Total US housing starts inched down in September as the multi-family segment faltered and the single-family sector continued to struggle with availability, affordability, and building materials challenges. NAHB wrote, "Building material price increases and bottlenecks persist and interest rates are expected to rise in coming months as the Fed begins to taper its purchase of U.S. Treasuries and mortgage-backed debt."

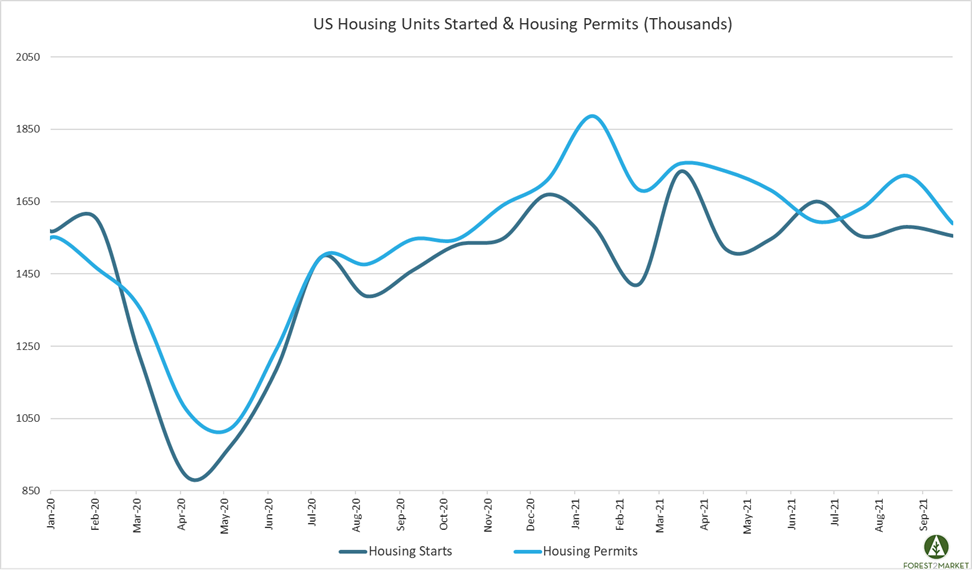

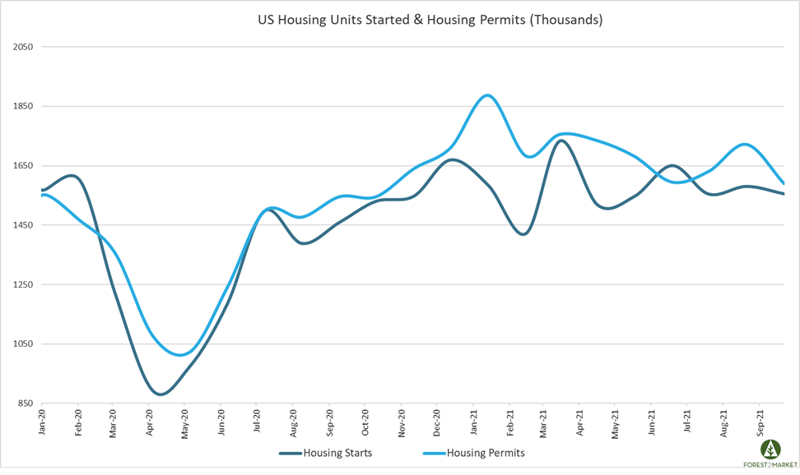

Housing Starts, Permits & Completions

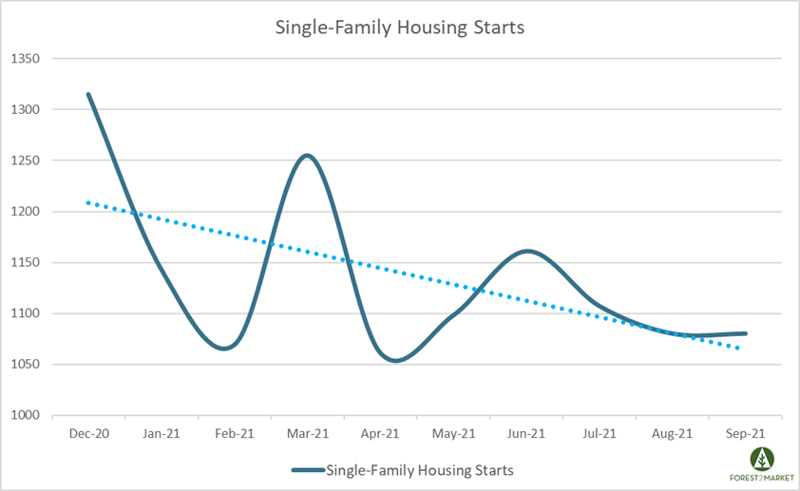

Privately-owned housing starts decreased 1.6 percent in September to a seasonally adjusted annual rate (SAAR) of 1.555 million units. Single-family starts were virtually unchanged at a rate of 1.080 million units. Starts for the volatile multi-family segment dropped 5 percent to a rate of 475,000 units in September.

Privately-owned housing authorizations were down 7.7 percent to a rate of 1.589 million units in September, and single-family authorizations were down 0.9 percent to a pace of 1.041 million units. Privately-owned housing completions dropped 4.6 percent to a SAAR of 1.240 million units. Per the US Census Bureau Report, seasonally-adjusted MoM total housing starts by region included:

- Northeast: -27.3 percent (+167 percent last month)

- South: -6.3 percent (+1.4 percent last month)

- Midwest: +6.9 percent (+11.4 percent last month)

- West: +19.3 percent (-21.1 percent last month)

Seasonally-adjusted MoM single-family housing starts by region included:

- Northeast: -1.5 percent (+52.4 percent last month)

- South: -6.6 percent (+2.5 percent last month)

- Midwest: +7.0 percent -12.5 percent last month)

- West: +17.8 percent (-20.5 percent last month)

The 30-year fixed mortgage rate inched up in September from 2.84 to 2.90, and the NAHB/Wells Fargo Housing Market Index (HMI) increased four points in mid-October to 80.

Market Trends

George Ratiu, senior economist at Realtor.com, says that remote work and other pandemic-induced adaptations are changing the market.

