4 min read

Renewable Biomass Offers Numerous Benefits for Hydrogen Producers

Larry Sullivan

:

August 25, 2021

Larry Sullivan

:

August 25, 2021

The Belgium-based Hydrogen Council, which advocates for increased hydrogen use, recently reported that global investment in hydrogen projects will total $500 billion through 2030. Why the resurgent interest in this technology, and what is driving demand?

As I noted in my previous post on this topic, climate/carbon emissions, circular economics, Environmental, Social, and Corporate Governance (ESG) policies, waste reductions, etc. are now part of a “social license to operate” that is being driven by the market, not legislation. The pressure behind corporate responsibility is now being applied via the finance sector, which has always had the ability to influence behavior at the corporate level.

“Nearly everything has doubled already this year in the world of clean hydrogen, and we expect the momentum to continue in the months ahead,” said Martin Tengler, lead hydrogen analyst at BloombergNEF. “More than 40 countries have now published a hydrogen strategy or are developing one. More than 90 projects are being planned worldwide to use bio based or renewable hydrogen in industry.”

Surging demand for clean vehicles and the rising use of liquid hydrogen in manufacturing – which is widely used in the production of petrochemicals, LEDs, displays, solar panels and semiconductors – will be big drivers of market growth during this decade. But innovations in hydrogen technology are poised to span multiple segments that will help fuel a greener economy. Tengler added that “Electricity generators have almost doubled their planned hydrogen-fired turbine capacity since January.”

Roughly 70 million metric tons of hydrogen are currently produced globally. That number is poised to skyrocket, as big players in global energy are making first moves in the hydrogen space:

- Shell recently constructed a new green (electrolysis) hydrogen plant at its Energy and Chemicals Park in Rheinland, Germany, which will use renewable electricity to produce up to 1,300 tons of green hydrogen a year. Shell has also partnered with EDF Renewables to build a wind farm off the coast of New Jersey, which will power a 5–10-megawatt electrolysis facility.

- Panasonic Corporation is converting a fuel-cell factory in Kusatsu, Japan into a hydrogen-based plant powered entirely by renewable energy. The company plans to commercialize the system by 2023 and sell it globally.

- A new agreement between Shanghai Electric and Shell China will provide a boost to hydrogen adoption in the country, as the two parties are expected to introduce domestic and foreign hydrogen energy planning to support China’s clean energy growth.

Closer to home in the US South, the Atlanta Business Chronicle recently noted that Georgia is home to some exciting new hydrogen projects including industrial equipment maker Chart Industries Inc., New York-based Plug Power Inc., and energy titan Southern Company.

Despite these promising developments, technological challenges remain to make hydrogen competitive with rival energy sources. Green hydrogen that is made from renewable energy “costs between $2.50 and $4.50 a kilogram and that price is unlikely to fall to the $1 a kilogram it takes to make the gas using fossil fuels before 2030, according to BloombergNEF.”

Addressing Economic Challenges of Green Hydrogen

Wood Mackenzie notes that “Green hydrogen’s economics are particularly sensitive to two factors – power prices and plant utilisation rates. The economics only work on what are unrealistic assumptions today – high load factors (more than 50%) and low electricity prices (below US$30/MWh). But, right now, a green hydrogen plant paired with a renewable source could expect load factors nearer 20%; typically, power purchase agreement prices for renewables are nearer to US$50/MWh globally.”

Cost reductions schemes are in development, and Wood Mackenzie adds “…we expect capex to fall by one-third by 2030, especially as the manufacturing process for electrolysers moves to automation, unit feedstock costs reduce by 5% and electrolyser efficiency improves by 8%.”

However, the largest driver will be via policy and corporate behaviors influenced by social desire for more sustainable energies, which “means investment in R&D, improvements in technology, pilot projects with industrial users and adapting to changing power markets as renewables penetration increases. Carbon pricing will be key – we estimate a carbon price of US$40/tonne in 2030 could get green hydrogen on a level with SMR-produced hydrogen paired with CCS.”

