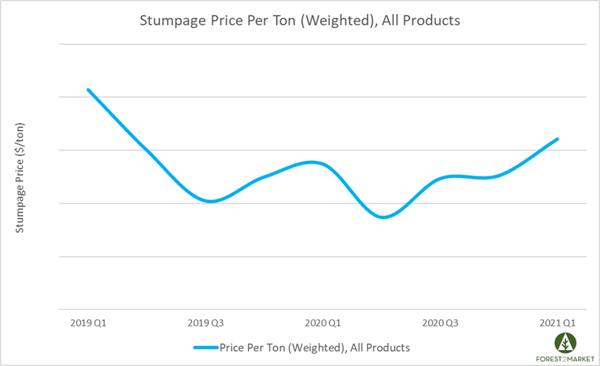

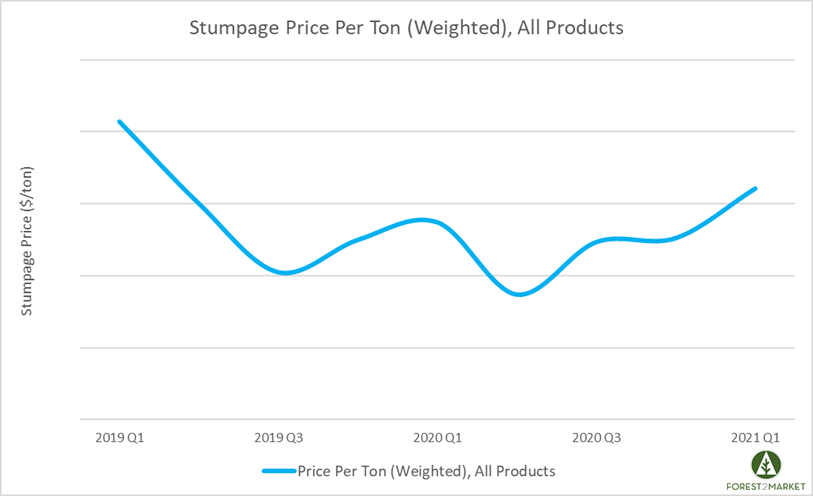

After predictably losing ground during the worst of the COVID-19 pandemic in 2Q2020, the southern timber market rebounded in 2H2020 driven by strong demand for most forest products, and the trend continues into 2021. In fact, 1Q2021 data illustrates that the weighted average price per ton for all southern timber products is now higher than it has been in nearly two years; prices are up +8.1 percent quarter-over-quarter (QoQ) and +19.1 percent year-over-year (YoY).

Pulpwood

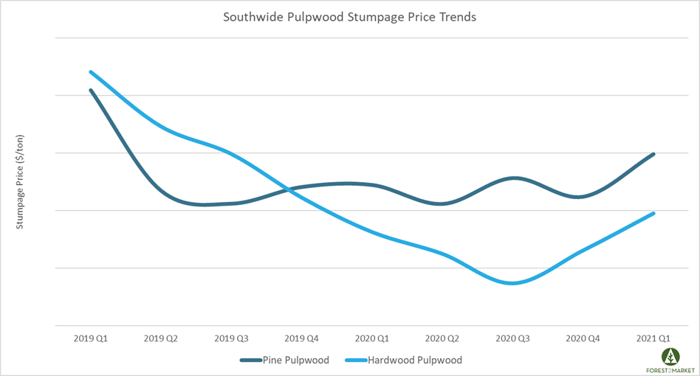

On a Southwide basis in 1Q2021, pine pulpwood prices increased +17.5 percent QoQ and +12.0 percent YoY, as all regions saw significant price increases for this product. Prices in the Mid-South surged +23.4 percent QoQ, prices in the West-South jumped +12.0 percent, and prices in the East-South were up +4.5 percent.

Surprisingly, hardwood pulpwood prices skyrocketed even higher than pine pulpwood, as Southwide prices jumped +19.5 percent QoQ and +9.0 percent YoY. Prices in the Mid-South were up +4.3 percent QoQ, prices in the West-South jumped +27.9 percent, and prices in the East-South increased +21.9 percent.

Sawtimber

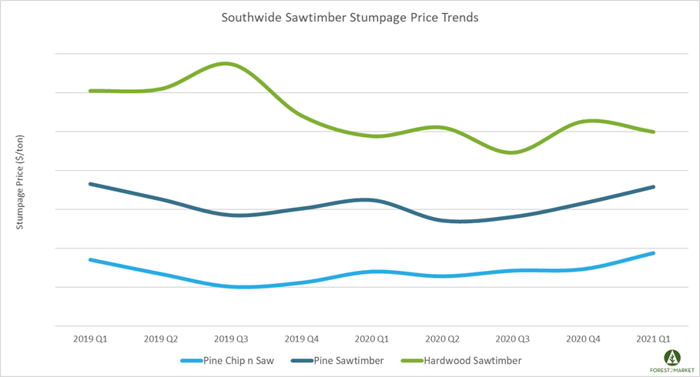

On a Southwide basis, pine chip-n-saw (CNS) prices increased +11.1 percent QoQ and +13.0 percent YoY, as all regions also saw significant price increases for this product. Prices in the Mid-South surged +12.4 percent QoQ, prices in the West-South were up +6.4 percent, and prices in the East-South jumped +10.4 percent.

In 1Q2021, pine sawtimber prices jumped +7.8 percent QoQ and +6.22 percent YoY on a Southwide basis, and all three regions experienced increases. Prices in the Mid-South were up +3.9 percent QoQ, prices in the West-South surged +14.0 percent, and prices in the East-South increased +6.8 percent.

After experiencing a brief uptick in 4Q2020, Southwide hardwood sawtimber prices dropped in 1Q2021 by -3.6 percent QoQ but increased +1.6 percent YoY. Prices in the Mid-South ticked up +1.5 percent QoQ, prices in the West-South dropped -7.2 percent, and prices in the East-South were up +4.0 percent.

Outlook

Real gross domestic product (GDP) increased at an annual rate of 6.4 percent in 1Q2021, as widespread vaccine deployment efforts continue to drive reopening and economic activity that were postponed or restricted due to COVID-19. Many sectors of the economy have bounced back significantly since this time last year – a number of which continue to struggle with supply chain constraints that are driving price increases.

The southern yellow pine lumber market has experienced such a surge in demand that prices have eclipsed previous records by tremendous margins. Forest2Market’s composite SYP lumber price for the week ending May 7 (week 18) was $1,091/MBF, a +3.0 percent increase from the previous week’s price of $1,059/MBF and a +166 percent increase over the same week last year.

Moving forward in the near term, most economists are optimistic about short-term prospects for manufacturing. “As the economy reopens more broadly, industrial activity will continue to be propelled by strong tailwinds including large fiscal stimulus, buoyant demand, and strong corporate profits,” said Oxford Economics’ Lydia Boussour. “These should more than outweigh ongoing headwinds from stretched supply chains and the global semiconductor shortage.”

Southern stumpage markets have remained strong since late 2020, confirming this sense of optimism. While the market has been oversupplied for a decade, stumpage prices across the South are now climbing back out of the COVID-induced hole experienced during much of 2020, when demand dropped in tandem with the economic shutdown.

Southern timber prices are now higher than they have been in two years, and more price volatility is likely in the coming months. If you are not a subscriber to our Stumpage 360 database, now is the time to stay ahead of your local market with the power of transactional data.