1 min read

Southern Yellow Pine Composite Lumber Prices - December 2012

Forest2Market

:

January 31, 2013

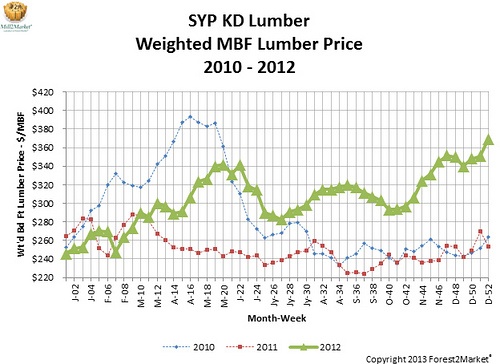

According to Mill2Market, Forest2Market’s lumber market report, southern pine lumber prices increased by 6 percent during the month of December. The composite price at the start of the month was $340/MBF (Week 49), a 3 percent decline from the last week of November (Week 48). Throughout the rest of the month, composite price steadily increased reaching $348/MBF in Week 50, $350/MBF in Week 51 and $369/MBF in Week 52. Because 2012 was a leap year, the year ended in Week 53 (not represented on the chart as it is without recent historical comparison) at $370/MBF.

Although the December trend in price was consistently higher, sales order volume per mill volume fluctuated throughout the month of December. Sales order volume per mill increased throughout the first 3 weeks of December (Week 49, Week 50 and Week 51), with orders per mill in Week 51 being the highest of the year. Sales order volume per mill dropped precipitously in the remaining weeks, as mills generally worked shortened weeks due to the Christmas and New Year’s holidays.

A historic look at the month of December reveals that current composite lumber prices reflect changing fundamentals in the residential construction industry. These fundamentals, weak for most of 2010 and 2011 (the early and artificial 2010 bump from the first-time homebuyer tax credit is the exception), turned the corner in 2012. (Read Suz-Anne Kinney's Housing Market Update for December 2012).

About the figure: The above figure summarizes pricing data gathered for Forest2Market’s weekly lumber market report, Mill2Market. For this market report, Forest2Market aggregates sales order data submitted directly by report subscribers. This figure charts weekly sales order prices from January 2010 through December 2012 and compares sales order data, FOB Mill on a volume weighted $/MBF basis. The prices in the figure are composite prices; they include dimension lumber, timbers and boards.