3 min read

South Arkansas/North Louisiana Timber Market Offers Operating Advantages

Pete Coutu

:

February 12, 2018

Pete Coutu

:

February 12, 2018

Why is it important that wood consumers know who owns the forests that will ultimately supply them with timber? Because wood-consuming facilities must have a mixture of supply chain strategies to minimize risk and manage costs. The distribution of forest ownership varies greatly between regions in the US and for a wood-consuming business, the ownership dynamic affects access to reliable sources of timber, price, seasonal availability and long-term forecasting.

Most timberland is privately-owned and managed in the US South, which makes it an attractive destination for wood-consuming industries of all kinds. As we noted in our October announcement of Forest2Market’s South Arkansas/North Louisiana timber market forecast, landowners and investors in this region have been waiting for a market turnaround. There have been modest gains over the last five years, but the region’s timberland ownership profile suggests that there is lots of untapped potential.

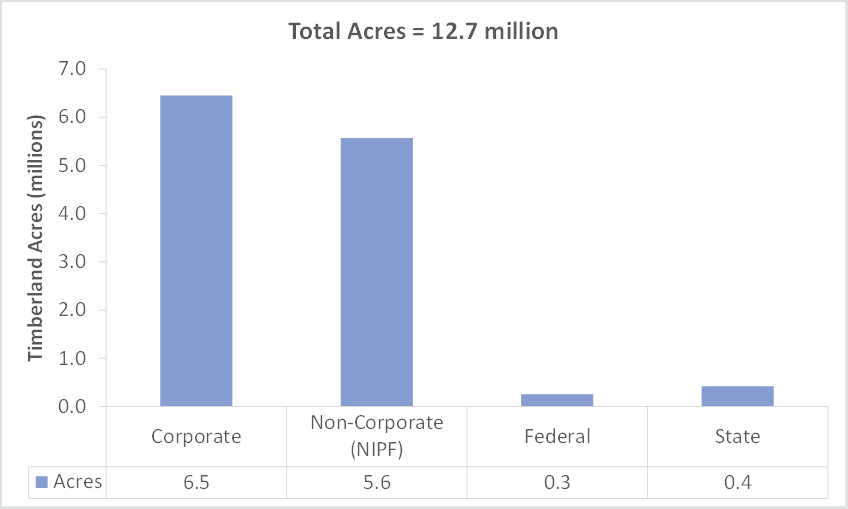

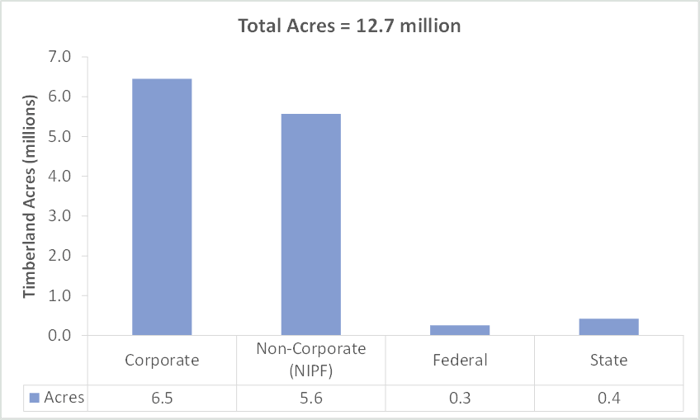

Of the 12.7 million total timberland acres in the South Arkansas/North Louisiana region, 6.5 million acres (51%) are owned by corporate owners consisting primarily of Timberland Investment Management Organizations (TIMOs) and Real Estate Investment Trusts (REITs). Non-corporate or non-industrial private forest (NIPF) owners are the second largest group comprising 5.6 million acres (44%). The remaining acreage—roughly 0.7 million acres—is owned by the federal or state governments.

Timberland Ownership Types: Advantages & Challenges for Wood Consumers

- TIMOs are private companies that manage timber for pension funds and/or trusts where the fund or trust is the actual landowner. Typically, the timberland is purchased with a finite investment period ending when the fund will be closed. While TIMOs are concentrated on timber cash flow to a certain degree, the larger goal is to maximize the exit valuation of the timberland.

- Advantage: TIMOs are reluctant to add management costs to the business and, therefore, sell timber on a stumpage rather than a delivered basis. This creates a savings opportunity for savvy supply chain managers.

- Challenge: Any wood-consuming facility that buys timber from a TIMO will likely need to manage harvesting and hauling contracts themselves.

- REITs are generally publicly-traded companies that focus on earnings for their shareholders; cost controls, cash flow and timber sale maximization are essential to their bottom line. As a result, REITs are highly focused on marketing and turnkey services that include harvesting and delivering timber.

- Advantage: Managing harvesting and hauling contracts is the norm for REITs, saving wood consumer the added time and costs associated with handling these tasks individually.

- Challenge: Delivered wood comes at a cost; since REITs absorb all the cost components of managing the timber supply chain, wood prices may be high and unsustainable.

- NIPF landowners include all of the private landowners in the wood basin—individuals that may own anywhere from a dozen acres to thousands of acres. Since this is a highly fragmented ownership group, a network of wood brokers operates to “market” the wood from these individual tracts of land. They purchase the rights to the timber on a stumpage basis, contract the harvest and deliver it to area facilities.

- Advantage: NIPF owners generally have a steady availability of timber and are oftentimes more willing to negotiate stumpage prices.

- Challenge: A highly-fragmented land base can be challenging to manage, access and source timber from. As is the case with TIMOs, any wood-consuming facility that buys timber from an NIPF owner will need to contract with a broker to harvest and haul the timber from the property.

The distribution of timberland acres between corporate and NIPF ownership in South Arkansas and North Louisiana is slightly atypical for the US South region as a whole. In the broader South, NIPF landownership makes up approximately 56% of all ownership types, whereas corporate landownership is much lower at just 33%. However, in the South Arkansas and North Louisiana market, corporate ownership represents a greater percentage (51%).

The prevalence of corporate timber in the area is a benefit for existing wood-consuming facilities, and could be a draw for new potential projects. The high concentration of corporate-owned timber is a boon in terms of the market’s ability to quickly react to economic signals; these owners manage their resources to maximize economic value (asset value, cash flow and internal rate of return).

For wood consumers, sourcing supply from a handful of corporate owners rather than a large group of fragmented NIPF landowners can consolidate their supply chains, decrease operating costs and improve profits. With access to millions of acres of fast-growing pine in all age classes, these combined market dynamics make the South Arkansas and North Louisiana region an attractive destination for members of the modern forest products industry.