"The transition to remote work that began during the pandemic is maturing into the preferred long-term employment arrangement for the majority of Americans. This shift is also changing homebuyer preferences, with larger homes, quieter suburban neighborhoods, and access to the outdoors high on the list of must-haves. For builders, the biggest challenge remains building enough homes with these features at affordable prices. Meeting this challenge will become even more imperative as we expect mortgage rates to continue rising into 2022, squeezing potential buyers' budgets with higher financing costs."

Per fresh housing market insights published in our most recent issue of the Economic Outlook, National Association of Realtors’ Lawrence Yun thinks the housing sector may be settling down, citing indications of cooling competition. For example, 23 percent of buyers waived a home inspection in August, down from 27 percent in July, and the average number of offers fell to 3.81, from 4.5. Alternatively, that cooling may be a symptom of people having “essentially given up on buying at these higher prices because they are priced out,” Yun said.

Another sign housing may be settling down is that resale prices have begun to revert to the seasonality of more typical markets instead of blowing through seasonal patterns as they did during the frenzy in 2020. “Reverting to seasonality is the first step back from craziness toward what is now called ‘normalization’ or ‘deceleration,’” wrote analyst Wolf Richter.

Looking more specifically at the single-family metric, after bottoming during the peak of the pandemic lockdowns in April 2020, single-family starts bounced back quickly before cresting in December. Since then, however, single-family starts have been on a volatile downward trend as illustrated in the chart below.

Moving forward, risks remain to the housing sector. E.g., it is unclear what impact the Fed’s tapering of mortgage backed securities will have; also, whether the long-awaited tsunami of evictions will finally arrive.

All in all, “the nation’s homebuilders are finding ways to defy expectations, keep their pipelines moving and put up more homes,” Zillow’s Matthew Speakman observed. “It’s not all perfect, and some creativity is being shown by builders to keep things moving. These choppy waters are unlikely to calm anytime soon, but builders are continuing to find ways to stay afloat.”