail. This bill passed with strong majorities in both the NH House and Senate, but was vetoed by Governor Sununu in June. Legislators will have an opportunity to override this veto when they meet in September. In the interim, at least three plants have stopped buying wood, and are expected to shut down in the coming weeks.

Biomass has long been a part of New Hampshire’s forest industry, and its importance has grown as pulp mills in the state and region have closed. At the same time, plummeting wholesale electricity prices have left some plants unable to compete in the market. How these issues are reconciled in the near term will shape the forest industry and forest management in New Hampshire for years to come.

[i] This data is for Tax Year 2015, the most recent data publicly available.