2 min read

Regional Wood Fiber Costs vs. Oil Prices: Is there a Correlation?

Pete Coutu

:

July 10, 2019

Pete Coutu

:

July 10, 2019

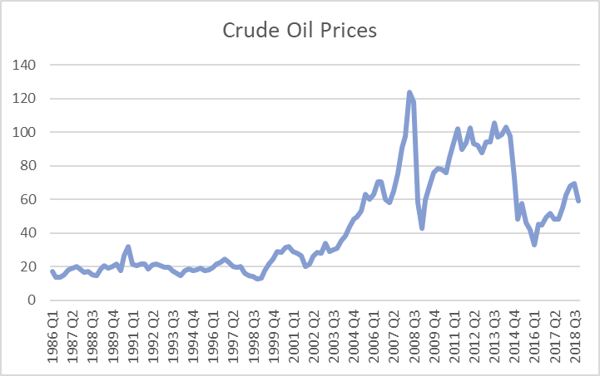

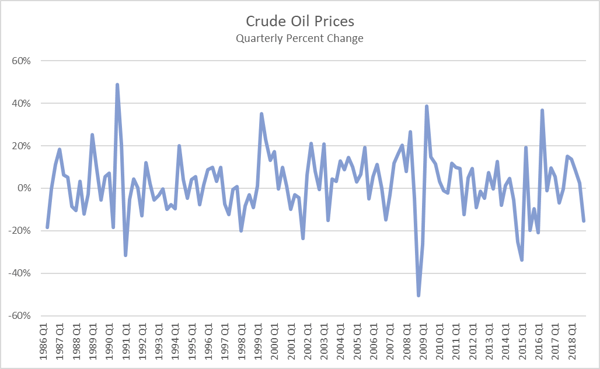

In my first installment on the topic of oil price volatility and its impact on delivered wood costs, I showed the drastic changes in oil price—dramatic peaks and valleys when displayed in chart form—that began in 2005. However, upon closer inspection, the data actually show that while crude oil prices are significantly higher from roughly 2005 onward, price volatility and the percent change in price has been fairly constant since the mid-1980s.

