Timber prices in the US South during 4Q2018 were mixed. Pine pulpwood products decreased significantly while hardwood pulpwood products increased at nearly the same rate. Prices for pine log products increased, and the overall general trend of timber prices was up (+0.9 percent) in 4Q2018.

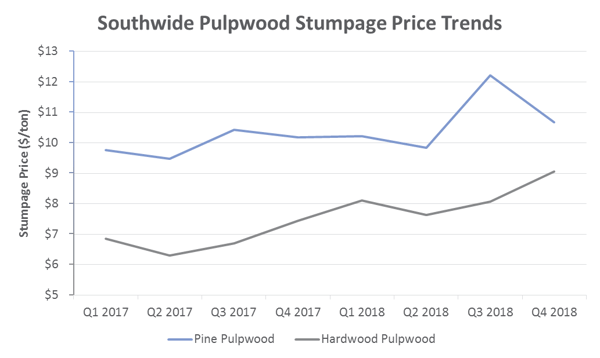

Pulpwood

On a Southwide basis, pine pulpwood prices dropped -12.6 percent to $10.68/ton in 4Q2018 despite the fact that one out of three regions saw prices increase. The Mid-South experienced the largest decrease of -11.0 percent to $8.07/ton, and the East-South dropped -0.7 percent to $15.45/ton. However, the West-South showed a significant increase in price of +21.2 percent to $9.41/ton.

On a Southwide basis, hardwood pulpwood prices increased +12.2 percent during 4Q to $9.05/ton. The Mid-South region experienced the largest increase of +13.3 percent to $11.35/ton; the West-South jumped +10.1 percent to $10.74/ton, and the East-South rose by +0.4 percent to $4.44/ton.

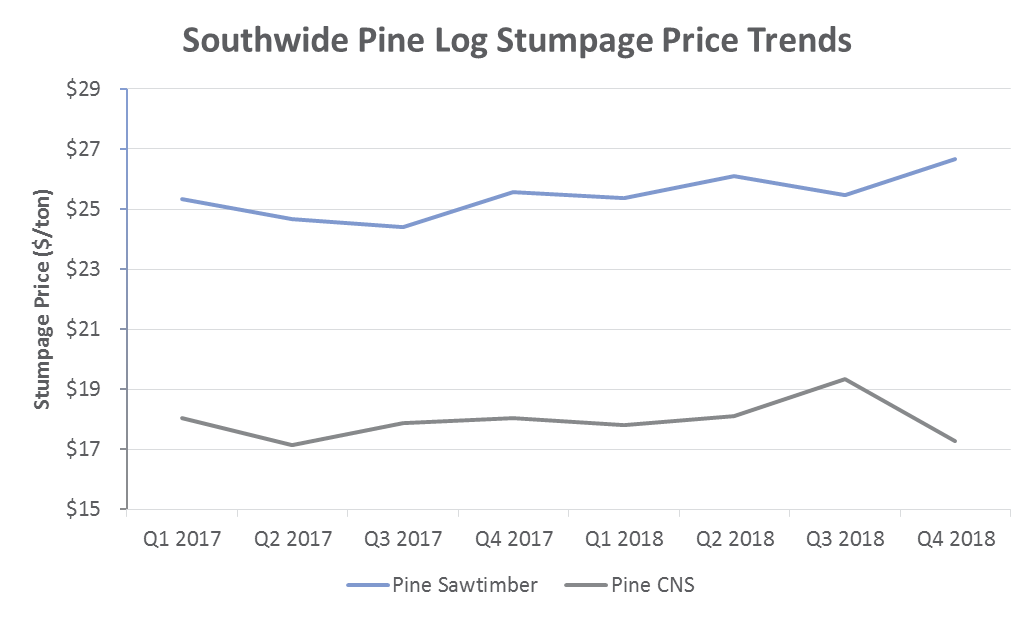

Pine Logs

Pine chip-n-saw (CNS) prices saw a significant decrease to $17.26/ton, a drop of -10.7 percent Southwide. The Mid-South and East-South regions experienced a decrease, as prices fell -7.8 percent to $15.91/ton and -8.0 percent to $20.36/ton, respectively. Prices in the West-South region rose considerably to $14.85/ton, a +24.9 percent increase.

Pine sawtimber prices increased +4.7 percent to an average of $26.68/ton on a Southwide basis; all three regions saw increases in price. The Mid-South rose +2.1 percent to $25.12/ton, the East-South ticked up slightly by +0.2 percent to $26.31/ton, and prices in the West-South surged +12.1 percent to $29.30/ton.

Outlook

The Bureau of Economic Analysis (BEA) recently confirmed that official gross domestic product (GDP) figures for 4Q2018 will not be released until February 28 due to the government furlough in January. However, the Atlanta Federal Reserve’s GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in 4Q is 2.7 percent.

Housing starts data has also been on hiatus due to the government furlough. Forest2Market’s southern yellow pine lumber price index has increased in recent weeks, suggesting that demand is up and inventory building is well under way in preparation for building season. Severe weather has impacted the region over the last several months; high rainfall levels, flooding and natural disasters such as Hurricane Michael have all contributed to a situation that has made harvesting more difficult and driven sawtimber prices higher. On a Southwide basis, we look for sawtimber stumpage prices to continue to trend higher in the near term, and we expect increased volatility in select local markets.