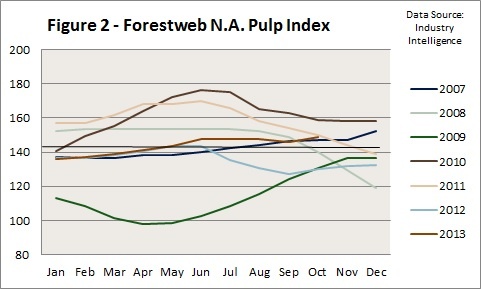

The obvious question is “Are we at the point of repeating the market performance of 2010 or 2011?” If we could provide a definitive answer to this question, we would be trading futures rather than remaining objective market observers. However, to our eyes, there is the potential for 2014 to be a reasonably strong year for pulp prices. We tend to place some credence in the axiom that the past can be a good indication of the future – assuming no material dislocations occur.

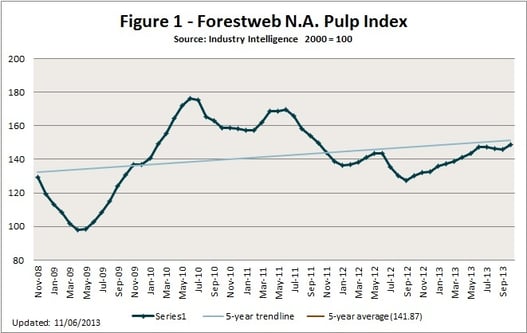

The price line has been on a positive trend relative to the 5 year average since August 2012. For the last several months, the price and trendline have been essentially the same line. In March, prices edged above trendline. If we look back in history, the first quarter of 2014 falls somewhat between the 2010 and 2011 lines in the second chart. It will be interesting to see the April data point. Our thoughts are that the curve will be closer to the shape of the green 2011 curve than the dark orange 2010 curve. The dampening of large monthly fluctuations over the last 20 months combined with the relative stability of the overall North American economy lead us to this belief.

As with any outlook, time will tell how right or wrong we are. Tell us what you think.