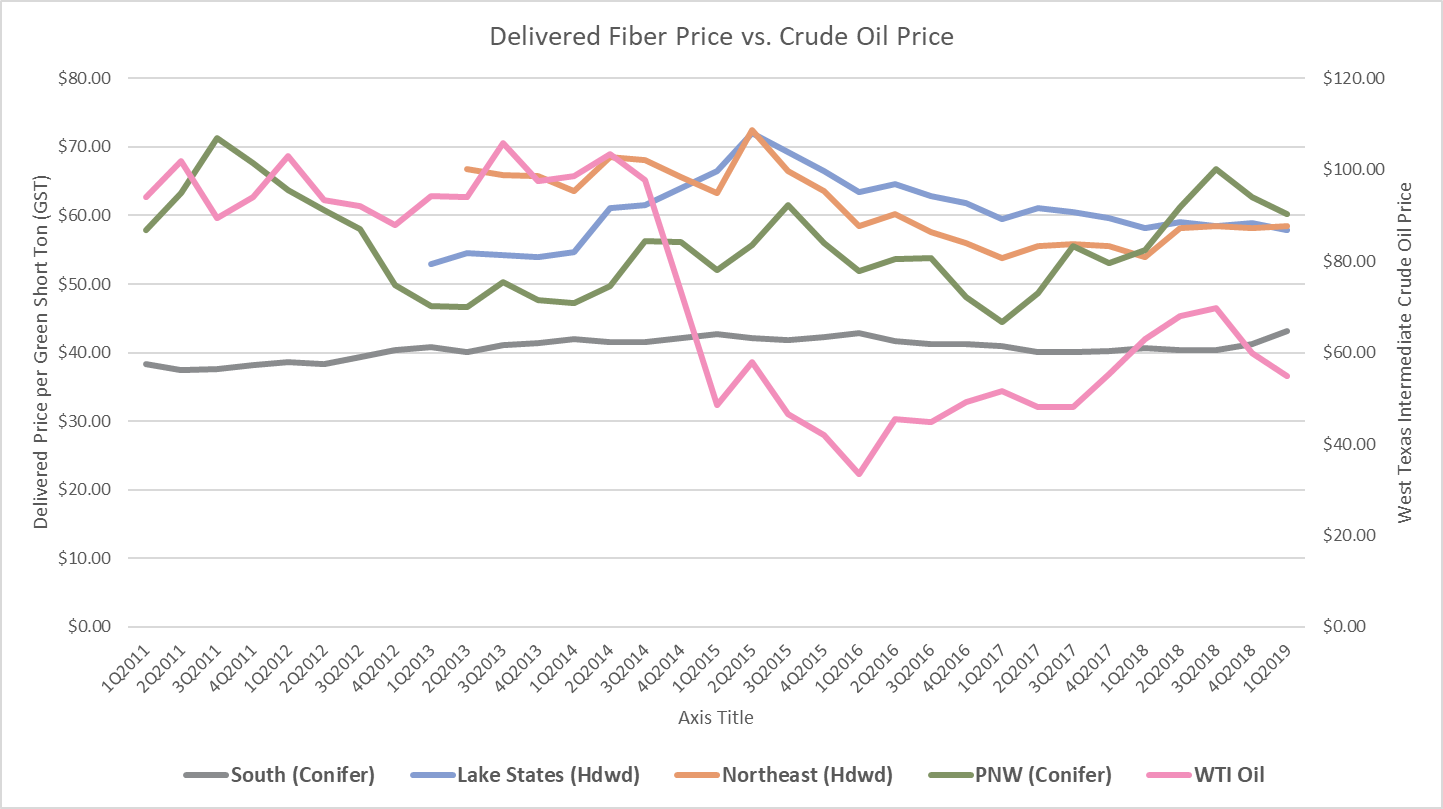

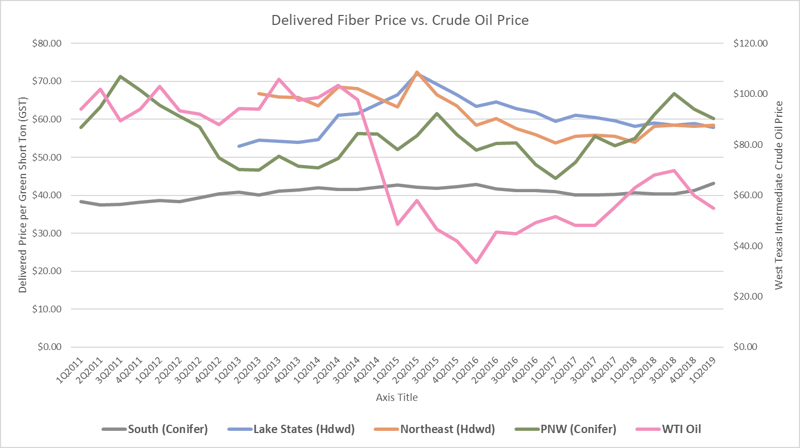

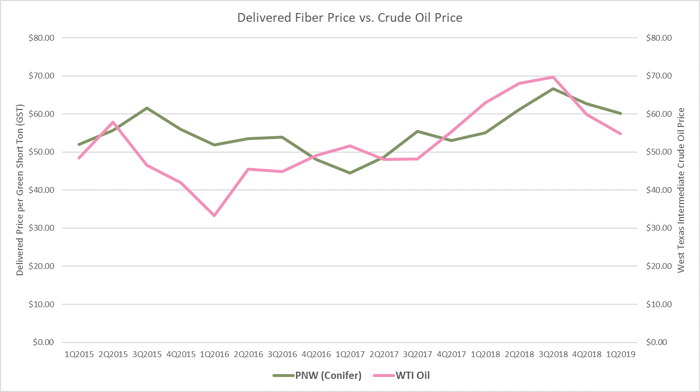

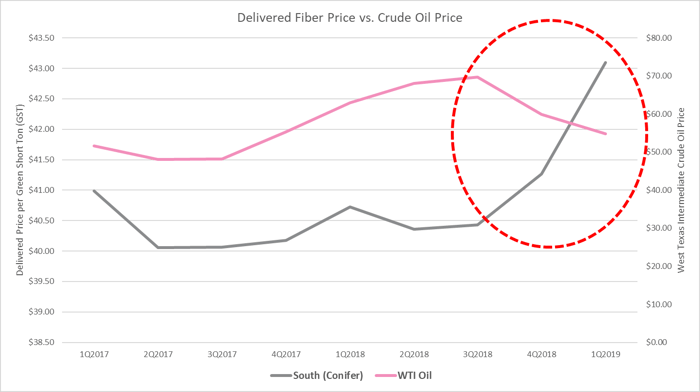

In his popular blog post published in early 2015, Daniel Stuber demonstrated that other factors, including weather, demand and inflation, exerted more influence on delivered fiber prices than oil and diesel prices. Four years later, the regional delivered price trends are quite different, but his hypothesis remains true. In the chart below, note the diverging and independent trends between regional delivered fiber prices and West Texas Intermediate crude oil price.

Now, note the tremendous drop in oil price during the latter half of 2014 and into 1Q2015, when prices plunged by roughly 50 percent. While there was some erratic regional delivered price behavior following that drop (except for the South), prices in the Lake States and the Northeast largely leveled off thereafter. Two interesting dynamics are worth noting, however:

- With the exception of 2016, oil prices and delivered fiber prices in the PNW have tracked pretty closely since 2015. Market demand and supply constraints for PNW sawlogs are the primary driver for price in the region and, unlike the US South, timber supply is constrained. Unlike markets where the timber supply is expanding and prices can adjust downward as supply outpaces demand, the PNW timber supply is tightly matched to lumber and panel production requirements. This limits sawmill expansions and caps residual production to a finite volume.

However, diesel costs are an important component of harvesting and trucking costs. A 2011 Wood Supply Research Institute (WSRI) study showed that fuel, consumables and trucking comprised 30% of logging costs in the Western US.

