2 min read

Post-Recession Disparity between Coastal and Piedmont Stumpage Prices

Joe Clark

:

May 1, 2014

Joe Clark

:

May 1, 2014

The main reason for this divergence in pine pulpwood and chip-n-saw prices is mill competition in the Coastal region. Pulp mills need to maintain a minimum volume of wood to remain operating at full capacity. When wood is in short supply, the process of ramping down manufacturing or temporarily shutting down a mill entirely is much less desirable and cost effective than paying high prices for stumpage to keep the mill running.

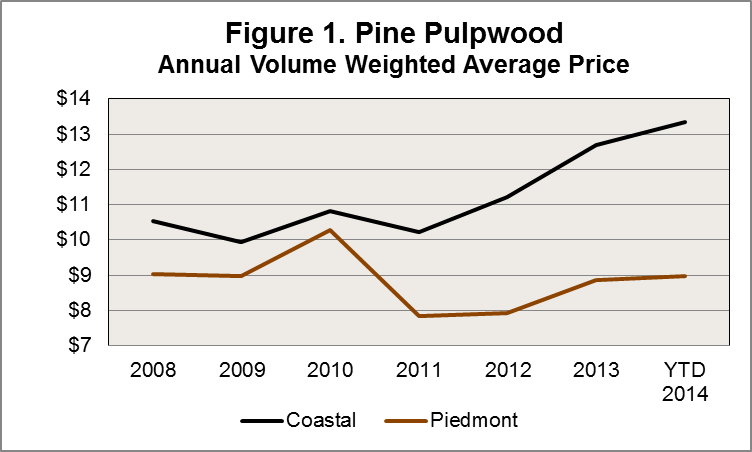

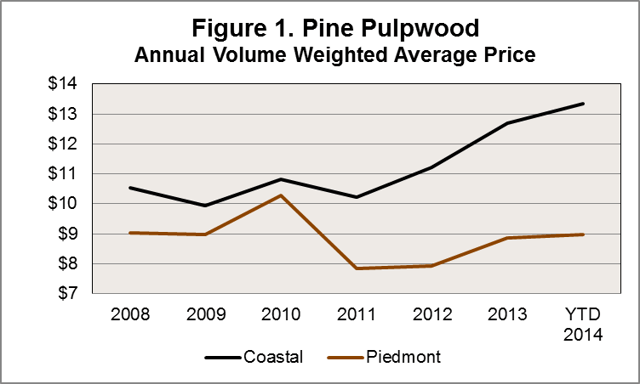

Mills in the Coastal region are paying a much higher price for pine pulpwood (Figure 1). In this area, many mills are competing with each other. Most of them are forced to pay a premium for pulpwood to retain adequate volumes of wood for their manufacturing processes. We have also seen a surge in the biofuels industry in the southeastern U.S. Biomass plants opening--mainly in the Coastal region--compete with traditional pulp mills for pulpwood material. Both tend to gravitate toward Coastal areas for access to ports and, in the case of pulp mills, ample water supply. These new plants have driven demand higher, placing even more pressure on supply. In the Piedmont region, by contrast, fewer mills and bioenergy facilities compete for pulpwood supply; less competition in this region leads to lower demand and prices.

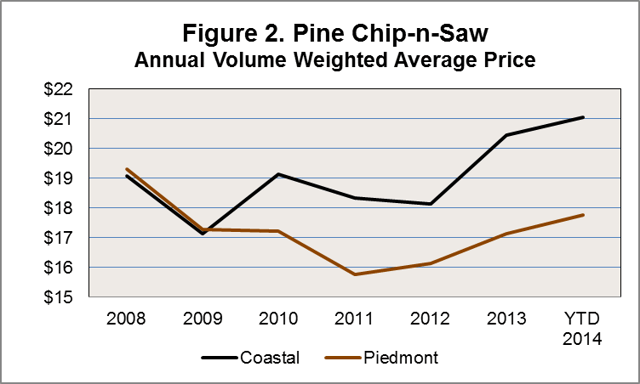

The price disparity can also be seen in pine chip-n-saw (Figure 2). The difference in chip-n-saw prices, however, can be explained as more of a “ripple effect” from the pulpwood demand. When demand for tracts containing pulpwood is high and supply is low, mills will begin to “reach up” and purchase tracts that contain chip-n-saw material to use for pulp. Mills turn to these chip-n-saw tracts to maintain their wood volume levels and stay operational. This extra competition/demand in the chip-n-saw market has the same effect that it has in the pulpwood market in the Coastal region: higher prices.

To date in 2014, this trend in pine pulpwood and chip-n-saw pricing seems to be continuing. Now, however, the contrast created by higher demand in the Coastal region is being augmented by the extremely wet winter the entire region has experienced in late 2013 and early 2014.

Comments

05-05-2014

Have you broken down these broad classification into regional comparison? Ex. Atlantic Coastal vs Atlantic Piedmont.Would be very interesting.

Comments

05-07-2014

No, I have not drilled down these classifications into more specific categories, though I do agree with you that it would be interesting to compare more specific areas. That may be something we can look into in the future with a follow up to this blog.

Comments

05-22-2014

Doesn’t distance to market and increased logging cost in the Piedmont influence this disparity? I would think in most cases….