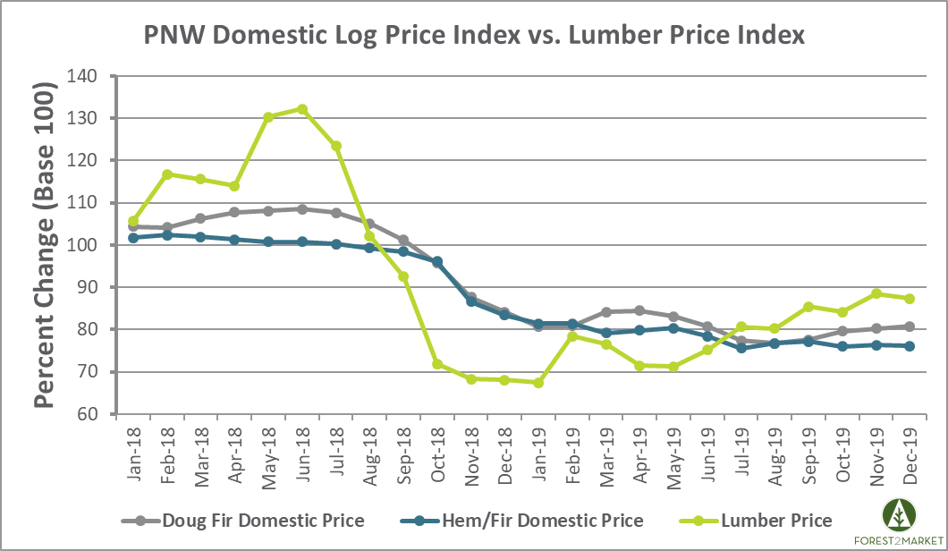

As Forest2Market data has confirmed over the last several years, log and lumber prices in the Pacific Northwest (PNW) can often result in a significant disconnect. When North American lumber prices peaked in tandem with log prices in 2Q2018, lumber prices then corrected course and plunged for five straight months before hitting a floor in December 2018. Only recently have log prices found some sense of equilibrium in the wake of the crash.

The sharp correction was detrimental to many producers in the PNW and especially in British Columbia (BC), who were forced to curtail production or shutter operations altogether over the last year.

How is the regional PNW market changing as we begin a new decade?

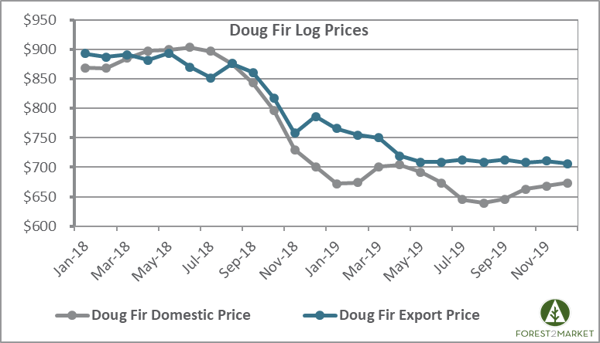

Log Prices

Since December 2018—when Doug Fir log export prices diverged significantly from the downward slide of domestic prices and jumped nearly $30/MBF—export prices have maintained a markedly higher price compared to domestic logs, suggesting there is some degree of softness in the domestic market. However, with increased trade fears, a coronavirus outbreak and worries over the future of China’s economy, export prices have recently tapered off while domestic prices have crept up.

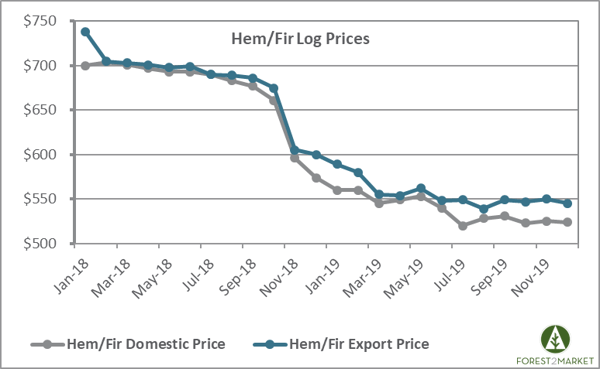

Unlike Doug fir, prices for Hem/fir began retreating in 1Q2018 and they have trended downward ever since; in December 2018, export and domestic prices demonstrated just a $9/MBF variance. Like Doug fir export prices, export Hem/Fir log prices have also tapered recently and are tracking just slightly higher than domestic logs.

Near-Term Outlook

Despite wild volatility and record high log pricing during most of 2018, a rebalancing of the log/lumber market has largely taken place in the PNW. There are few key dynamics to watch as we progress into 2020 and a new decade.

- Despite slight increases in PNW lumber prices, log prices have yet to react significantly. However, the current situation favors PNW producers much more than it did from 9/18 – 6/19. This is welcomed news for producers in the region, which provides an opportunity to improve margins after two challenging years.

- The recent announcement that US tariffs on Canadian lumber shipments may be reduced later this year should signal some increase in export volumes to the US. As CTV News recently noted, “In a report on Monday, CIBC analyst Hamir Patel suggested average U.S. duties would drop from about US$67 per thousand board feet to about US$30 based on current pricing levels of about US$400.” That said, BC lumber production has contracted considerably since 2019.

- Despite the announcement of a Phase 1 trade deal with China, PNW log export volumes and prices are flat to declining. The economies of both China and Japan are slowing, and the current Coronavirus situation will likely have further short-term impacts on Asian economies. In addition, the European log market, which is flooded with salvaged wood due to significant mortality from a beetle infestation, has become the largest supplier of softwood logs to China… at least for the near term. As a result, more regional log supply should remain in the US domestic market, resulting in lower log prices for regional sawmillers.

- Housing starts skyrocketed to a 13-year high in December as privately-owned housing starts were up 16.9 percent to a seasonally adjusted annual rate (SAAR) of 1.608 million units. Homebuilder sentiment soared over the course of 2019 and jumped in December to a 20-year high amid stronger sales and a surge in foot traffic from prospective buyers. With very low interest rates and a booming economy, the housing market is poised for growth in 2020.

The regional sawmilling industry in the PNW has gotten some much-needed relief to kick off the new year. If the housing market continues to perform, regional producers are well positioned to capitalize on the increase in demand while improving their margins after a challenging two years.