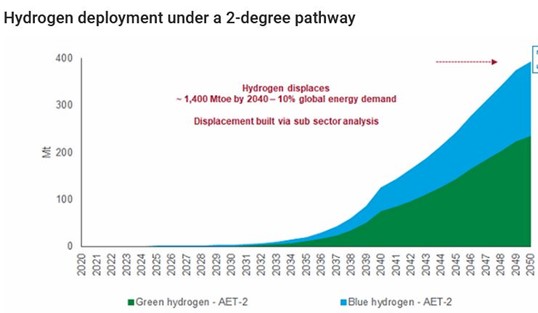

Source: Wood Mackenzie

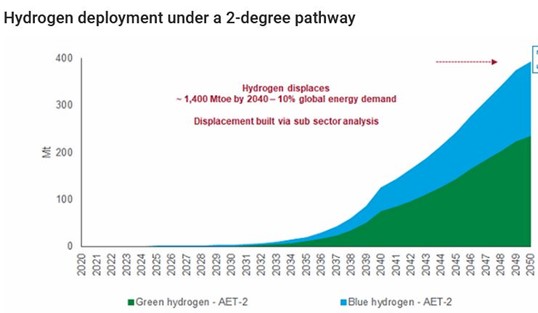

Source: Wood Mackenzie

Natural Leaders & Green Solutions

Based on existing distribution systems, infrastructures, supply chain proficiencies and access to capital, the most successful developers of hydrogen are currently 1) large oil refiners that understand hydrogen and its uses who can work in tandem with 2), a second tier of entrepreneurial developers who understand the urgency of new fuels. Right now, these oil companies are best positioned to be the “market makers” based on their fully integrated supply chains, as evidenced by Shell’s commitment that is noted above.

As the segment continues to expand, global wood resources will have an important role to play as a renewable feedstock in the production of green and blue hydrogen – especially for oil/gas players – for two primary reasons:

- Abundant wood fiber exists in the US South in the backyards of many existing oil and gas refinery complexes. This would be a natural feedstock of choice since wood-to-energy technology is proven and price volatility is minimal; incorporating biomass into the supply allows for the production of low-cost blue hydrogen.

- Currently, Europe’s largest single source of renewable energy is sustainable biomass, which is a cornerstone of the EU’s low-carbon energy transition. For the last decade, forest resources in the US Southeast have helped to meet existing goals. This heavily forested region exported over 7 million metric tons of sustainable biomass to the EU and UK in 2020, and it has the capacity and existing supply chains to sustainably increase its production to serve other innovative markets for wood.

Sustainable Biomass is Plentiful

There are five principles that define sustainable biomass, how it supports forest growth in the US Southeast, and how it can contribute to green and blue hydrogen production:

- Sustainable biomass is sourced from forests where forest inventory and carbon stocks are stable or increasing. Steady increases in forest inventory mean emissions from biomass are quickly sequestered by the continually growing forest landscape from which it is sourced.

- In the US, sustainable biomass represents a tiny fraction of the forest products industry. Each year, only 4% of the forest is harvested in this region leaving the remaining 96% to keep growing. Of that 4% that is harvested, roughly 3% is used for biomass.

- Forest tracts in the US Southeast are not harvested for biomass. Wood from a single tract of land typically supplies multiple markets, including sawmills, solid wood products, pulp and paper, among others.

- Sustainable biomass is produced from low-value wood that is created as a byproduct of a traditional timber harvest. Forest tracts are typically managed for high-value sawtimber, which generate the most revenue for landowners. Some trees (namely “pulpwood”) that do not meet the specifications for sawtimber are cascaded for use as biomass, which is in keeping with the principle of using wood fiber for its greatest climate benefit.

- Biomass is a small market but helps forest owners keep planting trees. Private citizens own 86% of the forestland in the US Southeast. Strong demand for forest products, like biomass, incentivize landowners to continue the cycle of planting and harvesting, versus converting their forestland to other, more lucrative uses. This demand helps landowners preserve and manage their forest to promote wildlife and biodiversity in the region.

Hydrogen energy production is going to continue to increase because climate change pressures are driving it. The broader deployment will be directed, at a minimum, by social license to operate and (hopefully) by sound policy as an enhancement; enabling a complementary range of existing renewable resources that includes sustainable biomass will help us reach climate goals faster. And to help get us there, thousands of timberland owners throughout the US South stand ready to supply their renewable timber resources.