- Delivered prices in the US South have been remarkably flat since 2011, with very little fluctuation either way despite wild oil price volatility. However, notice the diverging trend beginning in 3Q2018; oil prices have declined sharply since then, but delivered prices have skyrocketed at a greater rate than at any time during the last nine years. This is likely a timing coincidence, as the South was inundated with heavy rainfall during that same period, which interrupted harvesting operations. Despite the relative high price of southern timber in 1Q2019, we look for prices to correct downward through 3Q.

What can this data tell us about how fuel prices impact the wood fiber supply chain? While there has been some interesting interaction between fiber prices and oil prices in the PNW over the last several years, the supply and demand of logs and wood fiber is ultimately what drives the price of these products on the market, which is always independent of fuel price. However, the cost of producing the logs and fiber is not independent of fuel price, or the price of any other factor that goes into generating these products; at some level, steel, labor, tires, etc. all affect the cost of producing logs and fiber. The interplay of these shifting factors eventually impacts supplier margins.

Can we say with 100 percent assurance that oil prices will never affect delivered fiber prices? In the wood business, it’s a wise policy to “never say never.” Unlike many global markets, the US is accustomed to cheap oil prices; diesel is currently around $3.10 per gallon. Should oil and diesel prices hit levels seen in some other markets—diesel is currently $6.40 per gallon in Sweden and Finland, both of which have robust forest economies—the increase in cost would certainly impact the supply chain.

In the absence of some economic situation that would result in pump diesel price hitting two or three times its current US level, there is simply no significant correlation between oil price and delivered wood fiber prices. However, there are always savings opportunities in the forest supply chain. Identifying these opportunities with Forest2Market’s transaction-based data leads to business improvements that drive profitability.